Region:Middle East

Author(s):Shubham

Product Code:KRAC3502

Pages:81

Published On:October 2025

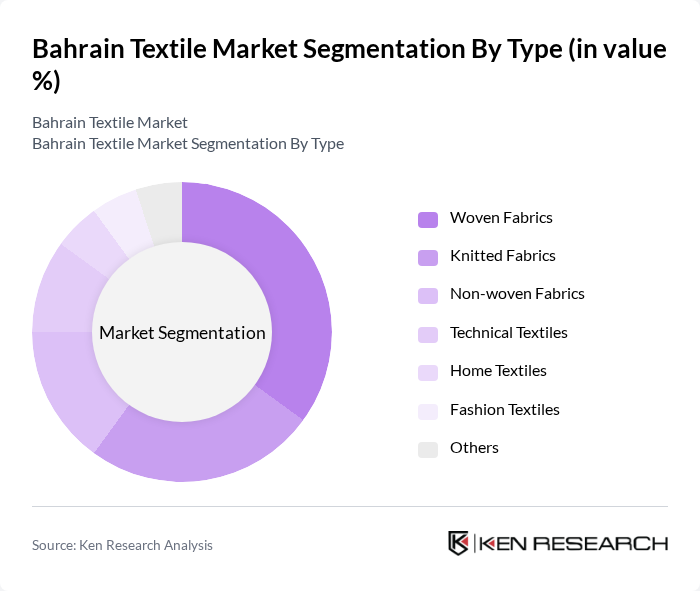

By Type:The textile market in Bahrain is segmented into Woven Fabrics, Knitted Fabrics, Non-woven Fabrics, Technical Textiles, Home Textiles, Fashion Textiles, and Others. Woven Fabrics continue to lead the market, driven by their versatility and extensive application in apparel and home furnishings. Demand for high-quality woven textiles is supported by consumer preferences for durability, design innovation, and aesthetic appeal, making them a preferred choice among manufacturers .

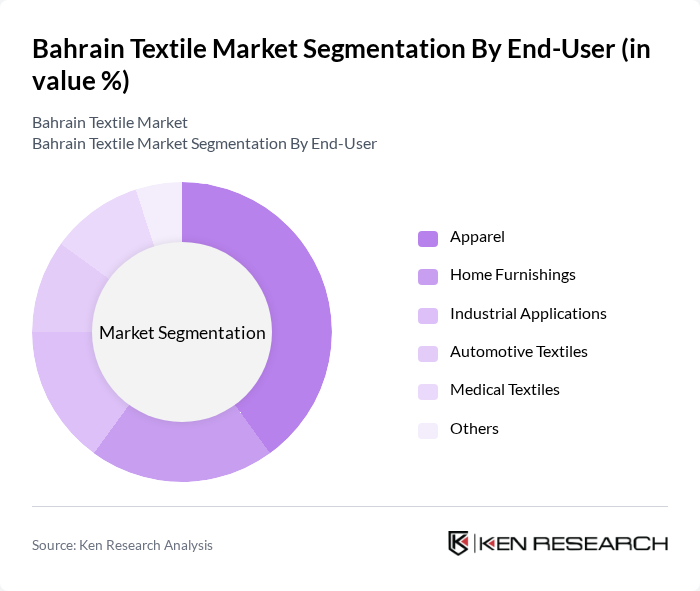

By End-User:The Bahrain Textile Market is also segmented by end-user applications, including Apparel, Home Furnishings, Industrial Applications, Automotive Textiles, Medical Textiles, and Others. The Apparel segment remains the most significant, fueled by a growing fashion industry, increasing consumer spending on clothing, and the rapid expansion of e-commerce platforms. These factors have led to greater demand for diverse and trendy apparel options, while industrial and technical applications are also expanding due to innovation in performance textiles .

The Bahrain Textile Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ahlia Textile, Bahrain Textile Company (BTC), Al Mufeed Textile, Gulf Textile Manufacturing Co., Al Jazeera Textile, Al Mufeed Group, Bahrain National Textile, Al Mufeed Fabrics, Al Ahlia Fabrics, Al Noor Textile, Al Fawaz Textile, Al Mufeed Industries, Al Ahlia Group, Al Jazeera Fabrics, Bahrain Textile Industries, Almoayyed International Group, Y.K. Almoayyed & Sons, Al Zayani Commercial Services, Al Rashid Group, and MRS Fashions Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain textile market appears promising, driven by increasing consumer awareness of sustainability and the growing demand for innovative textile solutions. As local manufacturers adapt to these trends, they are likely to invest in advanced technologies and sustainable practices. Additionally, the expansion of e-commerce will continue to reshape the retail landscape, providing opportunities for local brands to reach wider audiences and enhance their market presence, ultimately fostering a more resilient textile industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Woven Fabrics Knitted Fabrics Non-woven Fabrics Technical Textiles Home Textiles Fashion Textiles Others |

| By End-User | Apparel Home Furnishings Industrial Applications Automotive Textiles Medical Textiles Others |

| By Distribution Channel | Online Retail Offline Retail Wholesale Direct Sales Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Fabric Composition | Cotton Polyester Wool Silk Blends Others |

| By Application | Clothing Upholstery Technical Applications Fashion Accessories Others |

| By Sustainability Level | Conventional Textiles Eco-friendly Textiles Recycled Textiles Organic Textiles Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Manufacturing Insights | 40 | Production Managers, Quality Control Supervisors |

| Retail Market Dynamics | 40 | Store Managers, Merchandising Directors |

| Consumer Preferences in Textiles | 120 | End Consumers, Fashion Enthusiasts |

| Distribution Channel Analysis | 40 | Logistics Coordinators, Supply Chain Analysts |

| Sustainability Practices in Textiles | 40 | Sustainability Managers, Corporate Social Responsibility Officers |

The Bahrain Textile Market is valued at approximately USD 980 million, reflecting a significant growth trend driven by increasing consumer demand for both traditional and modern textile products, as well as a focus on sustainability and eco-friendly materials.