Region:Asia

Author(s):Geetanshi

Product Code:KRAC8143

Pages:85

Published On:November 2025

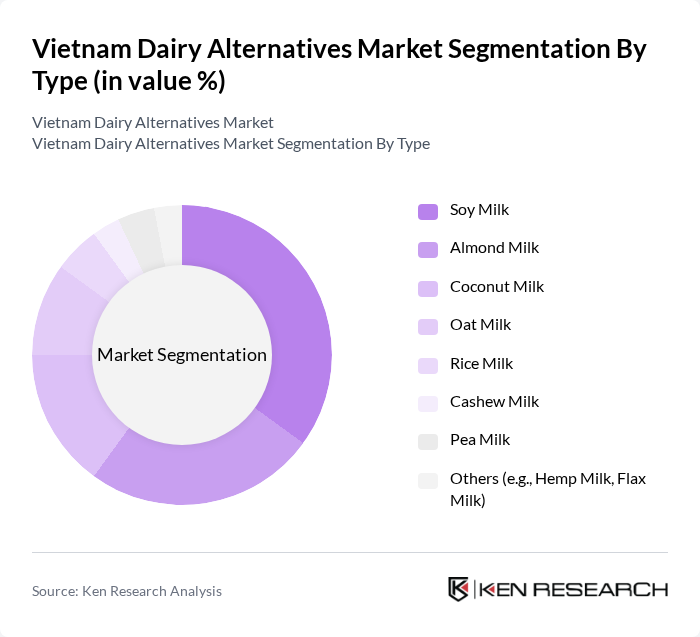

By Type:The market is segmented into various types of dairy alternatives, including soy milk, almond milk, coconut milk, oat milk, rice milk, cashew milk, pea milk, and others. Each type caters to different consumer preferences and dietary needs, with soy milk being the most popular due to its high protein content and versatility. Almond and coconut milk are also gaining traction, particularly among health-conscious consumers seeking low-calorie options. The market is further diversified with oat, rice, cashew, and pea milk, reflecting the broadening consumer interest in functional and innovative plant-based beverages.

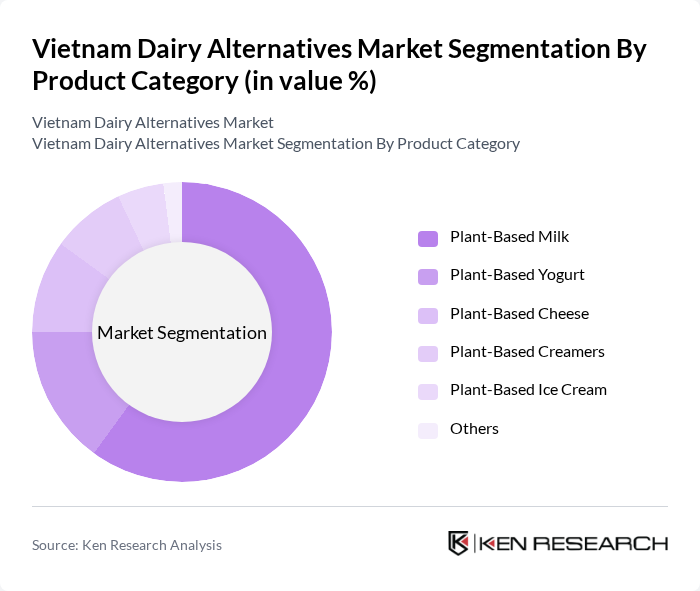

By Product Category:The market is also segmented by product category, which includes plant-based milk, plant-based yogurt, plant-based cheese, plant-based creamers, plant-based ice cream, and others. Plant-based milk dominates the category due to its widespread acceptance and versatility in various culinary applications. The growing trend of veganism and lactose intolerance has further propelled the demand for plant-based yogurt and cheese. Non-dairy creamers and ice creams are increasingly available, driven by consumer interest in functional and indulgent plant-based products.

The Vietnam Dairy Alternatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as TH True Milk, Nutifood, Vinasoy, FrieslandCampina Vietnam, Alpro (Danone), Oatly Group AB, Fonterra Brands Vietnam, Vinamilk (Vietnam Dairy Products JSC), Cocofina Ltd., Pureharvest, Silk (Danone North America), So Delicious (Danone North America), Califia Farms, Ripple Foods, Blue Diamond Growers contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam dairy alternatives market is poised for significant growth, driven by increasing health consciousness and a shift towards plant-based diets. As consumer preferences evolve, companies are expected to innovate with new flavors and formulations, catering to diverse tastes. Additionally, the government's support for sustainable practices will likely enhance production capabilities. In future, the market is anticipated to witness a surge in e-commerce sales, making dairy alternatives more accessible to consumers across the country, further solidifying their market presence.

| Segment | Sub-Segments |

|---|---|

| By Type | Soy Milk Almond Milk Coconut Milk Oat Milk Rice Milk Cashew Milk Pea Milk Others (e.g., Hemp Milk, Flax Milk) |

| By Product Category | Plant-Based Milk Plant-Based Yogurt Plant-Based Cheese Plant-Based Creamers Plant-Based Ice Cream Others |

| By End-User | Households Restaurants Cafés Food Processing Industry Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Health Food Stores Convenience Stores Others |

| By Packaging Type | Tetra Packs Bottles Cans Pouches Others |

| By Flavor | Original Vanilla Chocolate Strawberry Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Nutritional Content | High Protein Low Sugar Fortified (e.g., Calcium, Vitamins) Organic Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Dairy Alternatives | 120 | Health-conscious Consumers, Young Adults |

| Retailer Insights on Dairy Alternative Sales | 80 | Store Managers, Category Buyers |

| Production Insights from Dairy Alternative Manufacturers | 60 | Production Managers, Quality Control Officers |

| Nutritionist Perspectives on Dairy Alternatives | 50 | Registered Dietitians, Nutrition Consultants |

| Market Trends from Industry Experts | 40 | Market Analysts, Industry Consultants |

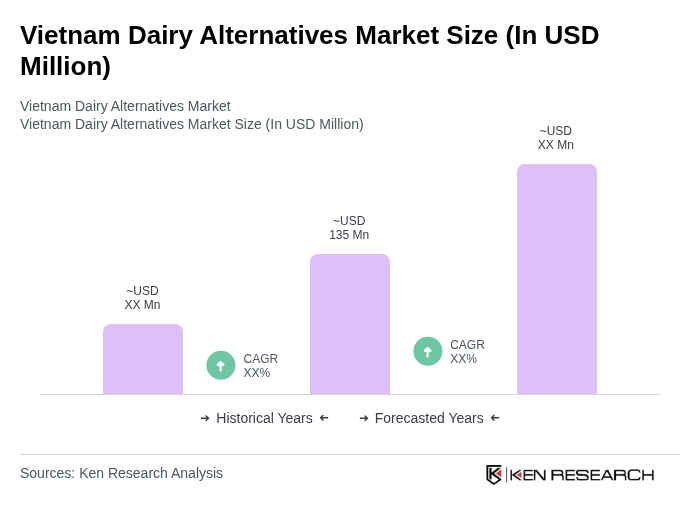

The Vietnam Dairy Alternatives Market is valued at approximately USD 135 million, reflecting a growing trend towards plant-based diets and increasing health consciousness among consumers, particularly in urban areas like Ho Chi Minh City and Hanoi.