Region:Middle East

Author(s):Dev

Product Code:KRAA7038

Pages:81

Published On:January 2026

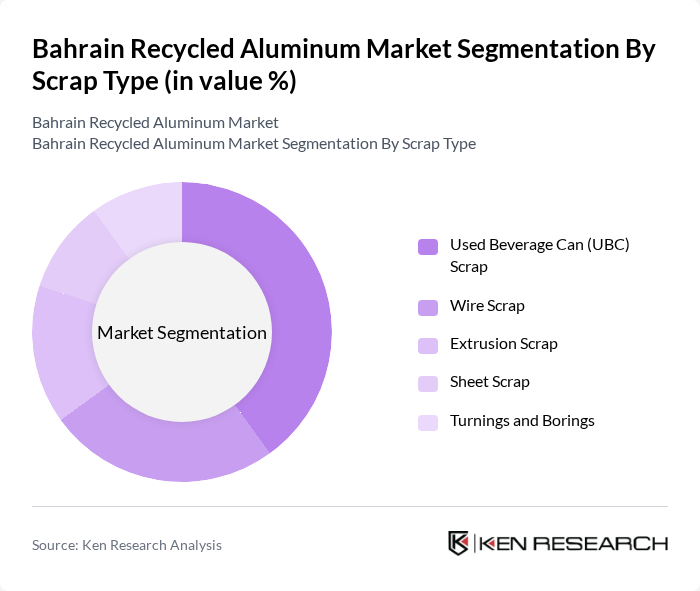

By Scrap Type:The market is segmented into various scrap types, including Used Beverage Can (UBC) Scrap, Wire Scrap, Extrusion Scrap, Sheet Scrap, and Turnings and Borings. Among these, Used Beverage Can (UBC) Scrap is the most dominant segment due to its high availability and demand in the recycling process. The increasing consumer preference for aluminum cans over plastic packaging has further bolstered this segment's growth. Wire Scrap and Extrusion Scrap also contribute significantly, driven by their applications in construction and automotive industries.

By Category:The market is categorized into New Scrap and Old Scrap. New Scrap is generated from manufacturing processes, while Old Scrap is sourced from post-consumer products. Old Scrap dominates the market due to the increasing focus on recycling and sustainability. The growing trend of recycling aluminum products, especially in the construction and automotive sectors, has led to a higher collection rate of Old Scrap, making it a vital component of the recycled aluminum supply chain.

The Bahrain Recycled Aluminum Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novelis Inc., Norsk Hydro ASA, Constellium N.V., Alcoa Corporation, Rio Tinto, RUSAL, Gulf Aluminium Rolling Mill Company (GARMCO), Aluminium Bahrain B.S.C. (ALBA), Emirates Global Aluminium, Al-Bahar Group, Al-Moayyed Group, Al-Futtaim Group, Bahrain National Holding Company, Gulf Industrial Investment Company (GIIC), Al-Mansoori Specialized Engineering contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain recycled aluminum market appears promising, driven by increasing consumer awareness and government support for sustainable practices. As the emphasis on the circular economy grows, industries are likely to adopt recycled materials more widely. Furthermore, technological advancements will continue to enhance recycling efficiency, making recycled aluminum more competitive. The market is expected to see a rise in partnerships between recycling facilities and local manufacturers, fostering innovation and expanding the use of recycled aluminum in various applications.

| Segment | Sub-Segments |

|---|---|

| By Scrap Type | Used Beverage Can (UBC) Scrap Wire Scrap Extrusion Scrap Sheet Scrap Turnings and Borings |

| By Category | New Scrap Old Scrap |

| By End-Use | Building & Construction Automotive Electronics Machinery and Equipment Packaging Others |

| By Processing Method | Mechanical recycling Hydrometallurgical recycling Pyrometallurgical recycling Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Recycling Practices | 100 | Project Managers, Sustainability Coordinators |

| Automotive Sector Aluminum Recovery | 80 | Operations Managers, Procurement Specialists |

| Consumer Electronics Recycling Trends | 70 | Product Managers, Environmental Compliance Officers |

| Government Recycling Initiatives | 60 | Policy Makers, Environmental Analysts |

| Recycling Facility Operations | 90 | Facility Managers, Process Engineers |

The Bahrain Recycled Aluminum Market is valued at approximately USD 1.76 billion, reflecting a significant growth trend driven by increasing environmental awareness and demand for sustainable materials across various industries, particularly in construction and automotive sectors.