Region:Middle East

Author(s):Rebecca

Product Code:KRAB2136

Pages:90

Published On:January 2026

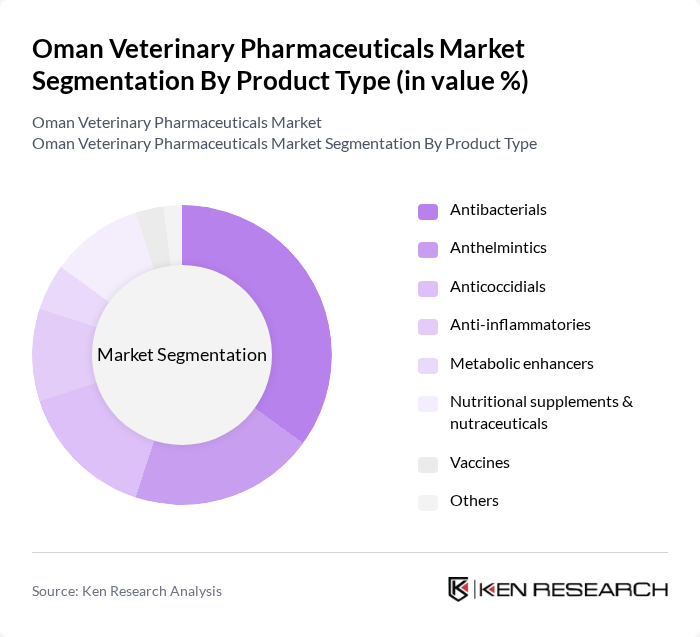

By Product Type:The product type segmentation includes various categories such as antibacterials, anthelmintics, anticoccidials, anti-inflammatories, metabolic enhancers, nutritional supplements & nutraceuticals, vaccines, and others. These product groups reflect the standard therapeutic and preventive classes used across livestock and companion animals in the region. Among these, antibacterials are the leading subsegment due to the rising incidence of bacterial infections in livestock and pets and their central role in treating respiratory, gastrointestinal, and systemic infections, driving demand for effective treatment options. The increasing focus on animal health and welfare, antimicrobial stewardship, and productivity improvement in commercial poultry, dairy, and feedlot systems further propels the growth of this subsegment, while also encouraging a gradual shift toward responsible use and alternative products where possible.

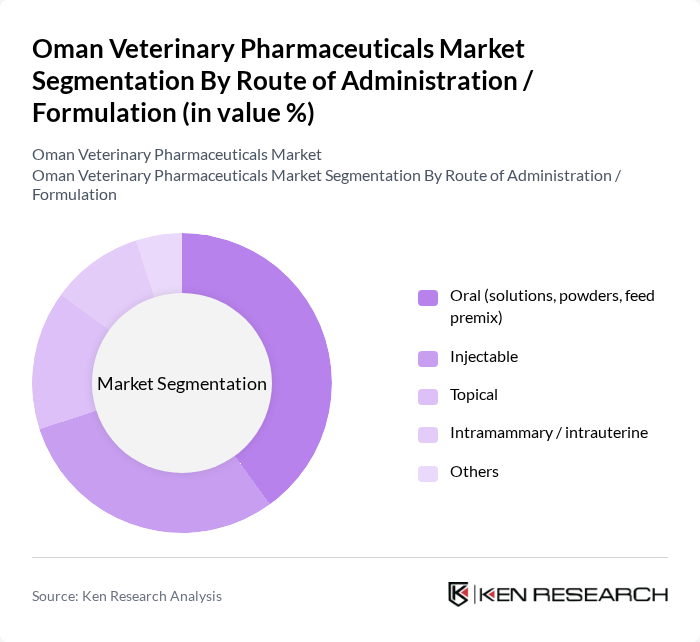

By Route of Administration / Formulation:This segmentation includes oral (solutions, powders, feed premix), injectable, topical, intramammary/intrauterine, and others. The oral route is the most prevalent due to its ease of administration, suitability for herd/flock treatment via drinking water or feed, and effectiveness in delivering medications to livestock and pets. The growing trend of preventive healthcare in animals, including the use of feed?grade supplements, premixes, and routine dewormers, has also contributed to the popularity of oral formulations, making it a dominant subsegment in the market while injectable routes remain critical for vaccines, long?acting therapies, and emergency care.

