Region:Asia

Author(s):Dev

Product Code:KRAD1713

Pages:98

Published On:November 2025

By Type:The market is segmented into various types of molecular diagnostic methods, including PCR-based diagnostics, NGS-based diagnostics, isothermal amplification, microarray-based diagnostics, immunoassay-based diagnostics, and others.PCR-based diagnosticsremain the most widely used due to their high accuracy, rapid turnaround, and cost-effectiveness, particularly for detecting viral and bacterial infections. The demand for rapid and multiplex testing solutions has reinforced the dominance of PCR technology, while NGS-based and isothermal amplification methods are gaining traction for their ability to detect emerging and complex pathogens .

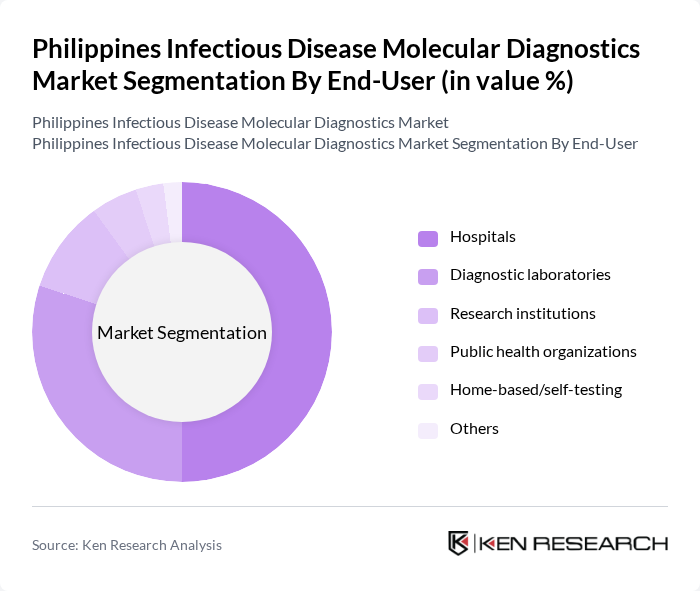

By End-User:The end-user segmentation includes hospitals, diagnostic laboratories, research institutions, public health organizations, home-based/self-testing, and others.Hospitalsare the leading end-users, driven by the rising number of patients requiring infectious disease testing and the critical need for rapid, accurate results in clinical settings. Diagnostic laboratories also play a significant role, supported by the expansion of laboratory infrastructure and automation. The adoption of home-based and self-testing solutions is increasing, especially following the COVID-19 pandemic, reflecting a shift toward decentralized and patient-centric diagnostics .

The Philippines Infectious Disease Molecular Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roche Diagnostics, Abbott Laboratories, Cepheid, bioMérieux, Thermo Fisher Scientific, Hologic, QIAGEN, Agilent Technologies, Becton, Dickinson and Company, Siemens Healthineers, GenMark Diagnostics, PerkinElmer, Luminex Corporation, Illumina, Eiken Chemical Co., Ltd., Sysmex Corporation, Fujirebio, Manila HealthTek, Inc., Hi-Precision Diagnostics, and St. Luke's Medical Center Molecular Laboratory contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines infectious disease molecular diagnostics market appears promising, driven by technological advancements and increased healthcare investments. The integration of artificial intelligence in diagnostics is expected to enhance accuracy and efficiency, while the expansion of telemedicine will facilitate remote access to diagnostic services. As the government continues to prioritize healthcare funding, the market is likely to witness significant growth, improving disease management and patient outcomes across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | PCR-based diagnostics NGS-based diagnostics Isothermal amplification Microarray-based diagnostics Immunoassay-based diagnostics Others |

| By End-User | Hospitals Diagnostic laboratories Research institutions Public health organizations Home-based/self-testing Others |

| By Disease Type | Viral infections (e.g., COVID-19, HIV, Dengue, Influenza) Bacterial infections (e.g., Tuberculosis, Salmonella) Fungal infections Parasitic infections (e.g., Malaria) Others |

| By Sample Type | Blood samples Urine samples Saliva samples Nasopharyngeal/oral swabs Tissue samples Others |

| By Distribution Channel | Direct sales Online sales Distributors Retail pharmacies Others |

| By Technology | Real-time PCR Digital PCR Sequencing technologies Microfluidics Isothermal amplification Others |

| By Policy Support | Government subsidies Tax incentives Research grants Public-private partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Health Laboratories | 100 | Laboratory Directors, Public Health Officials |

| Private Diagnostic Centers | 80 | Operations Managers, Clinical Pathologists |

| Healthcare Providers (Hospitals) | 110 | Procurement Officers, Medical Technologists |

| Research Institutions | 50 | Research Scientists, Epidemiologists |

| Government Health Agencies | 60 | Policy Makers, Health Program Managers |

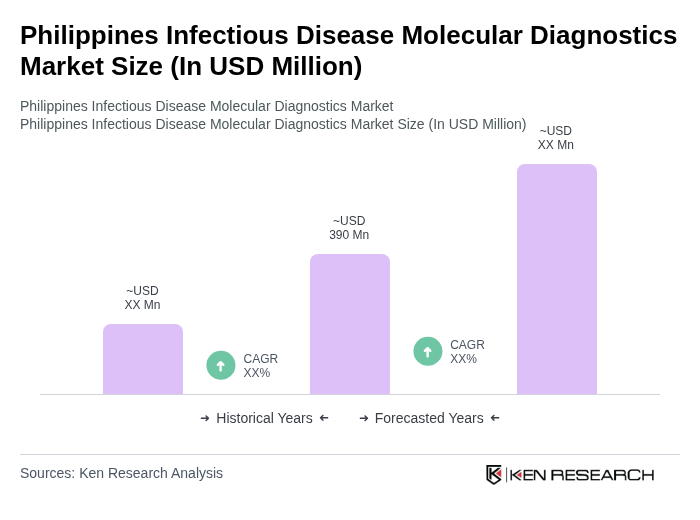

The Philippines Infectious Disease Molecular Diagnostics Market is valued at approximately USD 390 million, driven by the rising prevalence of infectious diseases and the adoption of advanced diagnostic technologies.