Region:Asia

Author(s):Geetanshi

Product Code:KRAA0135

Pages:99

Published On:August 2025

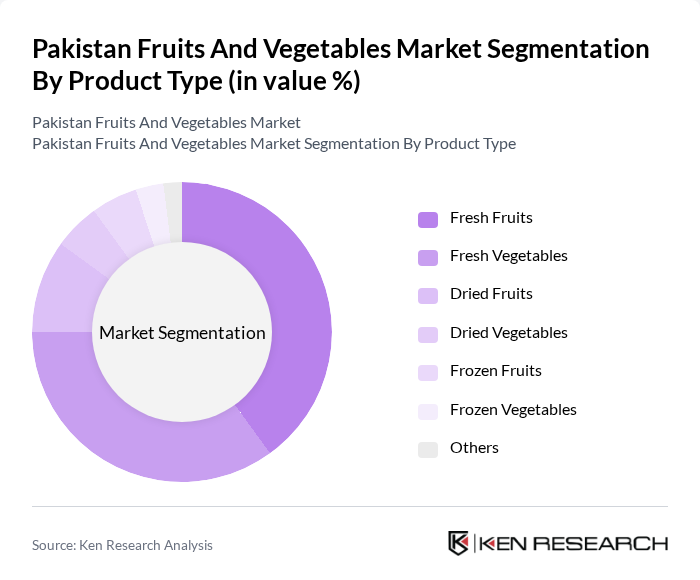

By Product Type:The product type segmentation includes various categories such as fresh fruits, fresh vegetables, dried fruits, dried vegetables, frozen fruits, frozen vegetables, and others. Among these, fresh fruits and vegetables dominate the market due to their high demand in both local and export markets. The increasing health awareness among consumers has led to a surge in the consumption of fresh produce, making it a preferred choice for households and restaurants alike .

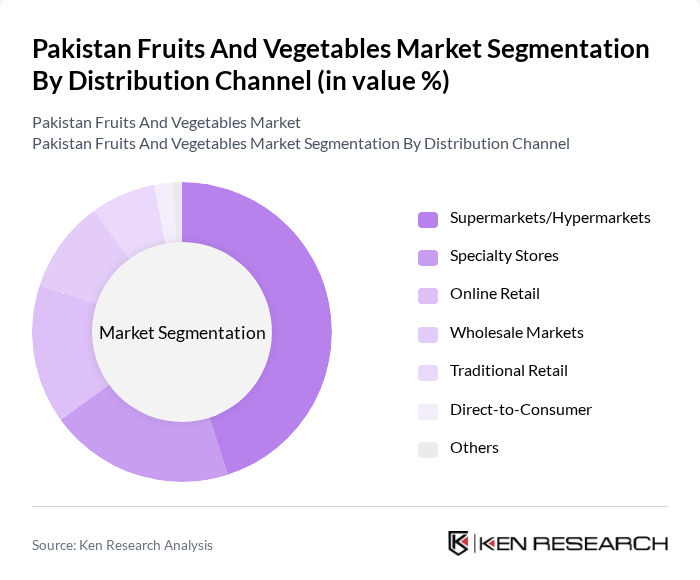

By Distribution Channel:The distribution channel segmentation encompasses supermarkets/hypermarkets, specialty stores, online retail, wholesale markets, traditional retail, direct-to-consumer, and others. Supermarkets and hypermarkets are leading channels due to their convenience and variety, catering to the growing urban population's demand for fresh produce. Online retail is also gaining traction, especially post-pandemic, as consumers increasingly prefer the convenience of home delivery .

The Pakistan Fruits and Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iftekhar Ahmed & Co., Roshan Enterprises, Durrani Associates, Fatima Vegetable & Fruit Exporters, Al-Rafique Enterprises, PK Fruits & Vegetables, Shaheen Food Processors, Freshco Pakistan, Farm Fresh, Taja Fruit & Vegetable Exporters, S.A. Enterprises, Naveed Fruits Company, Green Circle, Mehran Enterprises, Pak Green Exports contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Pakistan fruits and vegetables market appears promising, driven by increasing urbanization and health consciousness among consumers. As the demand for fresh produce continues to rise, the sector is likely to witness innovations in supply chain management and sustainable farming practices. Additionally, the government's focus on enhancing export capabilities and supporting local farmers will play a crucial role in shaping the market landscape, fostering growth and resilience in the face of challenges.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fresh Fruits Fresh Vegetables Dried Fruits Dried Vegetables Frozen Fruits Frozen Vegetables Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Wholesale Markets Traditional Retail Direct-to-Consumer Others |

| By Region | Punjab Sindh Khyber Pakhtunkhwa Balochistan Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| By Quality | Premium Quality Standard Quality Economy Quality Others |

| By Seasonality | Seasonal Fruits Seasonal Vegetables Year-Round Availability Others |

| By Consumer Segment | Households Restaurants Food Processing Industry Export Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fruit Sales | 100 | Store Managers, Category Buyers |

| Wholesale Vegetable Distribution | 80 | Wholesale Distributors, Supply Chain Managers |

| Export Market Insights | 60 | Export Managers, Trade Analysts |

| Consumer Preferences Survey | 120 | Household Consumers, Nutritionists |

| Agricultural Production Insights | 50 | Farmers, Agricultural Extension Officers |

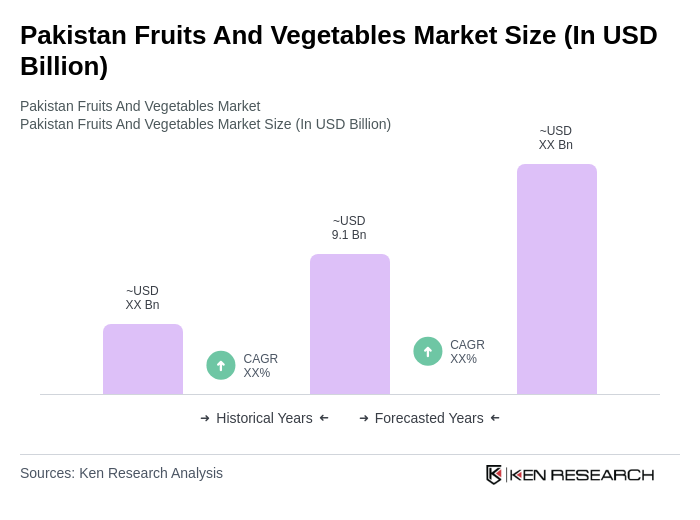

The Pakistan Fruits and Vegetables Market is valued at approximately USD 9.1 billion, reflecting significant growth driven by urbanization, health consciousness, and demand for organic produce. This valuation is based on a five-year historical analysis of the market.