Region:Middle East

Author(s):Dev

Product Code:KRAA7033

Pages:98

Published On:January 2026

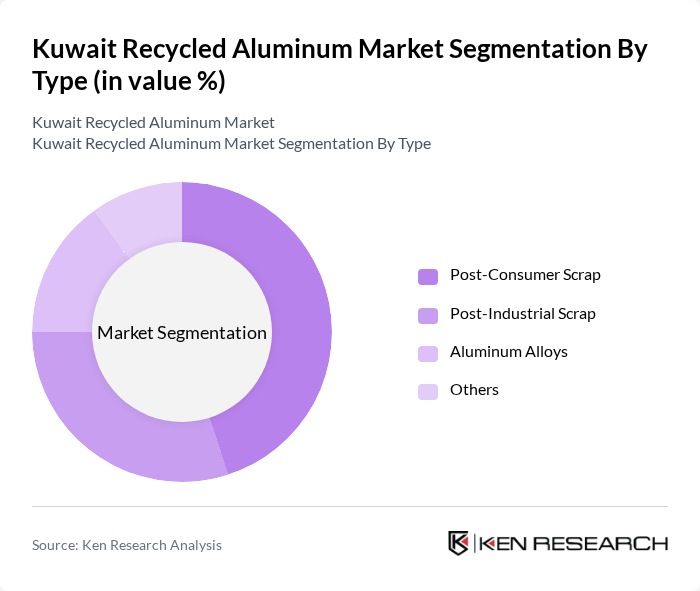

By Type:The market is segmented into various types, including Post-Consumer Scrap, Post-Industrial Scrap, Aluminum Alloys, and Others. Among these, Post-Consumer Scrap is the leading sub-segment, driven by increasing consumer awareness regarding recycling and sustainability, particularly from beverage cans which dominate due to high recycling rates. The growing trend of recycling household aluminum products, such as cans and foil, has significantly contributed to the market's expansion. Post-Industrial Scrap follows closely, as industries increasingly focus on reducing waste and utilizing recycled materials in their production processes.

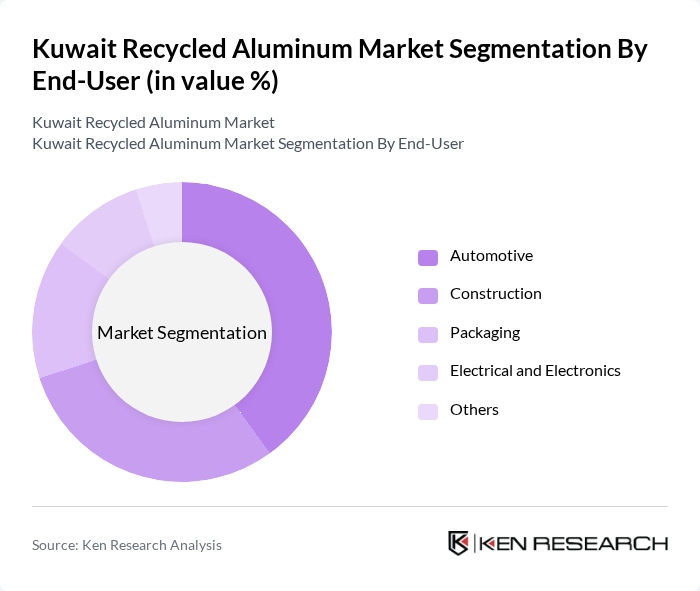

By End-User:The end-user segmentation includes Automotive, Construction, Packaging, Electrical and Electronics, and Others. The Automotive sector is the dominant end-user, as manufacturers increasingly adopt lightweight materials to enhance fuel efficiency and reduce emissions. The construction industry also plays a significant role, utilizing recycled aluminum for various applications, including windows, doors, and structural components. The growing emphasis on sustainable building practices further drives the demand for recycled aluminum in this sector.

The Kuwait Recycled Aluminum Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Aluminum Rolling Mill Company, Kuwait Aluminum Extrusion Company, Al-Mansoori Specialized Engineering, Al-Futtaim Group, Al-Khaldiya Group, Al-Muhalab Group, Al-Qatami Global for General Trading & Contracting, Al-Sayer Group, Al-Bahar Group, Al-Masoud Group, Al-Hazaa Investment Group, Al-Mansour Group, Al-Muhanna Group, Al-Shaheen Group, Al-Sabhan Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait recycled aluminum market appears promising, driven by increasing consumer demand for sustainable products and supportive government policies. As the construction sector continues to expand, the integration of recycled materials is expected to become more prevalent. Furthermore, advancements in recycling technologies will likely enhance efficiency and reduce costs, making recycled aluminum more competitive. The market is poised for growth, with a focus on sustainability and innovation shaping its trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Post-Consumer Scrap Post-Industrial Scrap Aluminum Alloys Others |

| By End-User | Automotive Construction Packaging Electrical and Electronics Others |

| By Source of Scrap | Municipal Collection Industrial Collection Retail Collection Others |

| By Processing Method | Shredding Melting Casting Others |

| By Application | Building and Construction Automotive Parts Consumer Goods Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geographic Distribution | Urban Areas Rural Areas Industrial Zones Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aluminum Recycling Facilities | 45 | Plant Managers, Operations Directors |

| Manufacturers Using Recycled Aluminum | 60 | Procurement Managers, Production Supervisors |

| Government Regulatory Bodies | 30 | Policy Makers, Environmental Officers |

| Environmental NGOs and Advocacy Groups | 40 | Sustainability Coordinators, Research Analysts |

| Construction Sector Stakeholders | 50 | Project Managers, Supply Chain Coordinators |

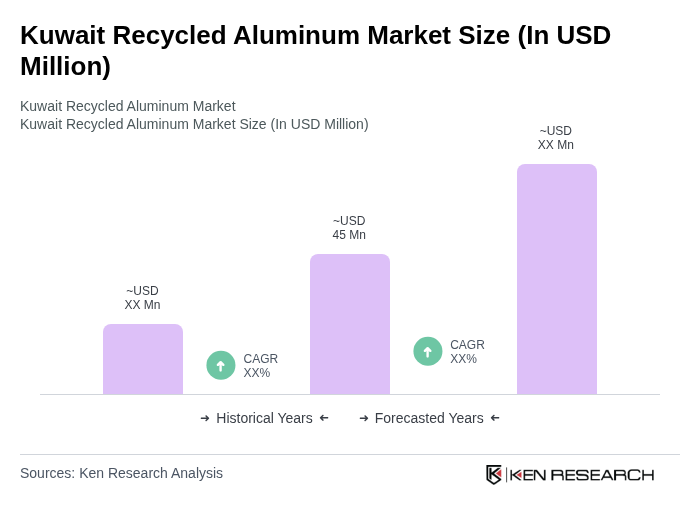

The Kuwait Recycled Aluminum Market is valued at approximately USD 45 million, reflecting a growing trend driven by environmental awareness, government initiatives, and increased demand for sustainable materials across various industries, particularly automotive and construction.