Region:Middle East

Author(s):Rebecca

Product Code:KRAD6091

Pages:99

Published On:December 2025

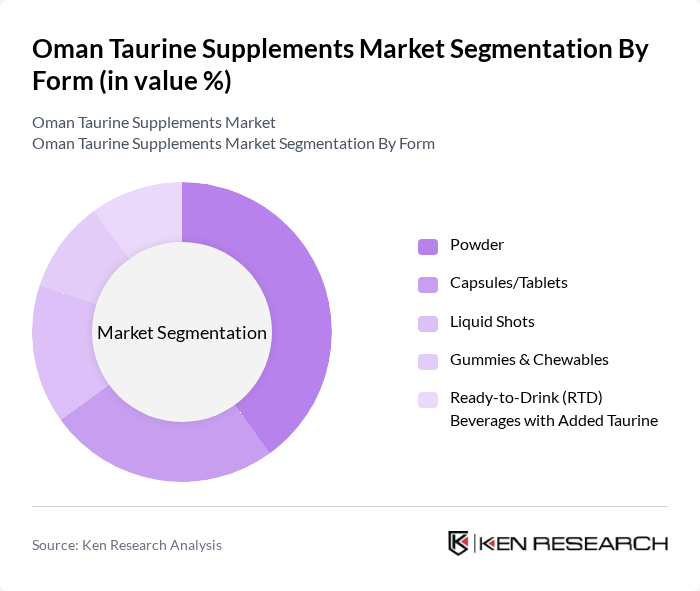

By Form:The market is segmented into various forms of taurine supplements, including Powder, Capsules/Tablets, Liquid Shots, Gummies & Chewables, and Ready-to-Drink (RTD) Beverages with Added Taurine. Among these, the Powder form is currently widely adopted in sports nutrition stacks due to its versatility, ability to be mixed with pre?workout formulas or protein shakes, and cost-effectiveness for regular users, particularly among athletes and fitness enthusiasts. The convenience of capsules and tablets also appeals to consumers looking for precise dosing and quick, easy consumption options suitable for daily wellness routines. Liquid shots and RTD beverages are gaining traction, especially among younger consumers seeking instant energy boosts through functional drinks, where taurine is commonly combined with caffeine and B?vitamins.

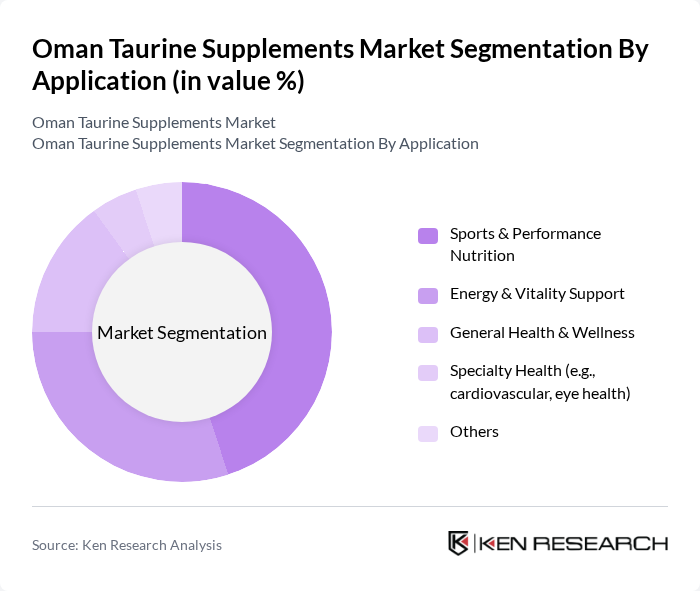

By Application:The applications of taurine supplements are diverse, including Sports & Performance Nutrition, Energy & Vitality Support, General Health & Wellness, Specialty Health (e.g., cardiovascular, eye health), and Others. The Sports & Performance Nutrition segment is leading the market, driven by the increasing number of athletes and fitness enthusiasts who rely on taurine for improved endurance, reduced muscle fatigue, and faster recovery within broader pre?workout and intra?workout formulations. Energy & Vitality Support is also a significant application, appealing to consumers looking for quick energy boosts and cognitive support, particularly in the context of busy lifestyles, extended working hours, and the rising consumption of energy drinks in Oman and the wider Gulf region.

The Oman Taurine Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Optimum Nutrition (Glanbia Performance Nutrition), Muscletech (Iovate Health Sciences International Inc.), NOW Foods, Life Extension, BulkSupplements.com, Nutricost, Myprotein (The Hut Group), Dymatize Enterprises LLC, Ultimate Nutrition Inc., GNC Holdings LLC, Herbalife International of America, Inc., Vitabiotics Ltd., Natures Only, Oman, Al Jothen Pharmacy Group, Oman, Oman Pharmaceutical Products Co. LLC contribute to innovation, geographic expansion, and service delivery in this space through diversified product portfolios, omni?channel distribution, and a strong focus on sports nutrition and general wellness supplements.

The future of the taurine supplements market in Oman appears promising, driven by increasing health awareness and the expansion of e-commerce. As consumers continue to prioritize health and wellness, the demand for taurine supplements is expected to rise in future. Additionally, the trend towards personalized nutrition and sustainable sourcing will likely shape product offerings, encouraging brands to innovate and cater to evolving consumer preferences. This dynamic environment presents significant opportunities for growth and market penetration.

| Segment | Sub-Segments |

|---|---|

| By Form | Powder Capsules/Tablets Liquid Shots Gummies & Chewables Ready-to-Drink (RTD) Beverages with Added Taurine |

| By Application | Sports & Performance Nutrition Energy & Vitality Support General Health & Wellness Specialty Health (e.g., cardiovascular, eye health) Others |

| By Distribution Channel | Online Retail & E?commerce Platforms Supermarkets/Hypermarkets Specialty Nutrition & Health Stores Pharmacies & Drugstores Gyms, Fitness Centers & Sports Clubs Others |

| By Packaging Type | Bottles & Jars Sachets & Pouches Blister Packs Tetra Packs & Cans (for RTD) Others |

| By Consumer Group | Professional Athletes Recreational & Fitness Enthusiasts Students & Young Adults Working Professionals Others |

| By Gender | Male Female Others |

| By Price Range | Economy Mid-range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Store Retailers | 100 | Store Owners, Sales Managers |

| Nutritionists and Dietitians | 50 | Registered Dietitians, Nutrition Consultants |

| Fitness Centers and Gyms | 40 | Gym Owners, Personal Trainers |

| Consumers of Dietary Supplements | 120 | Health-Conscious Individuals, Athletes |

| Online Retail Platforms | 60 | E-commerce Managers, Product Category Managers |

The Oman Taurine Supplements Market is valued at approximately USD 20 million, reflecting a growing demand driven by health consciousness, fitness activities, and the popularity of energy drinks containing taurine.