Region:Middle East

Author(s):Rebecca

Product Code:KRAC2527

Pages:83

Published On:October 2025

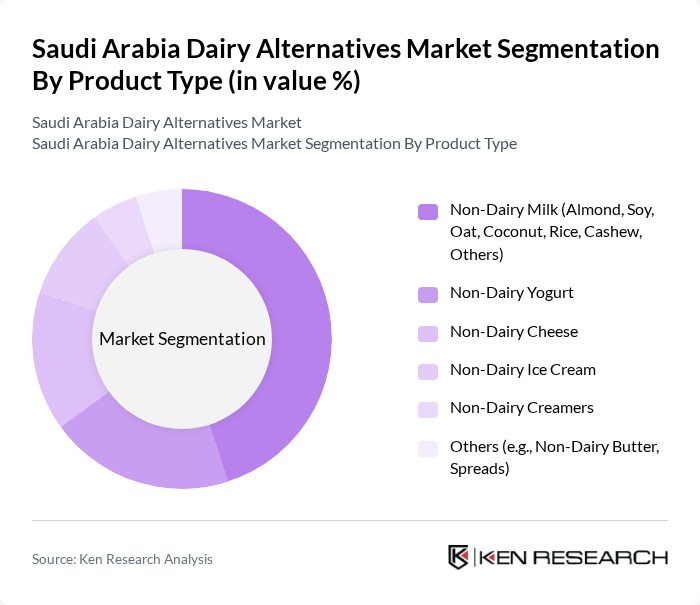

By Product Type:The product type segmentation includes various categories such as Non-Dairy Milk, Non-Dairy Yogurt, Non-Dairy Cheese, Non-Dairy Ice Cream, Non-Dairy Creamers, and Others. Among these, Non-Dairy Milk is the leading subsegment, driven by consumer preferences for almond, soy, and oat milk. The increasing availability of diverse flavors, fortified options, and convenient packaging has further boosted its popularity. Non-Dairy Yogurt and Non-Dairy Cheese are also gaining traction as consumers seek healthier alternatives to traditional dairy products, with product innovation and new launches expanding choices for lactose-intolerant and vegan consumers .

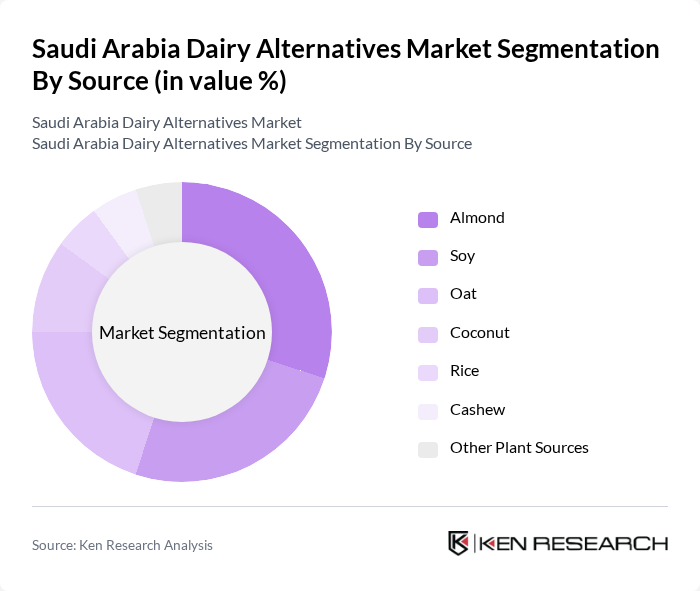

By Source:The source segmentation includes various plant-based sources such as Almond, Soy, Oat, Coconut, Rice, Cashew, and Other Plant Sources. Almond and Soy are the dominant sources due to their widespread acceptance and nutritional benefits. Oat milk is rapidly gaining popularity, particularly among health-conscious consumers, while Coconut and Rice are also notable for their unique flavors and lactose-free properties. The market is also seeing increased interest in blends and fortified products, which offer enhanced nutritional profiles and cater to evolving consumer preferences .

