Region:Asia

Author(s):Rebecca

Product Code:KRAB2139

Pages:81

Published On:January 2026

By Product Type:The product type segmentation includes various categories such as vaccines, parasiticides, anti-infectives, anti-inflammatory drugs, medical feed additives, nutraceuticals, biologics, and others. This structure is consistent with standard classifications used for veterinary medicine and animal healthcare in Japan, where pharmaceuticals, biologics, and medicated feed additives are key pillars of the market. Among these, vaccines represent one of the most rapidly expanding subsegments, supported by strong demand for preventive healthcare in both companion and livestock animals and rising investment in animal vaccination programs. The rising incidence and surveillance of zoonotic and food-borne diseases, combined with regulatory emphasis on herd health and biosecurity, continue to drive the need for immunization in pets and farm animals, making vaccines a critical component of veterinary healthcare.

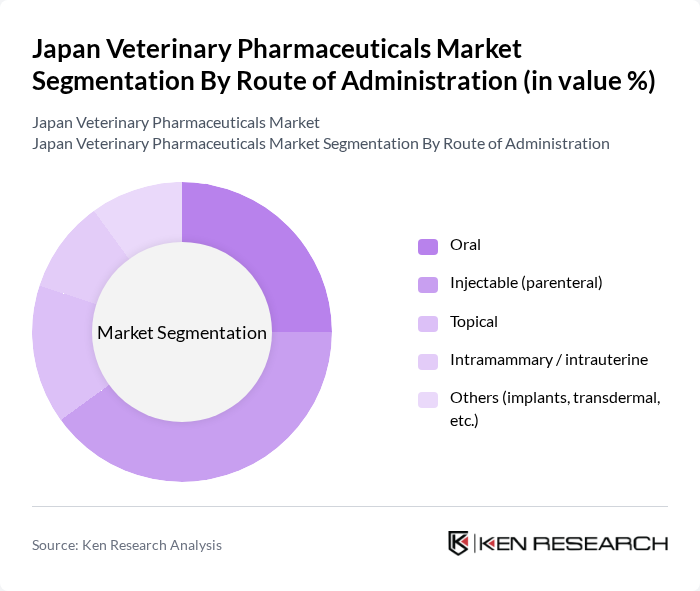

By Route of Administration:The route of administration includes oral, injectable, topical, intramammary/intrauterine, and others. This segmentation reflects prevailing delivery practices in veterinary medicine in Japan, where systemic and local treatments are tailored to species, indication, and clinical setting. Injectable products hold a substantial share in therapeutic categories that require rapid onset of action, precise dosing, and high bioavailability, particularly in livestock and in acute companion animal care. The preference for injectable formulations is further supported by their extensive use in vaccination, parenteral anti-infectives, and anti-inflammatory therapies across both companion animals and production animals, ensuring dependable therapeutic outcomes.

The Japan Veterinary Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Japan, Boehringer Ingelheim Animal Health Japan, MSD Animal Health (Merck Animal Health), Elanco Japan, Ceva Santé Animale Japan, Virbac Japan, Vetoquinol Japan, Kyoritsu Seiyaku Corporation, Nippon Zenyaku Kogyo Co., Ltd. (ZENOAQ), Meiji Seika Pharma Co., Ltd., DS Pharma Animal Health Co., Ltd., Chuo Kagaku Co., Ltd. (animal health-related business, if applicable), Takeda Pharmaceutical Company Limited (veterinary-related activities, if any), Otsuka Pharmaceutical Co., Ltd. (veterinary-related activities, if any), and other emerging domestic veterinary pharmaceutical players contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan veterinary pharmaceuticals market appears promising, driven by increasing pet ownership and advancements in veterinary medicine. As the market evolves, a notable shift towards preventive care is expected, with pet owners prioritizing regular health check-ups. Additionally, the integration of technology in veterinary practices will enhance service delivery, making veterinary care more accessible. These trends indicate a robust growth trajectory for the sector, fostering innovation and improved health outcomes for animals.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Vaccines Parasiticides Anti-infectives (antibiotics, antivirals, antifungals) Anti-inflammatory and analgesic drugs Medical feed additives Nutraceuticals and dietary supplements Biologics (including monoclonal antibodies) Others (hormones, reproductive and specialty therapies) |

| By Route of Administration | Oral Injectable (parenteral) Topical Intramammary / intrauterine Others (implants, transdermal, etc.) |

| By Animal Type | Companion animals (dogs, cats) Equine Ruminants (cattle, sheep, goats) Swine Poultry Aquaculture Others (small mammals, exotics) |

| By End-User | Veterinary hospitals and clinics Reference laboratories Retail and online pharmacies Livestock producers and integrators Academic and research institutes Others |

| By Distribution Channel | Direct sales (to hospitals, clinics, and producers) Wholesalers and distributors Retail pharmacies and drug stores Online channels and e-commerce platforms Others |

| By Formulation | Solid (tablets, boluses, powders) Liquid (solutions, suspensions) Semi-solid (ointments, gels, creams) Long-acting and implantable formulations Others |

| By Region | Hokkaido Tohoku Kanto Chubu Kinki (Kansai) Chugoku Shikoku Kyushu–Okinawa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Companion Animal Pharmaceuticals | 120 | Veterinarians, Pet Store Owners |

| Livestock Health Products | 90 | Farm Managers, Veterinary Technicians |

| Regulatory Compliance Insights | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Veterinary Distribution Channels | 60 | Distributors, Supply Chain Managers |

| Market Trends and Innovations | 80 | Industry Analysts, Product Development Managers |

The Japan Veterinary Pharmaceuticals Market is valued at approximately USD 2.7 billion, reflecting a robust growth driven by increasing pet ownership, advancements in veterinary medicine, and rising awareness of animal health and welfare.