Region:Asia

Author(s):Dev

Product Code:KRAA9523

Pages:95

Published On:November 2025

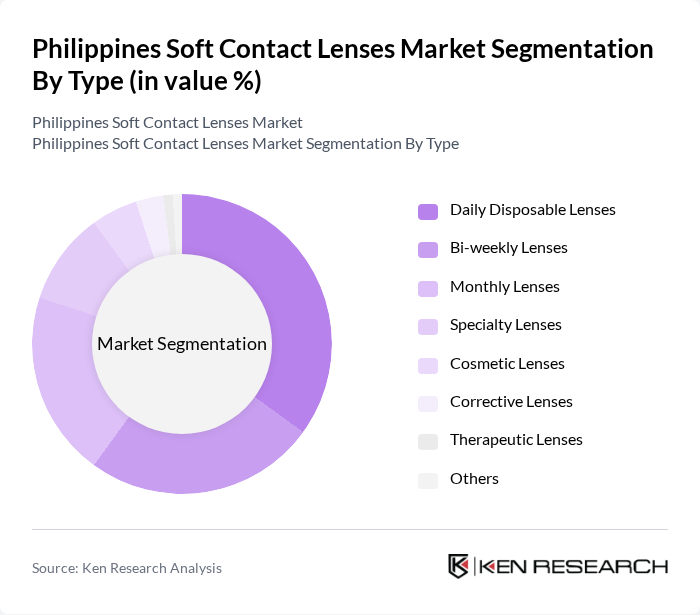

By Type:The market is segmented into various types of soft contact lenses, including Daily Disposable Lenses, Bi-weekly Lenses, Monthly Lenses, Specialty Lenses, Cosmetic Lenses, Corrective Lenses, Therapeutic Lenses, and Others. Among these, Daily Disposable Lenses are gaining significant traction due to their convenience and hygiene benefits, appealing particularly to busy professionals and young adults. Bi-weekly and Monthly Lenses also hold substantial market shares, catering to consumers looking for cost-effective options. Specialty and Cosmetic Lenses are increasingly popular for aesthetic purposes, especially among younger demographics.

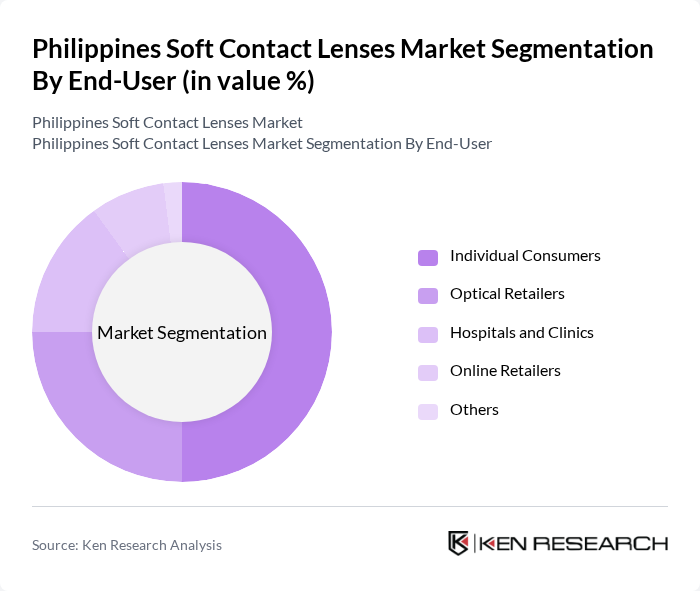

By End-User:The market is segmented by end-users into Individual Consumers, Optical Retailers, Hospitals and Clinics, Online Retailers, and Others. Individual Consumers dominate the market, driven by the increasing number of people opting for contact lenses over glasses for convenience and aesthetic reasons. Optical Retailers and Online Retailers are also significant contributors, as they provide easy access to a variety of lens options. Hospitals and Clinics play a crucial role in prescribing lenses, particularly for corrective and therapeutic purposes.

The Philippines Soft Contact Lenses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson Vision Care, Alcon Laboratories, Inc., Bausch + Lomb, CooperVision, Menicon Co., Ltd., Hoya Corporation, EssilorLuxottica, Carl Zeiss AG, Vision Express Philippines, Ideal Vision Center, EO-Executive Optical, 1-800 Contacts, LensCrafters, Metro Optical, Specsavers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the soft contact lenses market in the Philippines appears promising, driven by increasing consumer awareness and technological advancements. As the population ages, the demand for corrective lenses is expected to rise, particularly for daily disposables. Additionally, the expansion of e-commerce platforms will facilitate greater access to a wider range of products, allowing consumers to make informed choices. These trends indicate a robust growth trajectory for the market, with opportunities for innovation and collaboration in the healthcare sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Daily Disposable Lenses Bi-weekly Lenses Monthly Lenses Specialty Lenses Cosmetic Lenses Corrective Lenses Therapeutic Lenses Others |

| By End-User | Individual Consumers Optical Retailers Hospitals and Clinics Online Retailers Others |

| By Age Group | Children Teenagers Adults Seniors Others |

| By Material | Hydrogel Lenses Silicone Hydrogel Lenses Rigid Gas Permeable Lenses Methacrylate Hydrogel Lenses Others |

| By Distribution Channel | Offline Retail Stores Online Marketplaces Direct Sales Hospitals and Clinics Others |

| By Brand | Established Brands Emerging Brands Private Labels Domestic Brands Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmologist Insights | 45 | Ophthalmologists, Eye Care Specialists |

| Optometrist Feedback | 40 | Optometrists, Vision Care Providers |

| Retailer Perspectives | 50 | Optical Retail Managers, Sales Representatives |

| Consumer Usage Patterns | 90 | Soft Contact Lens Users, Potential Users |

| Market Trend Analysis | 40 | Industry Analysts, Market Researchers |

The Philippines Soft Contact Lenses Market is valued at approximately USD 57 million, reflecting a significant growth trend driven by increased awareness of eye health and the rising prevalence of vision disorders among the population.