Region:Middle East

Author(s):Rebecca

Product Code:KRAD1397

Pages:98

Published On:November 2025

By Type:The market is segmented into various types of smart sensors, including Environmental Sensors, Industrial Sensors, Smart Home Sensors, Healthcare Sensors, Automotive Sensors, Wearable Sensors, Pressure Sensors, Optical Sensors, Ultrasonic Sensors, Capacitive Sensors, and Others. Among these, Environmental Sensors are gaining traction due to the increasing focus on environmental monitoring and sustainability. Industrial Sensors are also prominent, driven by the need for automation and efficiency in manufacturing processes.

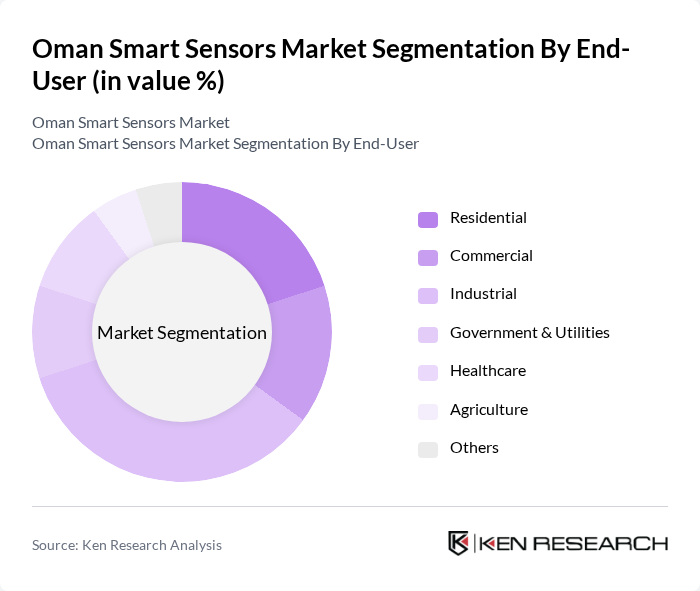

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, Healthcare, Agriculture, and Others. The Industrial segment is leading the market due to the rapid adoption of automation and smart technologies in manufacturing processes. The Healthcare segment is also witnessing significant growth, driven by the increasing demand for remote patient monitoring and health management solutions.

The Oman Smart Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Siemens AG, Bosch Sensortec GmbH, STMicroelectronics N.V., Texas Instruments Incorporated, Analog Devices, Inc., NXP Semiconductors N.V., Infineon Technologies AG, TE Connectivity Ltd., Emerson Electric Co., Schneider Electric SE, Mitsubishi Electric Corporation, Rockwell Automation, Inc., ABB Ltd., General Electric Company, OMRON Corporation, Panasonic Corporation, Sensirion AG, Gulf Business Machines (GBM Oman LLC), Bahwan CyberTek LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Oman smart sensors market is poised for significant growth, driven by technological advancements and increasing government support for smart city initiatives. As the integration of artificial intelligence with smart sensors becomes more prevalent, the efficiency and capabilities of these systems will improve. Additionally, the shift towards sustainable practices will further enhance the adoption of smart sensors across various sectors, including agriculture and energy management, creating a more connected and efficient environment in Oman.

| Segment | Sub-Segments |

|---|---|

| By Type | Environmental Sensors Industrial Sensors Smart Home Sensors Healthcare Sensors Automotive Sensors Wearable Sensors Pressure Sensors Optical Sensors Ultrasonic Sensors Capacitive Sensors Others |

| By End-User | Residential Commercial Industrial Government & Utilities Healthcare Agriculture Others |

| By Application | Smart Buildings Smart Transportation Smart Agriculture Smart Healthcare Industrial Automation Environmental Monitoring Others |

| By Technology | MEMS Technology Optical Spectroscopy CMOS Technology Wireless Technology Wired Technology Hybrid Technology Others |

| By Market Segment | Consumer Electronics Automotive Healthcare Industrial Automation Infrastructure Others |

| By Distribution Channel | Online Sales Retail Sales Direct Sales Distributors/Integrators Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Smart Sensors | 100 | Healthcare Administrators, Biomedical Engineers |

| Agricultural Sensor Applications | 60 | Agronomists, Farm Managers |

| Industrial Automation Sensors | 90 | Plant Managers, Automation Engineers |

| Smart City Infrastructure | 70 | Urban Planners, City Officials |

| Environmental Monitoring Systems | 50 | Environmental Scientists, Policy Makers |

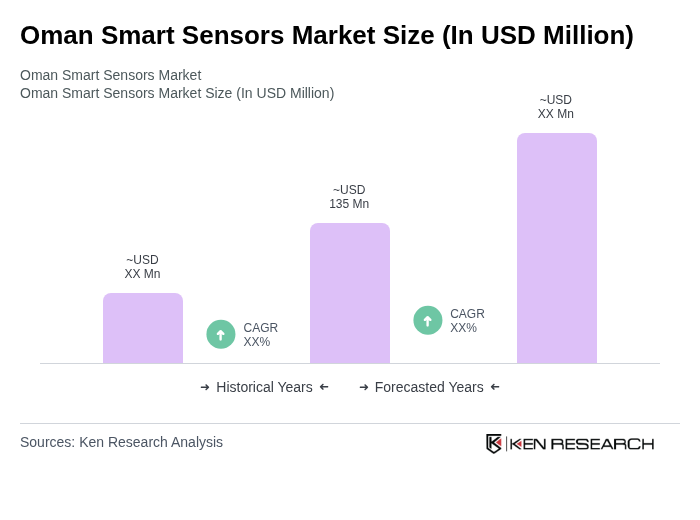

The Oman Smart Sensors Market is valued at approximately USD 135 million, reflecting a significant growth trend driven by the adoption of IoT technologies and government initiatives aimed at enhancing smart city infrastructure.