Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3919

Pages:99

Published On:November 2025

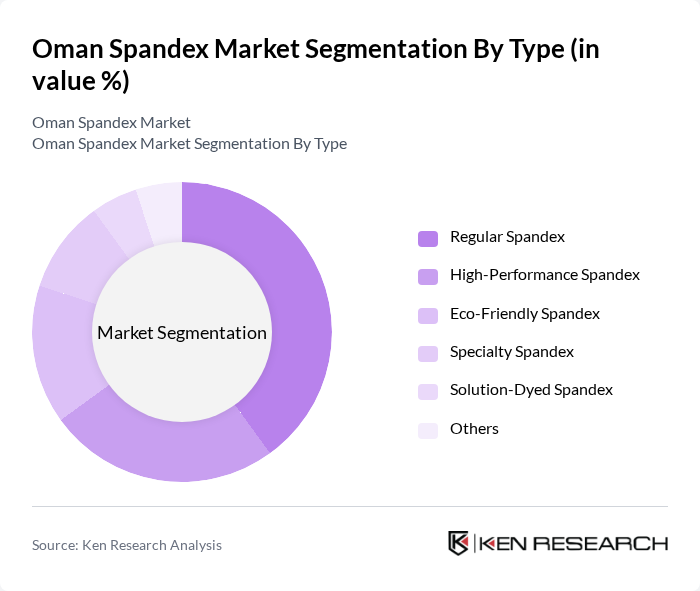

By Type:The spandex market can be segmented into several types, including Regular Spandex, High-Performance Spandex, Eco-Friendly Spandex, Specialty Spandex, Solution-Dyed Spandex, and Others. Among these, Regular Spandex is the most widely used due to its versatility and cost-effectiveness, making it a preferred choice for various applications in the apparel industry. High-Performance Spandex is gaining traction, particularly in sportswear, as consumers increasingly seek advanced materials that offer superior stretch and recovery. Eco-Friendly Spandex is also emerging as a significant segment, driven by growing environmental awareness among consumers and regulatory incentives for sustainable production , .

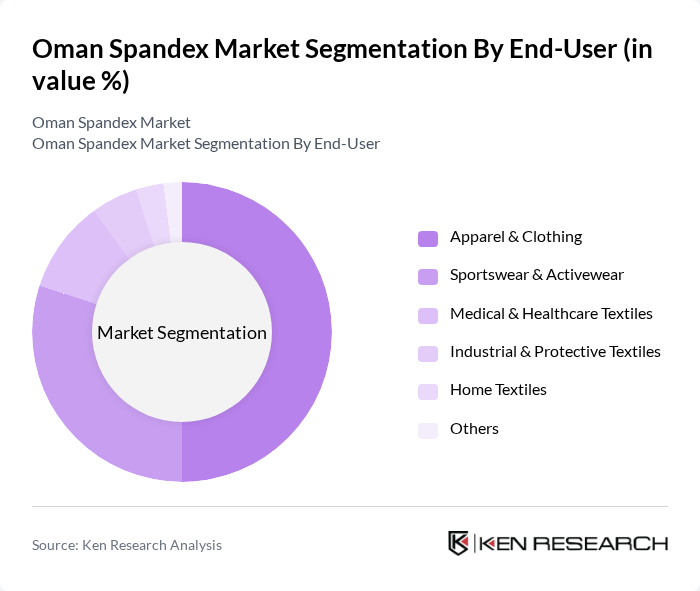

By End-User:The end-user segmentation includes Apparel & Clothing, Sportswear & Activewear, Medical & Healthcare Textiles, Industrial & Protective Textiles, Home Textiles, and Others. The Apparel & Clothing segment dominates the market, driven by the increasing demand for comfortable and flexible clothing options. Sportswear & Activewear is also a rapidly growing segment, fueled by the rising popularity of fitness and outdoor activities. Medical & Healthcare Textiles are gaining importance due to the need for specialized garments that provide support and comfort, particularly in post-pandemic healthcare infrastructure development , .

The Oman Spandex Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hyosung Corporation, Invista (Koch Industries), Asahi Kasei Corporation, Toray Industries, Inc., Zhejiang Huafon Spandex Co., Ltd., Taekwang Industrial Co., Ltd., Yantai Tayho Advanced Materials Co., Ltd., Xiamen Xiangyu Green Fiber Co., Ltd., Acelon Chemicals & Fiber Corporation, Jiangsu Shuangliang Spandex Co., Ltd., Dongguan Huicheng Spandex Co., Ltd., Zhejiang Yongsheng Spandex Co., Ltd., Huafon Group, Shandong Ruyi Technology Group Co., Ltd., Oman Textile Mills Co. LLC, National Spinning Company (Oman) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman spandex market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in sustainable production methods, which could reshape the competitive landscape. Additionally, the expansion of e-commerce platforms is expected to enhance market accessibility, allowing spandex products to reach a broader audience. This evolving market environment presents both challenges and opportunities for stakeholders in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Regular Spandex High-Performance Spandex Eco-Friendly Spandex Specialty Spandex Solution-Dyed Spandex Others |

| By End-User | Apparel & Clothing Sportswear & Activewear Medical & Healthcare Textiles Industrial & Protective Textiles Home Textiles Others |

| By Application | Clothing (e.g., underwear, outerwear, swimwear, shapewear) Footwear Compression Garments Bandages & Medical Supports Automotive Textiles Home Furnishings Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales (B2B) Wholesale/Distributors Others |

| By Region | Muscat Salalah Sohar Nizwa Duqm Others |

| By Product Form | Yarn Fabric Finished Goods Others |

| By Performance Characteristics | Stretchability Durability Moisture Management Colorfastness Eco-Friendliness Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Manufacturers | 100 | Production Managers, Procurement Officers |

| Spandex Distributors | 80 | Sales Managers, Supply Chain Coordinators |

| Retail Sector Buyers | 70 | Merchandise Managers, Category Buyers |

| Fashion Designers | 50 | Creative Directors, Product Development Managers |

| Textile Industry Experts | 60 | Consultants, Market Analysts |

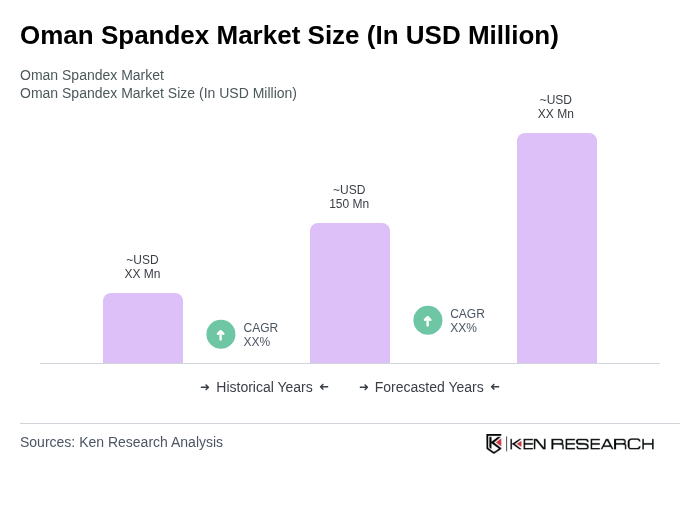

The Oman Spandex Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for high-performance textiles in apparel and activewear sectors, alongside advancements in manufacturing technologies.