Region:Middle East

Author(s):Rebecca

Product Code:KRAD5068

Pages:88

Published On:December 2025

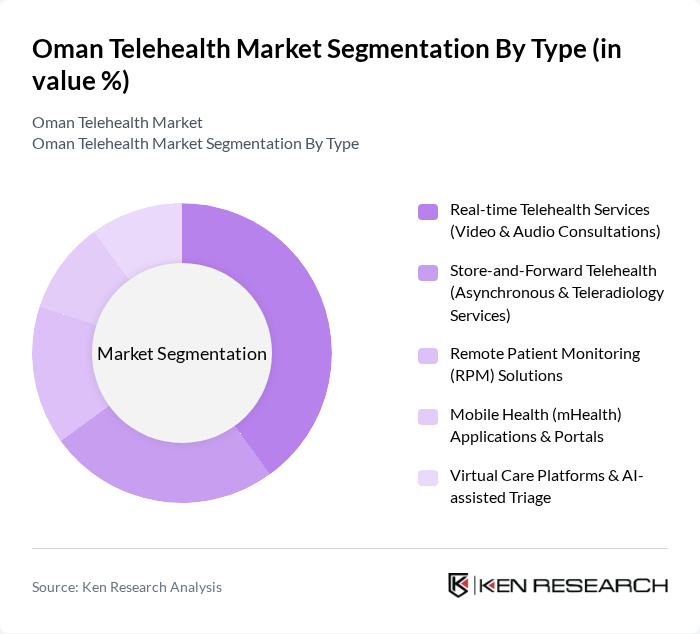

By Type:The telehealth market in Oman can be segmented into various types, including Real-time Telehealth Services, Store-and-Forward Telehealth, Remote Patient Monitoring Solutions, Mobile Health Applications, and Virtual Care Platforms. This structure aligns with Middle East and Africa telehealth segmentation, where services represent the largest revenue component and app- and cloud-based offerings continue to scale. Among these, Real-time Telehealth Services, which encompass video and audio consultations, are leading the market due to their convenience, user familiarity, and immediate access to healthcare professionals across primary care and multi-specialty settings. The growing acceptance of virtual consultations, especially post-pandemic, alongside the expansion of platforms like Shifa, Badr Al Samaa Telemedicine, and regional apps, has significantly influenced consumer behavior, making it the preferred choice for many patients seeking timely medical advice and follow-up care.

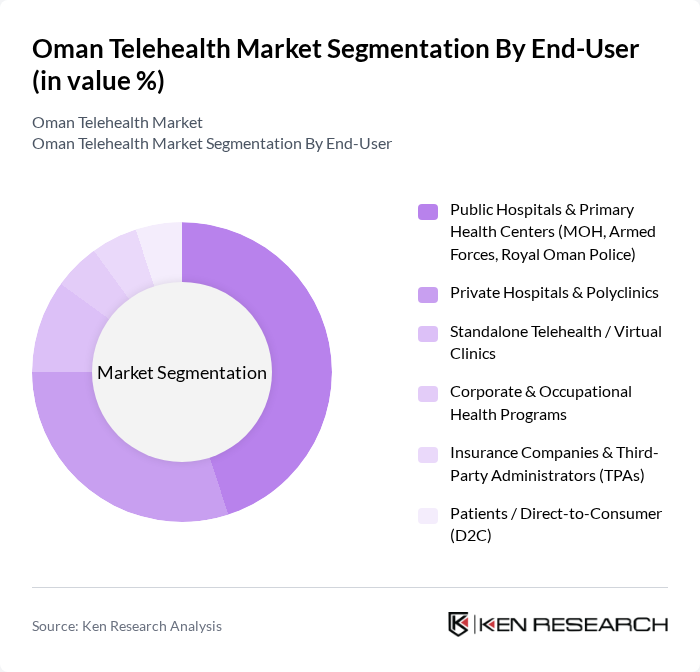

By End-User:The end-user segmentation of the telehealth market includes Public Hospitals, Private Hospitals, Standalone Telehealth Clinics, Corporate Health Programs, Insurance Companies, and Direct-to-Consumer patients. Public Hospitals and Primary Health Centers dominate this segment, as Ministry of Health facilities, armed forces hospitals, and public primary care centers have integrated teleconsultation services into routine care using platforms such as Shifa to manage outpatient volumes and extend reach to peripheral wilayats. The integration of telehealth into public health initiatives and chronic disease management programs has been pivotal in improving healthcare access, especially in rural and underserved areas, thereby driving the growth of this segment while enabling private hospitals and virtual clinics to complement capacity through hybrid in?person and remote care models.

