Region:Middle East

Author(s):Rebecca

Product Code:KRAE2916

Pages:89

Published On:February 2026

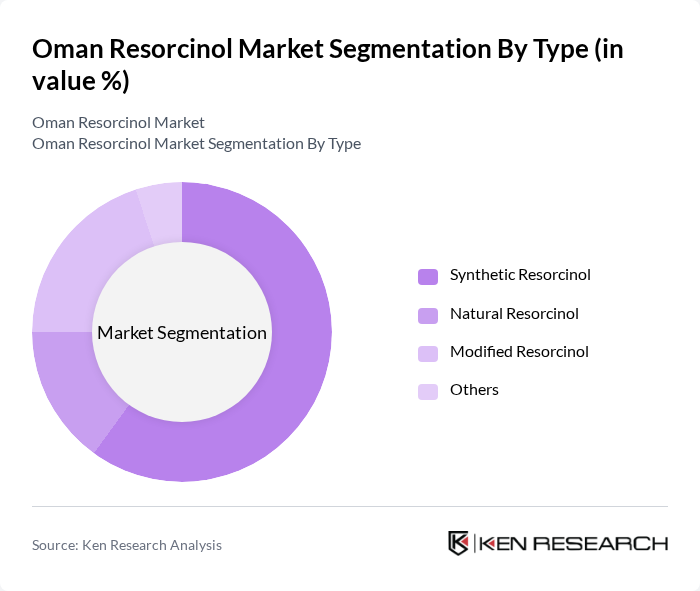

By Type:The market is segmented into various types of resorcinol, including Synthetic Resorcinol, Natural Resorcinol, Modified Resorcinol, and Others. Among these, Synthetic Resorcinol is the most dominant due to its widespread use in industrial applications, particularly in adhesives and coatings, where its properties provide superior performance. The demand for Synthetic Resorcinol is driven by the growing automotive and construction industries, which require high-quality bonding agents and sealants.

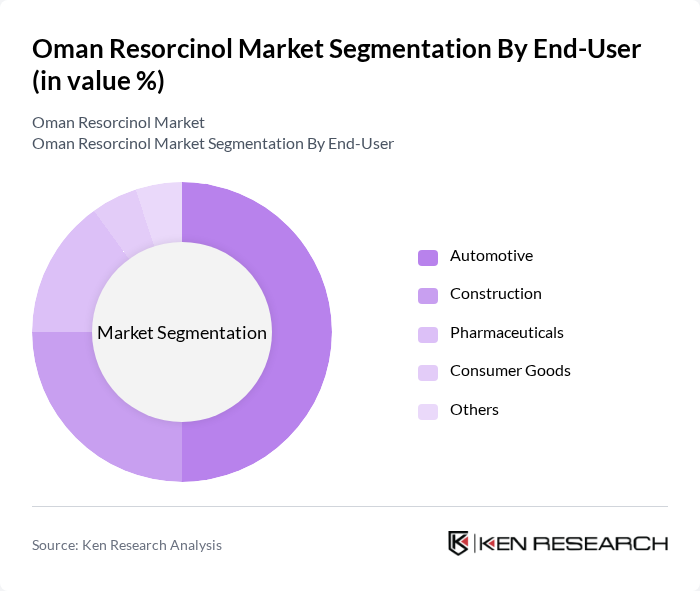

By End-User:The end-user segmentation includes Automotive, Construction, Pharmaceuticals, Consumer Goods, and Others. The Automotive sector is the leading end-user of resorcinol, primarily due to its application in tire manufacturing and other automotive components. The increasing production of vehicles in Oman, coupled with the demand for high-performance materials, has significantly boosted the consumption of resorcinol in this sector.

The Oman Resorcinol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Resorcinol Chemical Co., Oman Resins & Chemicals, Gulf Chemicals and Industrial Oils, Al Jazeera Chemicals, Oman Oil Refineries and Petroleum Industries, National Chemical Company, Muscat Chemicals, Al-Futtaim Group, Oman Chemical Industries, Gulf Resins, Oman Petrochemicals, Al-Maha Chemical Industries, Sohar Chemical Company, Oman Industrial Chemicals, Muscat Resorcinol Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman resorcinol market appears promising, driven by increasing investments in sustainable production methods and the expansion of the automotive and construction sectors. As the demand for eco-friendly products rises, manufacturers are likely to innovate and adapt their offerings. Additionally, the government's focus on infrastructure development will further stimulate market growth, creating opportunities for local producers to enhance their market share and competitiveness in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Resorcinol Natural Resorcinol Modified Resorcinol Others |

| By End-User | Automotive Construction Pharmaceuticals Consumer Goods Others |

| By Application | Adhesives Coatings Sealants Textiles Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Geography | Muscat Salalah Sohar Nizwa Others |

| By Product Form | Liquid Resorcinol Powdered Resorcinol Granular Resorcinol Others |

| By Regulatory Compliance | REACH Compliance OSHA Standards ISO Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 100 | Product Development Managers, Quality Assurance Engineers |

| Construction Sector Usage | 80 | Project Managers, Procurement Specialists |

| Adhesives and Sealants Market | 90 | Manufacturing Supervisors, R&D Directors |

| Textile and Coating Applications | 70 | Textile Engineers, Product Managers |

| Pharmaceutical and Cosmetic Uses | 60 | Regulatory Affairs Managers, Formulation Chemists |

The Oman Resorcinol Market is valued at approximately USD 45 million, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for resorcinol in various applications, particularly in adhesives, coatings, and pharmaceuticals.