Region:Middle East

Author(s):Rebecca

Product Code:KRAB2135

Pages:94

Published On:January 2026

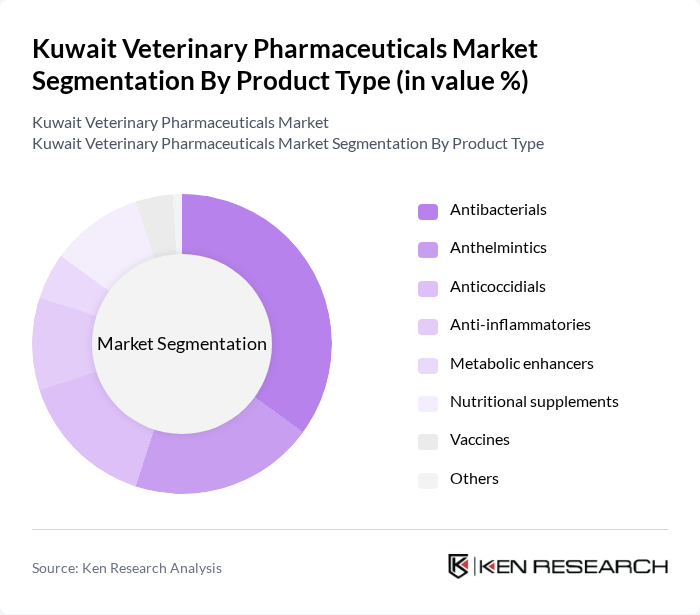

By Product Type:The product type segmentation includes various categories of veterinary pharmaceuticals that cater to different health needs of animals. The subsegments include Antibacterials, Anthelmintics, Anticoccidials, Anti-inflammatories, Metabolic enhancers, Nutritional supplements, Vaccines, and Others. Among these, Antibacterials are currently leading the market due to the rising incidence of bacterial and infectious diseases in both companion and livestock animals, alongside increasing use of anti-infectives and anti-parasitics as core therapeutic classes in Kuwait’s veterinary pharmaceuticals segment.

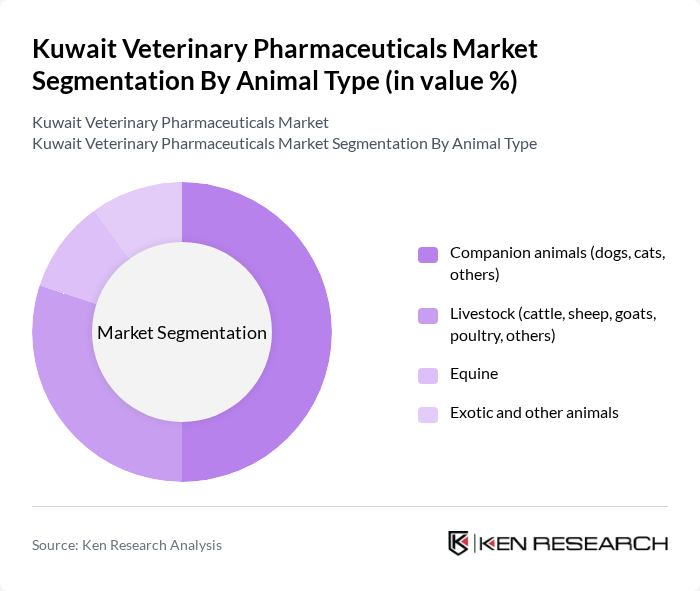

By Animal Type:This segmentation focuses on the different categories of animals that require veterinary pharmaceuticals. The subsegments include Companion animals (dogs, cats, others), Livestock (cattle, sheep, goats, poultry, others), Equine, and Exotic and other animals. The Companion animals segment is currently the largest in value terms due to the increasing trend of pet ownership in urban Kuwait, higher per?animal spending on diagnostics, vaccines, and therapeutics, and the growing willingness of pet owners to invest in advanced veterinary care and preventive health products.

The Kuwait Veterinary Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis, Merck Animal Health (MSD Animal Health), Boehringer Ingelheim Animal Health, Elanco Animal Health, Virbac, Vetoquinol, Ceva Santé Animale, IDEXX Laboratories, Neogen Corporation, Phibro Animal Health, Local distributors and importers (aggregated profiles), Regional GCC veterinary pharmaceutical players with presence in Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait veterinary pharmaceuticals market is poised for significant growth, driven by increasing pet ownership and heightened awareness of animal health. The expansion of e-commerce platforms is expected to facilitate access to veterinary products, while the adoption of telemedicine will enhance service delivery. Furthermore, the focus on preventive healthcare and sustainability will shape product development, encouraging innovation in veterinary pharmaceuticals. As these trends evolve, the market is likely to witness a dynamic transformation, fostering a healthier environment for both pets and livestock.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Antibacterials Anthelmintics Anticoccidials Anti-inflammatories Metabolic enhancers Nutritional supplements Vaccines Others |

| By Animal Type | Companion animals (dogs, cats, others) Livestock (cattle, sheep, goats, poultry, others) Equine Exotic and other animals |

| By Indication | Infectious diseases Parasitic diseases Reproductive and fertility disorders Metabolic and nutritional disorders Pain and inflammation management Preventive care (vaccination, prophylaxis) Others |

| By Distribution Channel | Veterinary hospitals & clinics Pharmacies Online retail Direct sales Others |

| By Formulation | Injectables Oral (tablets, capsules, suspensions) Topical Feed premixes Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Mubarak Al-Kabeer Governorate Al Jahra Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pet Owners | 120 | Dog and Cat Owners, Livestock Farmers |

| Pharmaceutical Distributors | 60 | Sales Managers, Distribution Coordinators |

| Regulatory Bodies | 70 | Policy Makers, Veterinary Inspectors |

| Research Institutions | 40 | Veterinary Researchers, Academic Professors |

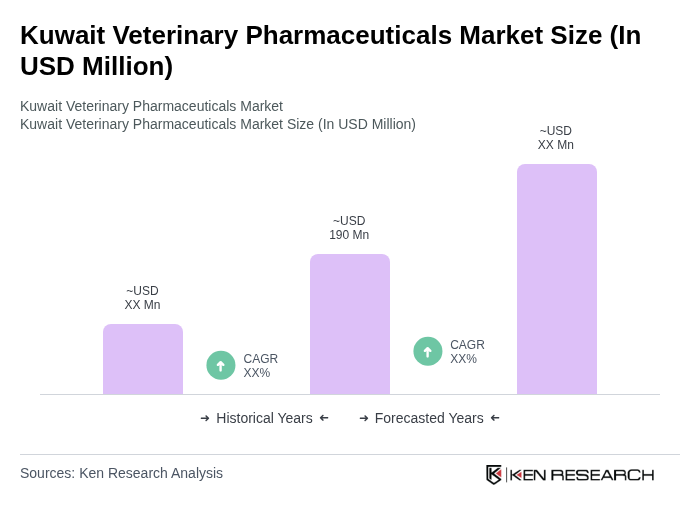

The Kuwait Veterinary Pharmaceuticals Market is valued at approximately USD 190 million, reflecting a comprehensive analysis of veterinary care, vaccines, and pharmaceutical spending in the country, driven by increasing pet ownership and livestock production.