Region:North America

Author(s):Rebecca

Product Code:KRAC9775

Pages:95

Published On:November 2025

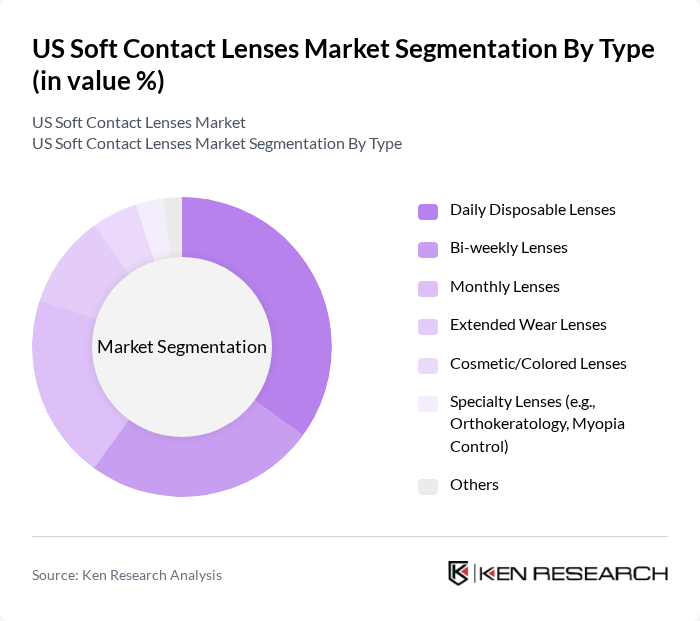

By Type:The market is segmented into various types of soft contact lenses, including Daily Disposable Lenses, Bi-weekly Lenses, Monthly Lenses, Extended Wear Lenses, Cosmetic/Colored Lenses, Specialty Lenses (e.g., Orthokeratology, Myopia Control), and Others. Among these, Daily Disposable Lenses are gaining significant traction due to their convenience, enhanced hygiene, and reduced risk of infection, appealing to a wide range of consumers. Bi-weekly and Monthly Lenses also hold substantial market shares, driven by their cost-effectiveness and comfort. The demand for Cosmetic/Colored Lenses is rising as consumers seek to enhance their appearance, while Specialty Lenses address specific vision correction needs such as myopia control and presbyopia .

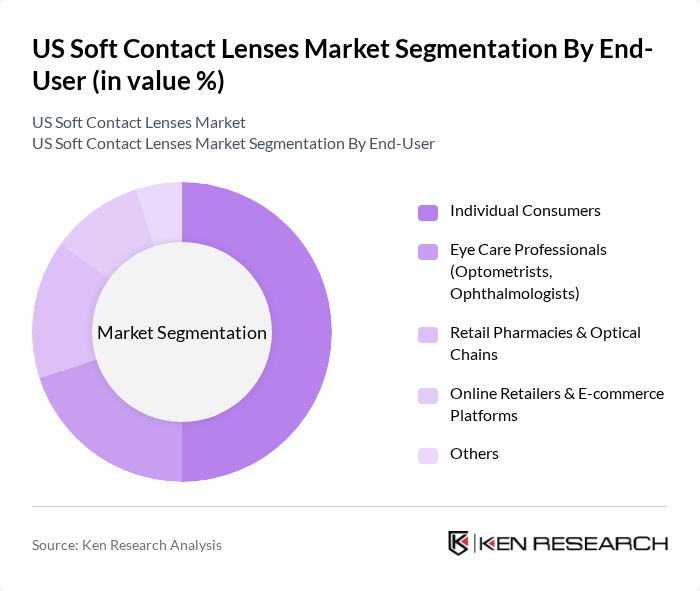

By End-User:The end-user segmentation includes Individual Consumers, Eye Care Professionals (Optometrists, Ophthalmologists), Retail Pharmacies & Optical Chains, Online Retailers & E-commerce Platforms, and Others. Individual Consumers represent the largest segment, driven by the increasing number of people opting for contact lenses over glasses. Eye Care Professionals play a crucial role in recommending and prescribing lenses, while the rise of online retailers has made purchasing more convenient. Retail Pharmacies and Optical Chains continue to be significant distribution channels, catering to consumers seeking immediate access to lenses. The growth of e-commerce platforms is particularly notable, reflecting changing consumer preferences for convenience and home delivery .

The US Soft Contact Lenses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson Vision Care, Inc., Alcon Inc., Bausch + Lomb Corporation, CooperVision, Inc., Hoya Corporation, Menicon Co., Ltd., Carl Zeiss Meditec AG, EssilorLuxottica S.A., SynergEyes, Inc., Vision Source, L.P., Eyeconic (a division of VSP Global), Acuvue (Johnson & Johnson Vision Care Brand), ClearLab (Clearlab US, Inc.), 1-800 Contacts, Inc., Lens.com, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. soft contact lenses market appears promising, driven by ongoing innovations and changing consumer preferences. As the demand for daily disposable lenses continues to rise, manufacturers are likely to focus on enhancing product offerings. Additionally, the integration of smart technology into contact lenses presents a unique opportunity for growth, appealing to tech-savvy consumers. The market is expected to adapt to sustainability trends, with an increasing emphasis on eco-friendly materials and practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Daily Disposable Lenses Bi-weekly Lenses Monthly Lenses Extended Wear Lenses Cosmetic/Colored Lenses Specialty Lenses (e.g., Orthokeratology, Myopia Control) Others |

| By End-User | Individual Consumers Eye Care Professionals (Optometrists, Ophthalmologists) Retail Pharmacies & Optical Chains Online Retailers & E-commerce Platforms Others |

| By Material | Hydrogel Lenses Silicone Hydrogel Lenses Hybrid Lenses Others |

| By Prescription Type | Spherical Lenses Toric Lenses (Astigmatism) Multifocal/Progressive Lenses Cosmetic/Plano Lenses Others |

| By Distribution Channel | Optical Retail Stores Online Sales/E-commerce Eye Care Clinics/Practices Mass Merchandisers & Pharmacies Others |

| By Age Group | Children (?17 years) Teenagers (13-19 years) Adults (20-64 years) Seniors (65+ years) |

| By Geographic Region | Northeast Midwest South West Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmologist Insights | 60 | Ophthalmologists, Optometrists |

| Consumer Preferences | 120 | Soft Contact Lens Users, Potential Users |

| Retail Distribution Feedback | 50 | Retail Managers, Optical Store Owners |

| Market Trends Analysis | 40 | Industry Analysts, Market Researchers |

| Product Development Insights | 40 | Product Managers, R&D Specialists |

The US Soft Contact Lenses Market is valued at approximately USD 2.7 billion, reflecting significant growth driven by increasing vision disorders, heightened awareness of eye health, and advancements in lens technology, particularly silicone hydrogel materials.