The Oman Telehealth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ministry of Health (MOH) Shifa Telemedicine & eHealth Platform, Badr Al Samaa Group – Badr Al Samaa Telemedicine Services, Burjeel Hospitals Oman – Burjeel eConsult & Virtual Clinic, KIMS Health Oman – KIMS Oman Virtual Care, Starcare Oman – Starcare Telemedicine & Online Consultations, Aster DM Healthcare – Aster Oman Telehealth & myAster App, Sultan Qaboos University Hospital (SQUH) Tele-clinics, Royal Hospital & MOH Regional Hospitals Tele-consult Networks, Altibbi (Regional Telehealth Platform Active in Oman), Okadoc (Digital Appointment & Teleconsultation Platform), Vezeeta (Regional Digital Health & Teleconsultation Platform), 6abibak / Tabibak Oman (Arabic-language Teleconsultation Service), Local Telehealth Start-ups & Virtual Clinics (e.g., Health 360, private app-based services), Insurance-linked Telehealth Programs (e.g., National Life & General, Oman Insurance-linked platforms), International Technology Vendors Supporting Telehealth (Cloud, RPM & Platform Providers) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman telehealth market appears promising, driven by technological advancements and increasing consumer acceptance. As the government continues to invest in digital health initiatives, the integration of artificial intelligence and machine learning into telehealth platforms is expected to enhance service delivery. Furthermore, the growing trend of patient-centric care models will likely lead to more personalized healthcare solutions, fostering greater engagement and satisfaction among patients.

| Segment | Sub-Segments |

|---|---|

| By Type | Real-time Telehealth Services (Video & Audio Consultations) Store-and-Forward Telehealth (Asynchronous & Teleradiology Services) Remote Patient Monitoring (RPM) Solutions Mobile Health (mHealth) Applications & Portals Virtual Care Platforms & AI-assisted Triage |

| By End-User | Public Hospitals & Primary Health Centers (MOH, Armed Forces, Royal Oman Police) Private Hospitals & Polyclinics Standalone Telehealth / Virtual Clinics Corporate & Occupational Health Programs Insurance Companies & Third-Party Administrators (TPAs) Patients / Direct-to-Consumer (D2C) |

| By Service Type | Tele-primary Care (Family Medicine & General Practice) Tele-specialist Care (Cardiology, Dermatology, Pediatrics, etc.) Tele-urgent & Emergency eConsults Tele-mental Health & Behavioral Health Telerehabilitation & Physiotherapy Chronic Disease Management & Follow-up Care |

| By Technology | Web-based Teleconsultation Platforms Cloud-based Telehealth Solutions & EHR-integrated Portals Mobile Applications (Android / iOS) Connected Medical Devices & Wearables (IoT-enabled) AI, Analytics & Clinical Decision Support Tools |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Patients with Chronic Conditions (Diabetes, CVD, COPD, etc.) High-risk & Remote Population Groups |

| By Payment Model | Subscription-based (Individual & Family Plans) Pay-per-visit / On-demand Consultations Employer-funded & Corporate Health Plans Insurance-covered / Reimbursed Teleconsultations Out-of-pocket Self-pay Models |

| By Geographic Coverage | Muscat Governorate Dhofar Governorate Al Batinah (North & South) Interior & Remote Governorates (Al Dakhiliyah, Al Wusta, Al Sharqiyah, Musandam, Others) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Provider Telehealth Adoption | 90 | Hospital Administrators, Clinic Managers |

| Patient Experience with Telehealth | 140 | Telehealth Users, General Patients |

| Technology Vendor Insights | 75 | Product Managers, Sales Directors |

| Regulatory Perspectives on Telehealth | 45 | Health Policy Makers, Regulatory Officials |

| Market Trends and Future Outlook | 65 | Healthcare Analysts, Market Researchers |

The Oman Telehealth Market is valued at approximately USD 120 million, reflecting significant growth driven by the adoption of digital health solutions and the increasing demand for accessible medical services, particularly in remote areas.