Region:Asia

Author(s):Geetanshi

Product Code:KRAB3339

Pages:95

Published On:October 2025

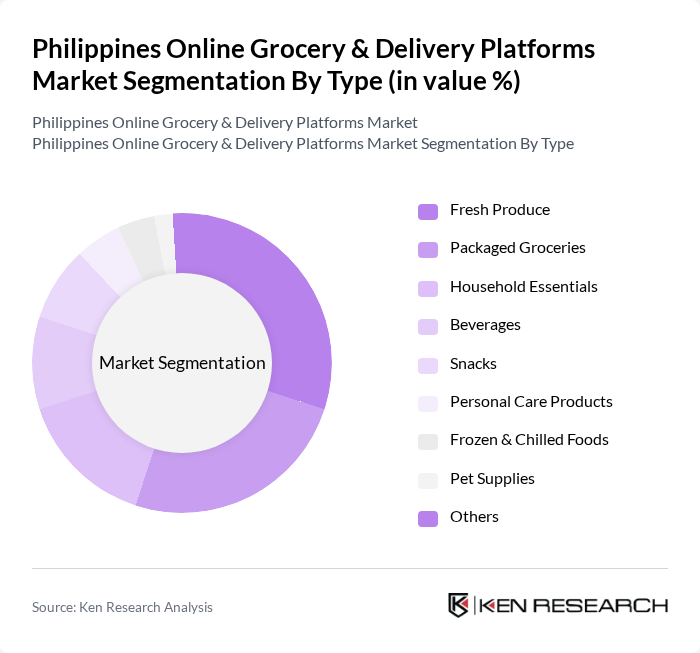

By Type:The market is segmented into various types of products available for online grocery shopping. The subsegments include Fresh Produce, Packaged Groceries, Household Essentials, Beverages, Snacks, Personal Care Products, Frozen & Chilled Foods, Pet Supplies, and Others. Among these, Fresh Produce is gaining significant traction due to the increasing consumer preference for fresh and organic food options. Packaged Groceries also hold a substantial share as they offer convenience and longer shelf life, appealing to busy consumers.

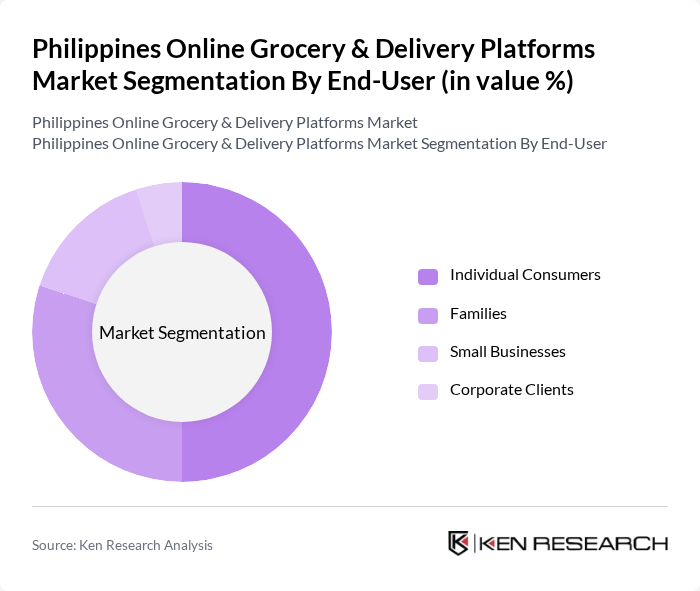

By End-User:The end-user segmentation includes Individual Consumers, Families, Small Businesses, and Corporate Clients. Individual Consumers dominate the market as they increasingly turn to online platforms for convenience and time savings. Families also represent a significant portion of the market, as they often purchase in bulk to meet household needs. Small businesses and corporate clients are emerging segments, leveraging online grocery services for operational efficiency.

The Philippines Online Grocery & Delivery Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lazada Philippines, Shopee Philippines, MetroMart, GrabMart, Puregold, Robinsons Supermarket, S&R Membership Shopping, Foodpanda, Pushkart.ph, WalterMart Delivery, AllDay Supermarket, Landers Superstore, 7-Eleven Philippines, The Marketplace, SM Markets (SM Supermarket, SM Hypermarket, Savemore) contribute to innovation, geographic expansion, and service delivery in this space.

As the online grocery market in the Philippines continues to evolve, several trends are expected to shape its future. The integration of advanced technologies, such as artificial intelligence and machine learning, will enhance personalization and improve inventory management. Additionally, the increasing focus on sustainability will drive platforms to adopt eco-friendly practices, appealing to environmentally conscious consumers. These developments will likely create a more competitive landscape, fostering innovation and improving service delivery in the online grocery sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Packaged Groceries Household Essentials Beverages Snacks Personal Care Products Frozen & Chilled Foods Pet Supplies Others |

| By End-User | Individual Consumers Families Small Businesses Corporate Clients |

| By Sales Channel | Mobile Applications Websites Social Media Platforms Third-Party Marketplaces |

| By Delivery Mode | Home Delivery Click and Collect Scheduled Deliveries Express/Quick Commerce Delivery |

| By Price Range | Low-End Products Mid-Range Products Premium Products |

| By Payment Method | Credit/Debit Cards E-Wallets Cash on Delivery Bank Transfers |

| By Frequency of Purchase | Daily Shoppers Weekly Shoppers Monthly Shoppers Occasional Shoppers |

| By Region | Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Grocery Consumers | 120 | Regular users of online grocery platforms, aged 18-55 |

| Logistics Providers | 100 | Operations Managers, Delivery Coordinators |

| Retail Sector Analysts | 80 | Market Analysts, Research Directors |

| Platform Operators | 70 | CEOs, Product Managers of online grocery platforms |

| Consumer Behavior Experts | 60 | Behavioral Scientists, Marketing Strategists |

The Philippines Online Grocery & Delivery Platforms Market is valued at approximately USD 3.1 billion, reflecting significant growth driven by digital payment adoption, e-commerce expansion, and changing consumer preferences for convenience, especially accelerated by the COVID-19 pandemic.