Region:Middle East

Author(s):Dev

Product Code:KRAB6892

Pages:96

Published On:October 2025

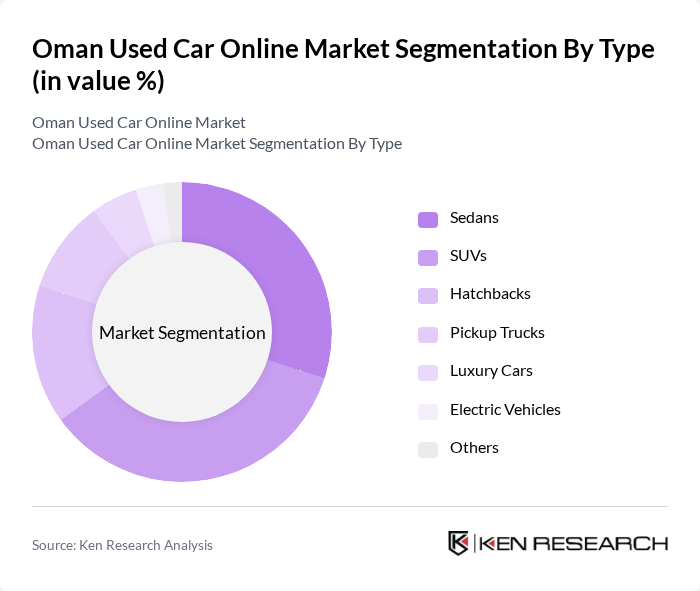

By Type:The market is segmented into various types of vehicles, including Sedans, SUVs, Hatchbacks, Pickup Trucks, Luxury Cars, Electric Vehicles, and Others. Among these, SUVs have gained significant popularity due to their versatility and spaciousness, appealing to families and adventure seekers alike. Sedans also maintain a strong presence due to their affordability and fuel efficiency, making them a preferred choice for urban commuters.

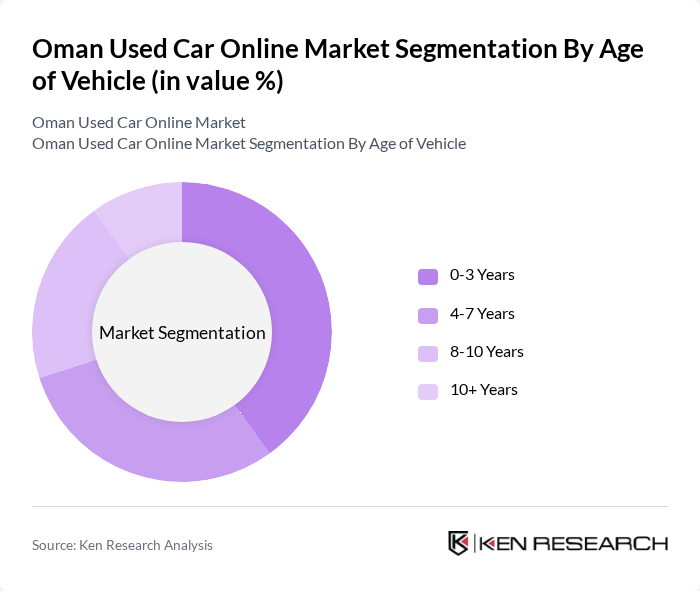

By Age of Vehicle:The segmentation by age includes vehicles aged 0-3 years, 4-7 years, 8-10 years, and 10+ years. The 0-3 years segment is particularly dominant as consumers increasingly prefer newer models that come with warranties and advanced features. This trend is driven by the desire for reliability and the latest technology, making younger vehicles more appealing to buyers.

The Oman Used Car Online Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Automobile Association, CarSwitch, Dubizzle Oman, Oman Used Cars, Al-Futtaim Motors, Al-Muheet Group, Al-Harthy Group, Al-Mahrouqi Group, Al-Mansoori Group, Al-Nahda Automotive, Al-Sahwa Automotive, Al-Waha Automotive, Al-Zawawi Group, Muscat Motors, Oman Car Market contribute to innovation, geographic expansion, and service delivery in this space.

The Oman used car online market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As digital payment solutions become more prevalent, facilitating seamless transactions, the market is likely to witness increased participation from both buyers and sellers. Additionally, the rise of certified pre-owned programs will enhance consumer confidence, addressing skepticism and promoting a more robust online marketplace. These trends indicate a promising future for the used car sector in Oman, with potential for sustained growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Sedans SUVs Hatchbacks Pickup Trucks Luxury Cars Electric Vehicles Others |

| By Age of Vehicle | 3 Years 7 Years 10 Years + Years |

| By Price Range | Below OMR 5,000 OMR 5,000 - OMR 10,000 OMR 10,000 - OMR 15,000 Above OMR 15,000 |

| By Condition | Certified Pre-Owned Non-Certified Used Cars |

| By Sales Channel | Online Marketplaces Dealerships Private Sales |

| By Financing Options | Cash Purchases Bank Loans Installment Plans |

| By Geographic Distribution | Muscat Salalah Sohar Nizwa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Used Car Buyers | 150 | Recent purchasers, first-time buyers |

| Used Car Dealers | 100 | Dealership owners, sales managers |

| Online Marketplace Operators | 80 | Platform managers, marketing directors |

| Automotive Industry Experts | 50 | Consultants, analysts, and researchers |

| Potential Buyers (Non-purchasers) | 120 | Individuals considering online purchases |

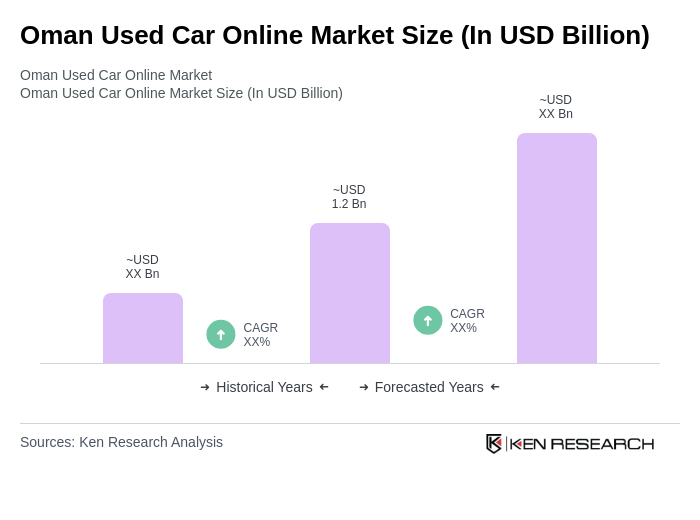

The Oman Used Car Online Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing consumer demand for affordable transportation and the rise of digital platforms facilitating online transactions.