Region:Middle East

Author(s):Dev

Product Code:KRAA8211

Pages:98

Published On:November 2025

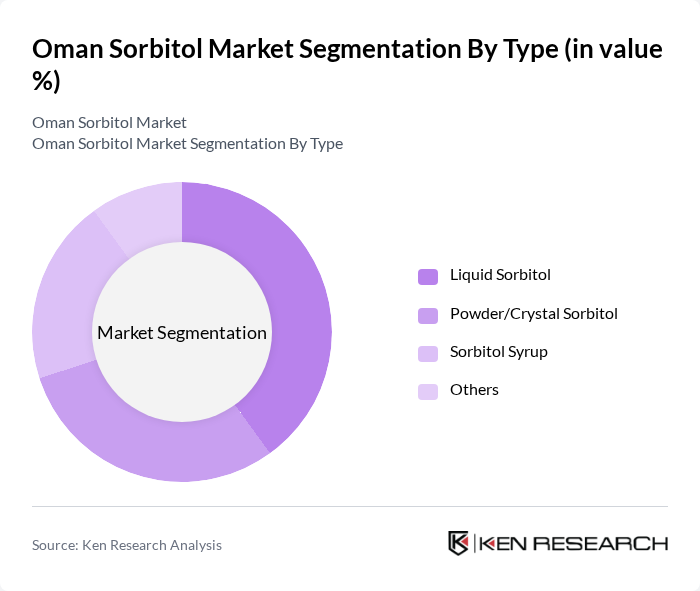

By Type:The sorbitol market can be segmented into various types, includingLiquid Sorbitol, Powder/Crystal Sorbitol, Sorbitol Syrup, and Others. Each type serves different applications and industries, catering to diverse consumer needs. The liquid form is favored for its ease of incorporation in food, beverage, and pharmaceutical products, while the powder form is preferred in dry blends and tablet formulations .

TheLiquid Sorbitolsegment is currently dominating the market due to its versatility and wide range of applications in food and beverage products, personal care items, and pharmaceuticals. Its liquid form allows for easy incorporation into various formulations, making it a preferred choice among manufacturers. The increasing trend towards healthier food options and the demand for low-calorie sweeteners have further boosted the consumption of liquid sorbitol, solidifying its market leadership .

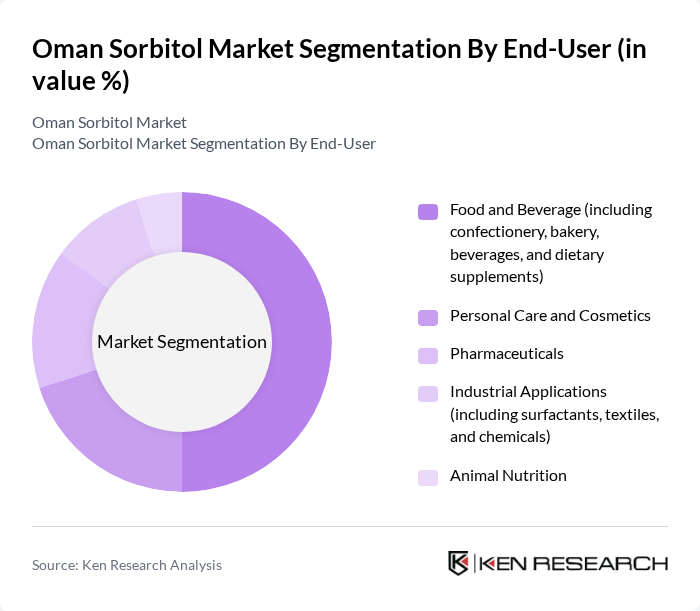

By End-User:The end-user segmentation includesFood and Beverage, Personal Care and Cosmetics, Pharmaceuticals, Industrial Applications, Animal Nutrition, and Others. Each segment reflects the diverse applications of sorbitol across different industries. The food and beverage sector is the largest consumer, driven by demand for sugar alternatives and humectants, while pharmaceuticals and personal care are significant due to sorbitol’s role as an excipient and moisturizing agent .

TheFood and Beveragesector is the leading end-user of sorbitol, accounting for a significant portion of the market. This dominance is attributed to the growing consumer preference for sugar alternatives and low-calorie sweeteners in food products. Sorbitol's role as a humectant and stabilizer in various food applications further enhances its demand. Additionally, the increasing trend of health-conscious eating habits among consumers is driving the growth of this segment .

The Oman Sorbitol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roquette Frères, Archer Daniels Midland Company, Ingredion Incorporated, Cargill, Incorporated, Merck KGaA, DuPont de Nemours, Inc., Tereos S.A., Ecogreen Oleochemicals, Mitsubishi Shoji Foodtech Co., Ltd., Südzucker AG, Gulshan Polyols Ltd., and Sukhjit Starch & Chemicals Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Oman sorbitol market is poised for significant growth, driven by increasing health awareness and the demand for sugar alternatives. As consumers continue to prioritize health and wellness, the market is likely to see a shift towards natural and organic products. Additionally, technological advancements in production processes will enhance efficiency and reduce costs. Strategic partnerships among key players will further facilitate market expansion, ensuring that sorbitol remains a vital ingredient across various sectors, including food, cosmetics, and pharmaceuticals.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Sorbitol Powder/Crystal Sorbitol Sorbitol Syrup Others |

| By End-User | Food and Beverage (including confectionery, bakery, beverages, and dietary supplements) Personal Care and Cosmetics Pharmaceuticals Industrial Applications (including surfactants, textiles, and chemicals) Animal Nutrition Others |

| By Application | Sweeteners Humectants Texturizers Stabilizers Others |

| By Distribution Channel | Direct Sales Online Retail Distributors and Wholesalers Others |

| By Region | Muscat Salalah Sohar Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| By Product Form | Granular Form Liquid Form Powder Form Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Industry | 100 | Product Development Managers, Quality Assurance Heads |

| Pharmaceutical Sector | 60 | Formulation Scientists, Regulatory Affairs Managers |

| Cosmetics and Personal Care | 50 | Brand Managers, R&D Directors |

| Industrial Applications | 40 | Procurement Managers, Operations Directors |

| Distribution and Supply Chain | 45 | Logistics Coordinators, Supply Chain Analysts |

The Oman Sorbitol Market is valued at approximately USD 10 billion, reflecting a robust growth trajectory driven by increasing demand across various sectors, including food and beverages, personal care, and pharmaceuticals.