Region:Middle East

Author(s):Shubham

Product Code:KRAC2864

Pages:97

Published On:October 2025

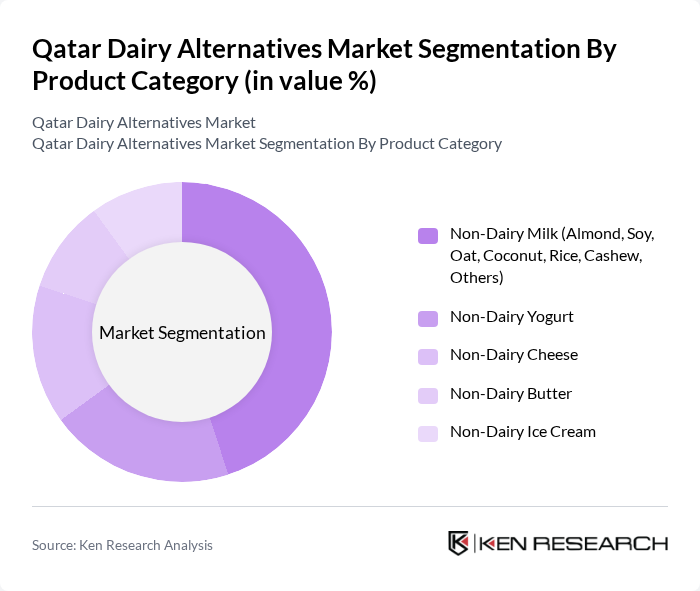

By Product Category:The product category segmentation includes Non-Dairy Milk (Almond, Soy, Oat, Coconut, Rice, Cashew, Others), Non-Dairy Yogurt, Non-Dairy Cheese, Non-Dairy Butter, and Non-Dairy Ice Cream. Non-Dairy Milk remains the leading subsegment, driven by increasing consumer preference for plant-based beverages. The rise in lactose intolerance, coupled with the popularity of vegan and flexitarian diets, has significantly contributed to the expansion of this category. Retail volume growth in plant-based yogurt and cheese is also notable, reflecting evolving consumer preferences .

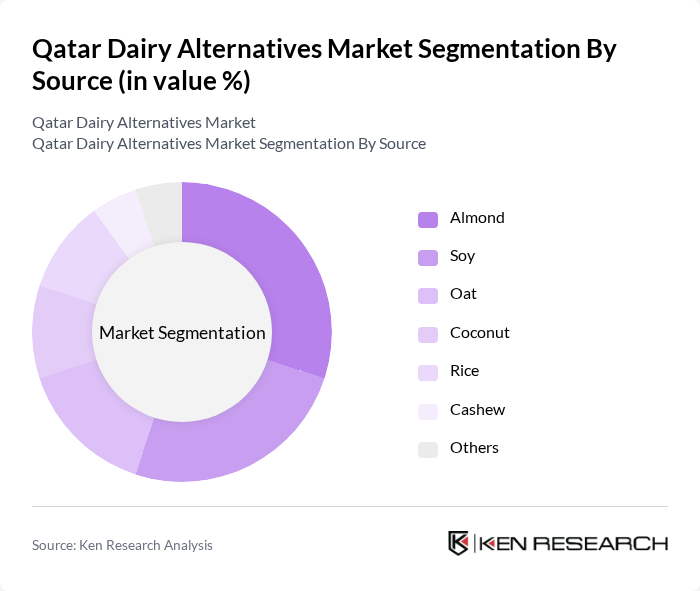

By Source:The source segmentation includes Almond, Soy, Oat, Coconut, Rice, Cashew, and Others. Almond and Soy are the dominant sources in the market, largely due to their nutritional benefits, versatility, and established consumer acceptance. The growing awareness of the health and environmental benefits associated with these sources has led to a surge in their popularity among Qatari consumers. Oat and coconut are also gaining traction as consumers seek variety and functional benefits .

The Qatar Dairy Alternatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alpro, Oatly, Silk, Califia Farms, So Delicious, Ripple Foods, Nutpods, Vitasoy, Dream, MALK Organics, Pure Harvest Smart Farms, The Hain Celestial Group, Inc., Danone S.A., Green Spot Co Ltd, Eden Foods Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the dairy alternatives market in Qatar appears promising, driven by increasing health awareness and a shift towards plant-based diets. As consumer preferences evolve, companies are likely to innovate and diversify their product offerings, focusing on organic and lactose-free options. Additionally, the government's support for sustainable practices will likely enhance production capabilities. The market is expected to see a rise in e-commerce sales, making dairy alternatives more accessible to consumers across the region.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Non-Dairy Milk (Almond, Soy, Oat, Coconut, Rice, Cashew, Others) Non-Dairy Yogurt Non-Dairy Cheese Non-Dairy Butter Non-Dairy Ice Cream |

| By Source | Almond Soy Oat Coconut Rice Cashew Others |

| By End-User | Households Restaurants Cafes Food Manufacturers |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Health Food Stores Convenience Stores Food Service (On-Trade) |

| By Packaging Type | Cartons Bottles Pouches |

| By Flavor | Original Vanilla Chocolate Unsweetened |

| By Price Range | Economy Mid-Range Premium |

| By Nutritional Content | High Protein Low Sugar Fortified Organic |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Dairy Alternatives | 100 | Health-conscious Consumers, Plant-based Diet Adopters |

| Retailer Insights on Dairy Alternative Sales | 60 | Store Managers, Category Buyers |

| Food Service Sector Adoption of Dairy Alternatives | 50 | Restaurant Owners, Menu Planners |

| Nutritionist Perspectives on Dairy Alternatives | 40 | Registered Dietitians, Nutrition Consultants |

| Market Trends from Distributors of Dairy Alternatives | 45 | Supply Chain Managers, Product Development Leads |

The Qatar Dairy Alternatives Market is valued at approximately USD 150 million, reflecting significant growth driven by health consciousness, lactose intolerance, and the rise of vegan and flexitarian diets among consumers.