Region:Asia

Author(s):Rebecca

Product Code:KRAE0881

Pages:83

Published On:December 2025

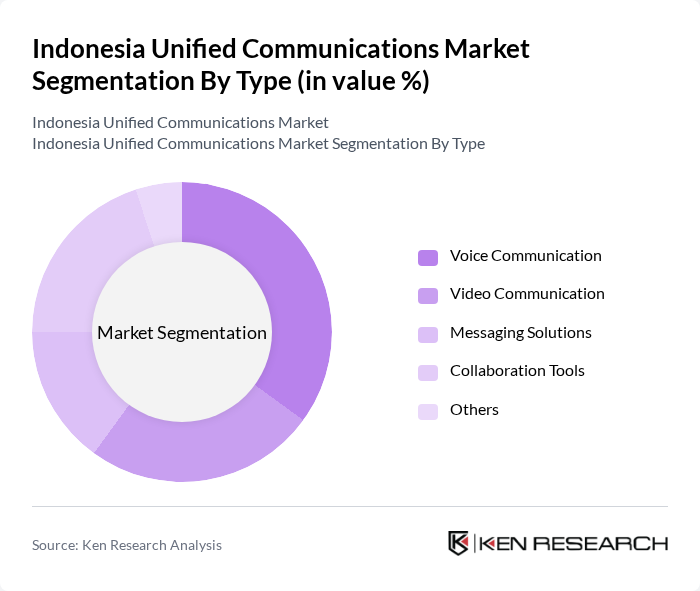

By Type:The market is segmented into various types of unified communication solutions, including voice communication, video communication, messaging solutions, collaboration tools, and others. Among these, voice communication is the most dominant segment, driven by the increasing need for real-time communication in businesses. Video communication is also gaining traction, especially with the rise of remote work and virtual meetings. The demand for messaging solutions and collaboration tools is growing as organizations seek to enhance team collaboration and productivity.

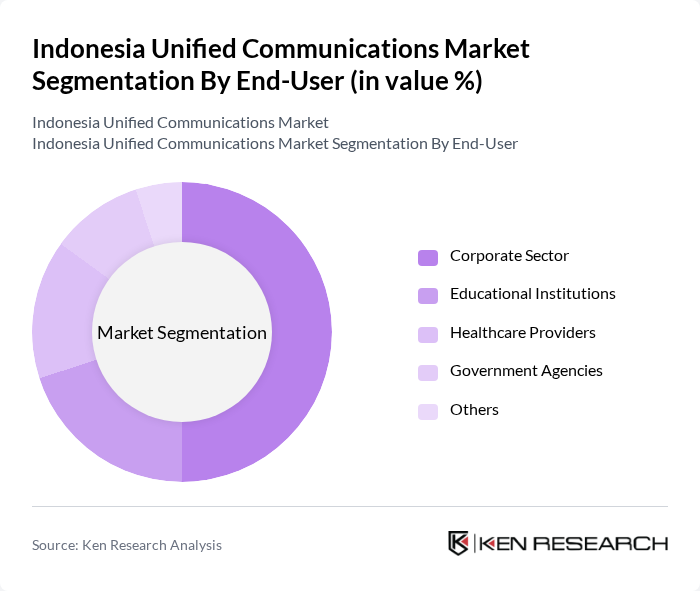

By End-User:The end-user segmentation includes corporate sectors, educational institutions, healthcare providers, government agencies, and others. The corporate sector is the leading end-user, as businesses increasingly adopt unified communication solutions to improve operational efficiency and enhance employee collaboration. Educational institutions are also leveraging these technologies for remote learning and administrative purposes, while healthcare providers utilize them for telemedicine and patient management.

The Indonesia Unified Communications Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telkom Indonesia, Indosat Ooredoo, XL Axiata, Smartfren Telecom, Cisco Systems, Avaya Inc., Microsoft Corporation, Zoom Video Communications, RingCentral, Mitel Networks, 8x8 Inc., Unify (Atos), Huawei Technologies, NEC Corporation, and Avaya Cloud contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia unified communications market appears promising, driven by technological advancements and increasing digital transformation initiatives. As businesses continue to embrace remote work and mobile solutions, the demand for integrated communication platforms will rise. Additionally, the government's commitment to enhancing digital infrastructure will facilitate broader access to these technologies. Companies that prioritize user experience and invest in innovative solutions will likely gain a competitive edge, positioning themselves favorably in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Voice Communication Video Communication Messaging Solutions Collaboration Tools Others |

| By End-User | Corporate Sector Educational Institutions Healthcare Providers Government Agencies Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Industry Vertical | IT and Telecommunications Banking, Financial Services, and Insurance (BFSI) Retail Manufacturing Others |

| By Communication Channel | Voice over IP (VoIP) Instant Messaging Video Conferencing Email Communication Others |

| By Service Type | Managed Services Professional Services Support and Maintenance Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Unified Communications Adoption | 150 | IT Managers, CIOs, and CTOs |

| SME Communication Solutions | 100 | Business Owners, Operations Managers |

| Telecom Service Provider Insights | 80 | Product Managers, Sales Directors |

| End-User Experience with UC Tools | 120 | Employees, Team Leaders, and Project Managers |

| Market Trends in Remote Work Solutions | 90 | HR Managers, Training Coordinators |

The Indonesia Unified Communications Market is valued at approximately USD 18 billion. This valuation reflects the growing demand for cloud-based collaboration tools and unified communication as a service (UCaaS) solutions, particularly in the context of increasing remote work trends.