The Oman Veterinary Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., MSD Animal Health (Merck & Co., Inc.), Boehringer Ingelheim Animal Health, Elanco Animal Health Inc., Ceva Santé Animale, Virbac Group, Vetoquinol SA, Dechra Pharmaceuticals PLC, Phibro Animal Health Corporation, Neogen Corporation, IDEXX Laboratories, Inc., Alltech Inc., Kemin Industries, Inc., PetIQ, Inc., Regional and local players (Oman & GCC) contribute to innovation, geographic expansion, and service delivery in this space, supported by distribution partnerships and alignment with GCC-wide veterinary product registration frameworks.

The future of the Oman veterinary pharmaceuticals market appears promising, driven by increasing investments in veterinary research and development. As the livestock sector continues to expand, the demand for innovative veterinary solutions will rise in future. Additionally, the integration of technology in veterinary practices, such as telemedicine, is expected to enhance service delivery. These trends will likely lead to improved animal health outcomes and increased market participation from both local and international pharmaceutical companies.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Antibacterials Anthelmintics Anticoccidials Anti-inflammatories Metabolic enhancers Nutritional supplements & nutraceuticals Vaccines Others |

| By Route of Administration / Formulation | Oral (solutions, powders, feed premix) Injectable Topical Intramammary / intrauterine Others |

| By Animal Type | Bovine & camel Small ruminants (ovine, caprine) Poultry (broilers, breeders, layers) Pets (canine, feline) Equine Others |

| By Indication | Infectious diseases Parasitic diseases Metabolic and nutritional disorders Reproductive & fertility disorders Pain & inflammation Others |

| By End-User | Veterinary clinics & hospitals Livestock farms Poultry farms Government agencies & research institutions Retail pharmacies & pet shops Others |

| By Distribution Channel | Veterinary clinics & hospitals Wholesalers & distributors Retail pharmacies Online channels Direct sales to farms Others |

| By Region | Muscat Dhofar (incl. Salalah) Al Batinah Al Dakhiliyah (incl. Nizwa) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pharmaceutical Distributors | 80 | Sales Managers, Distribution Coordinators |

| Livestock Farmers | 70 | Farm Owners, Livestock Managers |

| Pet Owners | 90 | Pet Owners, Veterinary Technicians |

| Regulatory Bodies | 50 | Policy Makers, Regulatory Affairs Specialists |

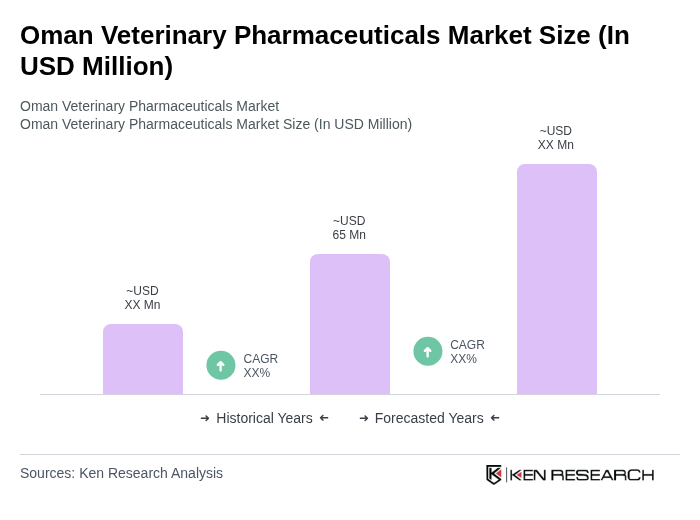

The Oman Veterinary Pharmaceuticals Market is valued at approximately USD 65 million, reflecting growth driven by increasing livestock production, rising pet ownership, and heightened awareness of animal health and welfare.