Region:Africa

Author(s):Rebecca

Product Code:KRAE3783

Pages:83

Published On:December 2025

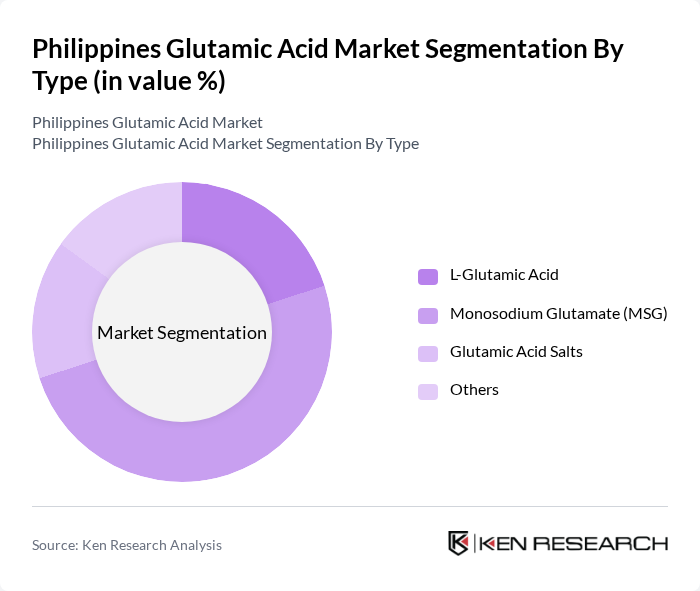

By Type:The glutamic acid market can be segmented into various types, including L-Glutamic Acid, Monosodium Glutamate (MSG), Glutamic Acid Salts, and Others. Among these, Monosodium Glutamate (MSG) is the leading sub-segment due to its widespread use as a flavor enhancer in various cuisines. The increasing consumer preference for umami flavors in food products has significantly boosted the demand for MSG, making it a staple in both household and commercial kitchens.

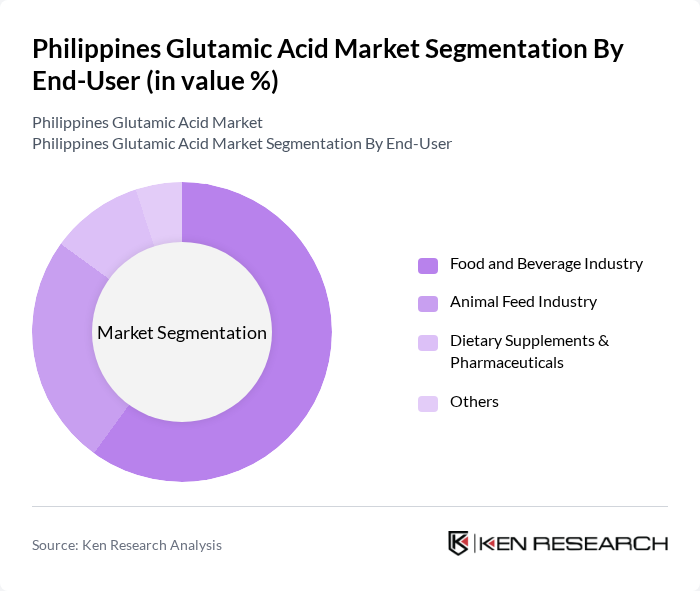

By End-User:The end-user segmentation includes the Food and Beverage Industry, Animal Feed Industry, Dietary Supplements & Pharmaceuticals, and Others. The Food and Beverage Industry dominates this segment, driven by the increasing demand for processed foods and the growing trend of flavor enhancement in culinary applications. The rise in health-conscious consumers has also led to a surge in the use of glutamic acid in dietary supplements, although the food sector remains the largest consumer.

The Philippines Glutamic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ajinomoto Philippines Corporation, Universal Robina Corporation, San Miguel Foods, Inc., Cargill Philippines, Inc., Nestlé Philippines, Inc., Del Monte Philippines, Inc., Purefoods Hormel Company, Inc., Philippine Foremost Milling Corporation, Vitarich Corporation, AgriNurture, Inc., Bounty Fresh Food, Inc., Greenfield Agro-Industrial Corporation, Evonik Industries AG (Asia-Pacific Operations), Kyowa Hakko USA (Regional Distributor), Global Bio-chem Technology Group Co Ltd (Regional Supplier) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the glutamic acid market in the Philippines appears promising, driven by increasing consumer demand for natural and health-oriented products. The trend towards sustainable production practices is likely to gain momentum, with manufacturers focusing on eco-friendly methods. Additionally, the rise of e-commerce platforms is expected to facilitate greater access to glutamic acid products, allowing for innovative marketing strategies and broader consumer reach, ultimately enhancing market growth prospects in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | L-Glutamic Acid Monosodium Glutamate (MSG) Glutamic Acid Salts Others |

| By End-User | Food and Beverage Industry Animal Feed Industry Dietary Supplements & Pharmaceuticals Others |

| By Application | Flavor Enhancer Nutritional Supplement Animal Nutrition Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct B2B Sales |

| By Packaging Type | Bulk Packaging (25kg+) Retail Packaging (500g-5kg) Others |

| By Region | Luzon Visayas Mindanao Others |

| By Product Form | Powder Liquid Granules Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Industry | 100 | Product Development Managers, Quality Control Specialists |

| Pharmaceutical Applications | 50 | Regulatory Affairs Managers, R&D Scientists |

| Animal Feed Production | 60 | Procurement Managers, Nutritionists |

| Retail and Distribution Channels | 70 | Supply Chain Managers, Sales Directors |

| Export Market Analysis | 40 | Export Managers, Trade Compliance Officers |

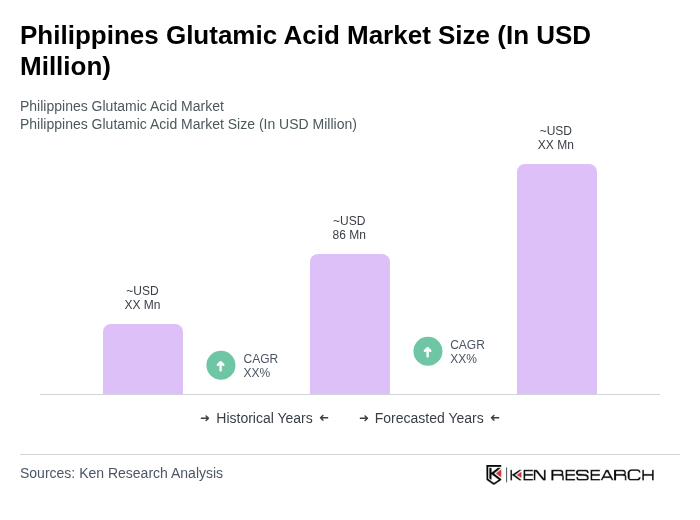

The Philippines Glutamic Acid Market is valued at approximately USD 86 million, driven by the increasing demand for flavor enhancers in the food and beverage industry, as well as the rising awareness of its health benefits in dietary supplements and animal feed.