Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3103

Pages:87

Published On:October 2025

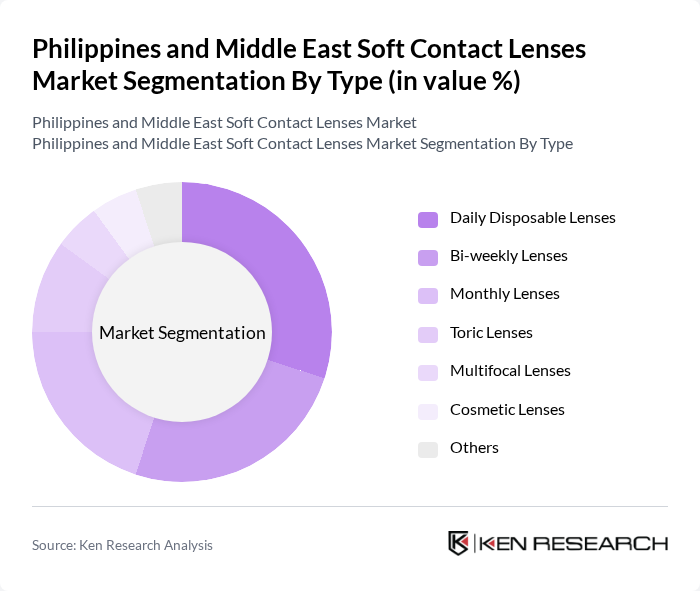

By Type:The market is segmented into various types of soft contact lenses, including daily disposable lenses, bi-weekly lenses, monthly lenses, toric lenses, multifocal lenses, cosmetic lenses, and others. Each type caters to different consumer needs, with daily disposable lenses gaining popularity due to their convenience, hygiene benefits, and reduced risk of infection. The adoption of silicone hydrogel materials is further enhancing comfort and extended wear capabilities .

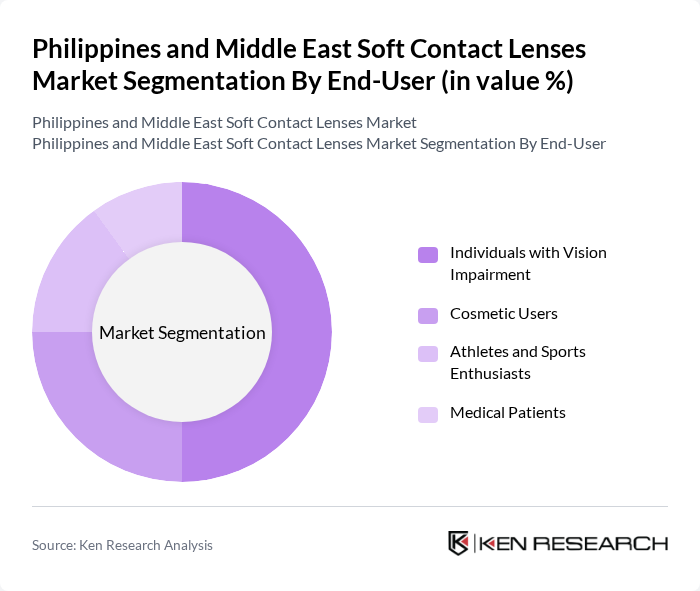

By End-User:The end-user segmentation includes individuals with vision impairment, cosmetic users, athletes and sports enthusiasts, and medical patients. The demand from individuals with vision impairment remains significant, as corrective lenses are essential for daily activities. Cosmetic users are increasingly opting for colored and decorative lenses, influenced by fashion trends and social media. Athletes and sports enthusiasts prefer soft contact lenses for their comfort and suitability during physical activities .

The Philippines and Middle East Soft Contact Lenses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson Vision Care, Alcon Inc., Bausch + Lomb, CooperVision, EssilorLuxottica, Hoya Corporation, Menicon Co., Ltd., Carl Zeiss AG, SynergEyes, Inc., Vision Source, Acuvue (Johnson & Johnson), ClearLab, Eyeconic, Opti-Free (Alcon), FreshLook (Alcon) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines and Middle East soft contact lenses market is poised for significant growth, driven by increasing consumer awareness and technological advancements. As the population ages, the demand for vision correction solutions will likely rise, particularly for daily disposable lenses. Additionally, the integration of smart technology in lenses and the shift towards sustainable products will shape future market dynamics. E-commerce platforms will also play a crucial role in expanding access to these products, particularly in underserved areas.

| Segment | Sub-Segments |

|---|---|

| By Type | Daily Disposable Lenses Bi-weekly Lenses Monthly Lenses Toric Lenses Multifocal Lenses Cosmetic Lenses Others |

| By End-User | Individuals with Vision Impairment Cosmetic Users Athletes and Sports Enthusiasts Medical Patients |

| By Distribution Channel | Online Retail Optical Stores Supermarkets and Hypermarkets Pharmacies |

| By Price Range | Budget Mid-Range Premium |

| By Material | Hydrogel Silicone Hydrogel Rigid Gas Permeable |

| By Brand | Established Brands Emerging Brands Private Labels |

| By Application | Corrective Vision Cosmetic Enhancement Therapeutic Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmologist Insights | 85 | Ophthalmologists, Optometrists |

| Retailer Feedback | 70 | Optical Retail Managers, Store Owners |

| Consumer Preferences | 120 | Soft Contact Lens Users, Potential Users |

| Distributor Insights | 65 | Medical Supply Distributors, Wholesale Managers |

| Market Trend Analysis | 55 | Market Analysts, Industry Experts |

The soft contact lenses market in the Philippines and Middle East is valued at approximately USD 425 million, driven by increasing awareness of eye health, rising vision impairment cases, and the growing popularity of contact lenses as a convenient alternative to glasses.