Region:Middle East

Author(s):Shubham

Product Code:KRAA8669

Pages:88

Published On:November 2025

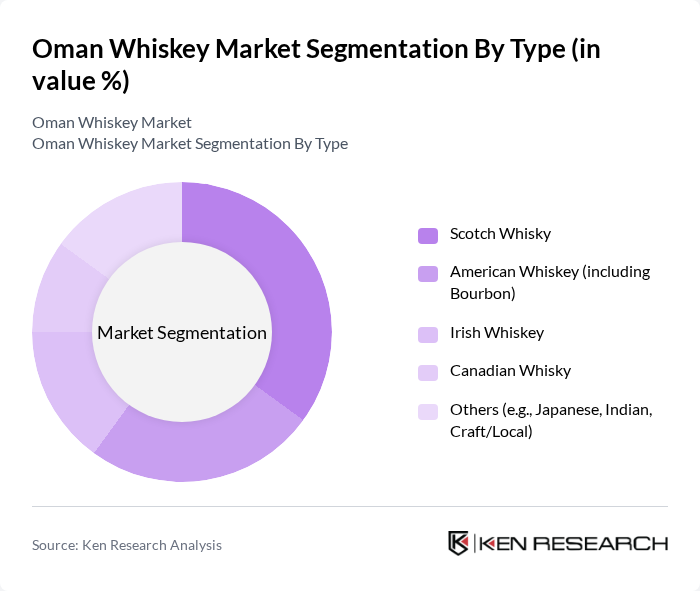

By Type:The whiskey market is segmented into Scotch Whisky, American Whiskey (including Bourbon), Irish Whiskey, Canadian Whisky, and Others (e.g., Japanese, Indian, Craft/Local). Each segment appeals to distinct consumer groups and shapes market dynamics, with Scotch and American whiskeys maintaining the largest shares due to established brand recognition and consumer loyalty .

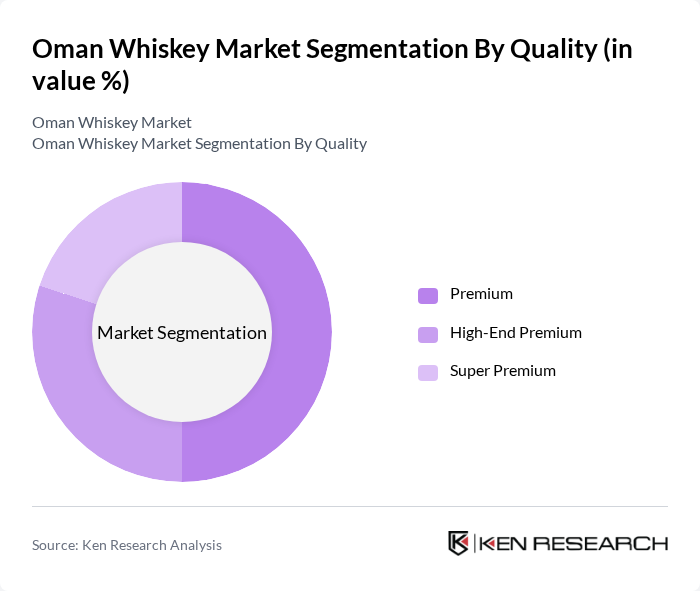

By Quality:The whiskey market is also segmented by quality, including Premium, High-End Premium, and Super Premium categories. Premiumization is a dominant trend, with consumers increasingly opting for higher-quality products that offer unique flavors and artisanal characteristics. This segmentation reflects evolving purchasing decisions and willingness to pay for superior quality .

The Oman Whiskey Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diageo plc (Johnnie Walker, Buchanan’s, J&B), Pernod Ricard (Chivas Regal, Ballantine’s, Jameson), Beam Suntory (Jim Beam, Maker’s Mark, Hibiki), Brown-Forman (Jack Daniel’s, Woodford Reserve), Bacardi Limited (Dewar’s, William Lawson’s), William Grant & Sons (Glenfiddich, Grant’s, The Balvenie), Edrington Group (The Macallan, Famous Grouse), Campari Group (Wild Turkey, Glen Grant), Sazerac Company (Buffalo Trace, Fireball, Southern Comfort), Oman United Agencies (key importer/distributor), African & Eastern Oman (major regional distributor), MHD LLC (Mohsin Haider Darwish, Oman’s leading beverage distributor), Al Seer Group (regional distributor, Oman), International Beverage Holdings (Old Pulteney, Hankey Bannister), Distell Group (Bain’s Cape Mountain Whisky, Three Ships) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman whiskey market is poised for dynamic growth, driven by increasing disposable incomes and a burgeoning tourism sector. As consumer preferences shift towards premium spirits, brands that emphasize quality and unique offerings are likely to thrive. Additionally, the rise of e-commerce platforms presents new avenues for distribution, allowing brands to reach a broader audience. The market's future will also be shaped by evolving consumer trends, including a growing interest in whiskey-based cocktails and sustainable production practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Scotch Whisky American Whiskey (including Bourbon) Irish Whiskey Canadian Whisky Others (e.g., Japanese, Indian, Craft/Local) |

| By Quality | Premium High-End Premium Super Premium |

| By End-User | Retail Consumers Bars and Restaurants Hotels and Resorts Corporate Events Others |

| By Packaging Type | Glass Bottles Miniatures Gift Packs Others |

| By Distribution Channel | On-Trade (Hotels, Bars, Restaurants) Off-Trade (Supermarkets/Hypermarkets, Liquor Stores) Duty-Free Shops Online Retail Others |

| By Price Range | Economy Mid-Range Premium Super Premium |

| By Occasion | Celebrations Casual Gatherings Corporate Functions Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Whiskey Retailers | 60 | Store Managers, Sales Representatives |

| Whiskey Consumers | 120 | Regular Whiskey Drinkers, Occasional Consumers |

| Importers and Distributors | 40 | Logistics Managers, Procurement Officers |

| Hospitality Sector | 50 | Bar Managers, Restaurant Owners |

| Industry Experts | 40 | Market Analysts, Beverage Consultants |

The Oman Whiskey Market is valued at approximately USD 8 million, based on a five-year historical analysis of import and consumption data. This valuation reflects the growing interest in premium whiskey products among consumers in Oman.