Region:Middle East

Author(s):Dev

Product Code:KRAD3445

Pages:99

Published On:November 2025

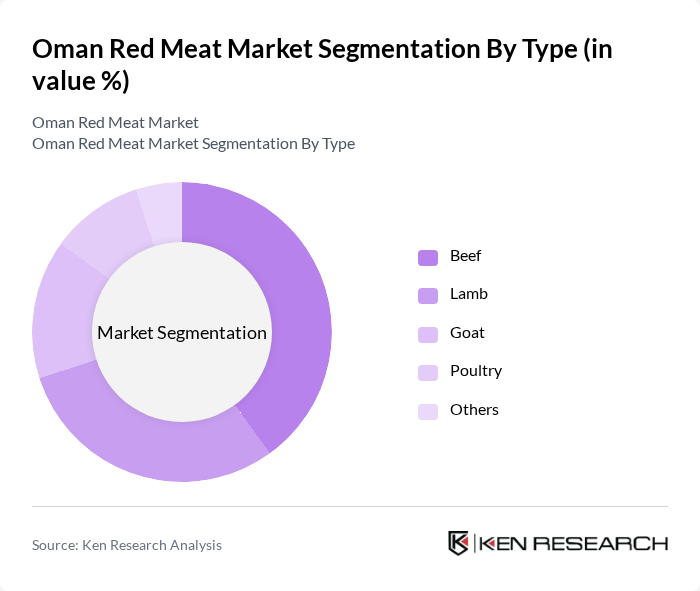

By Type:The red meat market in Oman is segmented into various types, including beef, lamb, goat, poultry, and others. Among these, beef and lamb are the most popular choices among consumers due to their rich flavors and versatility in cooking. The increasing preference for premium quality meat has led to a rise in demand for lamb, particularly during festive seasons. Poultry is also gaining traction as a healthier alternative, while goat meat remains a staple in traditional dishes.

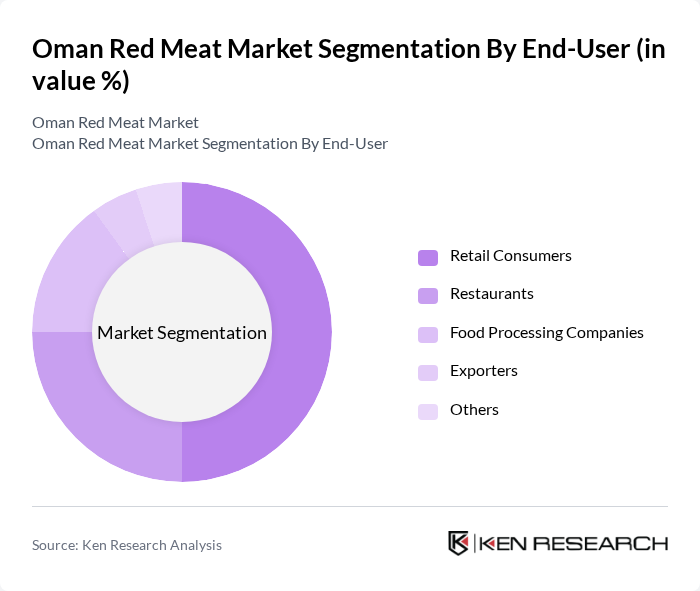

By End-User:The end-user segmentation of the red meat market includes retail consumers, restaurants, food processing companies, exporters, and others. Retail consumers dominate the market, driven by the increasing trend of home cooking and the demand for fresh meat products. Restaurants are also significant contributors, as they seek high-quality meat to meet customer expectations. Food processing companies are expanding their operations to cater to the growing demand for processed meat products, while exporters are focusing on international markets to enhance their reach.

The Oman Red Meat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Meat Products Company, Al Ain Farms, Al Jazeera Poultry, Al Fajr Al Mufeed, Al Mufeed Meat Company, Al Shams Meat Company, Al Waha Meat Company, Al Muna Meat Company, Al Noor Meat Company, Al Mufeed Group, Al Batinah Meat Company, Oman Livestock Company, Al Hail Meat Company, Al Muthanna Meat Company, Oman Food Investment Holding Company contribute to innovation, geographic expansion, and service delivery in this space.

The Oman red meat market is poised for growth, driven by increasing consumer preferences for high-quality and locally sourced products. As the hospitality sector expands and disposable incomes rise, local producers are likely to invest in modern processing facilities and sustainable practices. Additionally, the trend towards e-commerce in food sales is expected to reshape distribution channels, making high-quality meat more accessible to consumers. These factors will collectively enhance the market's resilience and adaptability in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Beef Lamb Goat Poultry Others |

| By End-User | Retail Consumers Restaurants Food Processing Companies Exporters Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Local Markets Direct Sales Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Product Form | Fresh Meat Processed Meat Frozen Meat Canned Meat Others |

| By Quality Grade | Premium Standard Economy Others |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging Traditional Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Meat Outlets | 100 | Store Managers, Meat Department Supervisors |

| Wholesale Distributors | 80 | Distribution Managers, Sales Representatives |

| Local Farmers and Producers | 60 | Farm Owners, Livestock Managers |

| Consumer Households | 150 | Household Decision Makers, Grocery Shoppers |

| Food Service Providers | 70 | Restaurant Owners, Catering Managers |

The Oman Red Meat Market is valued at approximately USD 1.2 billion, reflecting a steady growth driven by increasing consumer demand for high-quality meat products and rising disposable incomes among the population.