The Saudi Arabia Dairy Alternatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, National Agricultural Development Company (Nadec), Al Safi Danone Ltd., Al Watania Dairy, Al Rawabi Dairy Company, Al Ain Farms, Tetra Pak Arabia, Nestlé S.A., Danone S.A., Oatly AB, Blue Diamond Growers, Califia Farms, Silk (WhiteWave Foods, now part of Danone North America), So Delicious Dairy Free (Danone North America), Ripple Foods, Good Karma Foods contribute to innovation, geographic expansion, and service delivery in this space. These companies are focusing on product innovation, expanding distribution networks, and catering to the evolving preferences of Saudi consumers .

The Saudi Arabia dairy alternatives market is poised for significant growth, driven by increasing health consciousness and government initiatives supporting sustainable practices. As consumer preferences shift towards plant-based diets, the demand for innovative and functional dairy alternatives is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate greater access to these products, enhancing market penetration. Overall, the landscape is evolving, presenting opportunities for both established brands and new entrants to capitalize on changing consumer behaviors.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Non-Dairy Milk (Almond, Soy, Oat, Coconut, Rice, Cashew, Others) Non-Dairy Yogurt Non-Dairy Cheese Non-Dairy Ice Cream Non-Dairy Creamers Others (e.g., Non-Dairy Butter, Spreads) |

| By Source | Almond Soy Oat Coconut Rice Cashew Other Plant Sources |

| By End-User | Households Foodservice (Restaurants, Cafes, Hotels) Food Processing Industry |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Health Food Stores Specialty Stores |

| By Packaging Type | Cartons Bottles Pouches Cans |

| By Price Range | Premium Mid-Range Budget |

| By Flavor | Original/Plain Vanilla Chocolate Other Flavors (e.g., Strawberry, Coffee) |

| By Nutritional Content | High Protein Low Sugar Fortified (e.g., Calcium, Vitamins) Unsweetened |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Dairy Alternatives | 120 | Health-conscious Consumers, Vegan Diet Adopters |

| Retail Insights on Dairy Alternative Sales | 80 | Store Managers, Category Buyers |

| Food Service Sector Adoption of Dairy Alternatives | 60 | Restaurant Owners, Menu Planners |

| Nutritionist Perspectives on Dairy Alternatives | 50 | Registered Dietitians, Nutrition Consultants |

| Market Trends from E-commerce Platforms | 70 | E-commerce Managers, Digital Marketing Specialists |

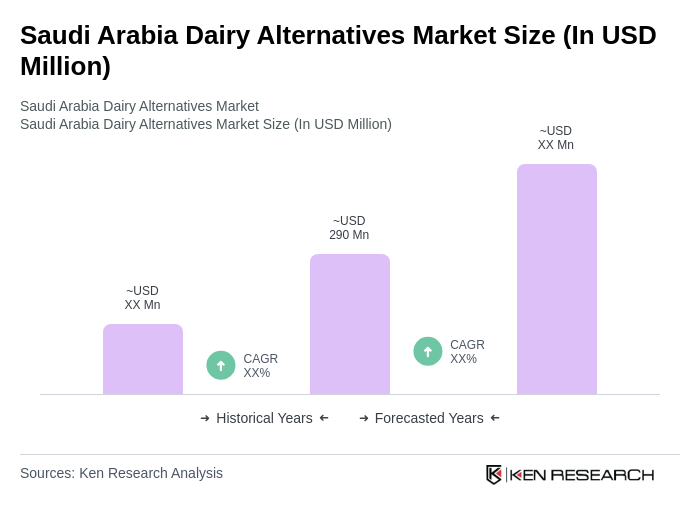

The Saudi Arabia Dairy Alternatives Market is valued at approximately USD 290 million, reflecting a significant growth trend driven by increasing health consciousness, a shift towards plant-based diets, and rising lactose intolerance among consumers.