Region:Asia

Author(s):Shubham

Product Code:KRAD5389

Pages:81

Published On:December 2025

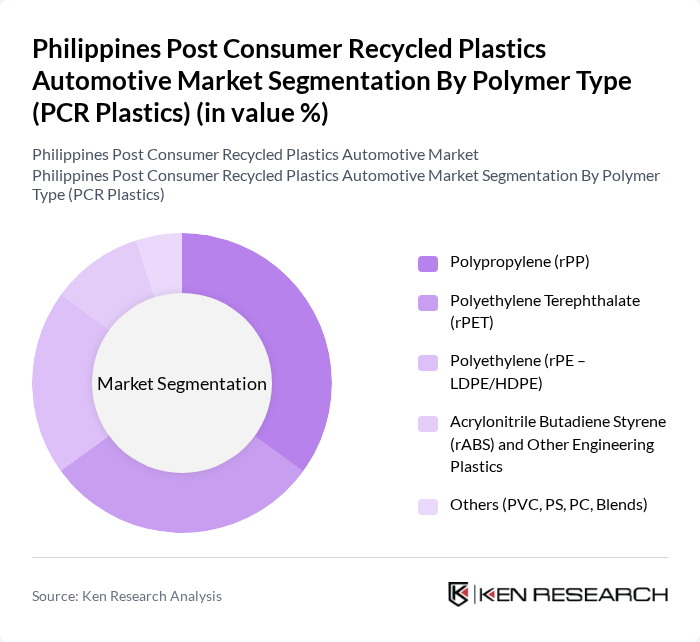

By Polymer Type (PCR Plastics):The market is segmented based on various polymer types used in the production of automotive components. The primary subsegments include Polypropylene (rPP), Polyethylene Terephthalate (rPET), Polyethylene (rPE – LDPE/HDPE), Acrylonitrile Butadiene Styrene (rABS) and Other Engineering Plastics, and Others (PVC, PS, PC, Blends). rPP is gaining traction due to its versatility, good impact performance, and cost-effectiveness in interior trims, consoles, and non-structural parts, while rPET is increasingly favored for its sustainability attributes and suitability in fibers, textiles, and some semi-structural applications.

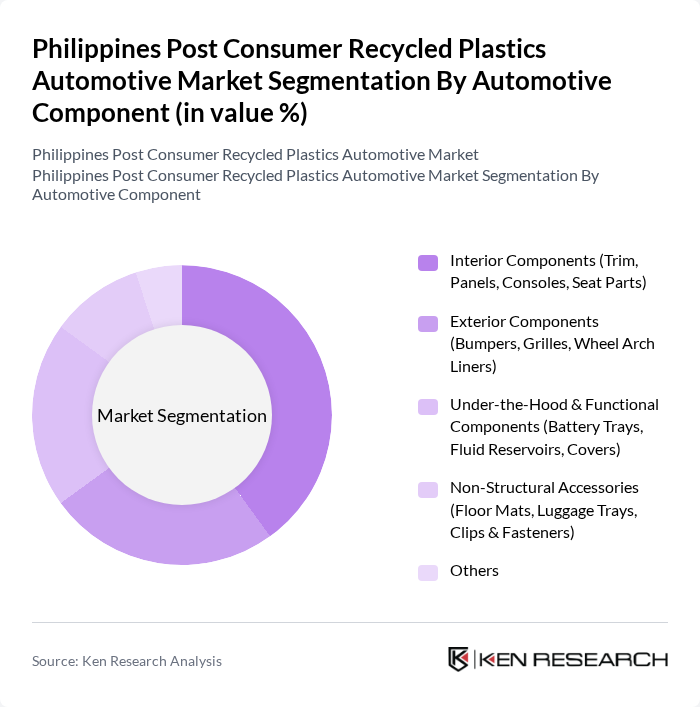

By Automotive Component:This segmentation focuses on the various automotive components that utilize post-consumer recycled plastics. The key subsegments include Interior Components (Trim, Panels, Consoles, Seat Parts), Exterior Components (Bumpers, Grilles, Wheel Arch Liners), Under-the-Hood & Functional Components (Battery Trays, Fluid Reservoirs, Covers), Non-Structural Accessories (Floor Mats, Luggage Trays, Clips & Fasteners), and Others. Interior components are leading the market due to their high demand for lightweight and durable plastics, the feasibility of incorporating higher recycled content without compromising safety-critical performance, and OEM sustainability commitments to increase recycled polymer content per vehicle.

The Philippines Post Consumer Recycled Plastics Automotive Market is characterized by a dynamic mix of regional and international players. Leading participants such as San Miguel Yamamura Packaging Corporation – Plastic Recycling Division, Manly Plastics Inc., D&L Industries Inc. – Polymer & Colorants Segment, Petroplas Corporation, Polystyrene Packaging Industries Corporation (PPIC), Envirotech Waste Recycling Inc., Genecosco Recycling Corp., Resin Enterprise & Industrial Sales Inc., JG Summit Olefins Corporation – Recycled & Circular Polymers Initiative, Phoenix Petroleum Philippines Inc. – Phoenix Plastics Recycling Unit, First Philippine Industrial Park Locators (Automotive Tier-1 Plastics Converters), Toyota Motor Philippines Corporation – Circular Plastics & Parts Localization, Mitsubishi Motors Philippines Corporation – Use of Recycled Plastics in Local Assembly, Nissan Philippines Inc. – Sustainability and Recycled Content Programs, Isuzu Philippines Corporation – Commercial Vehicle Plastics Recovery Initiatives contribute to innovation, geographic expansion, and service delivery in this space, supported by broader growth in the Philippine plastics industry and rising automotive production and sales.

The future of the Philippines post-consumer recycled plastics automotive market appears promising, driven by increasing environmental regulations and consumer demand for sustainable products. As the government continues to enhance recycling infrastructure and incentivize the use of recycled materials, the automotive sector is likely to see a significant shift towards eco-friendly practices. Innovations in recycling technologies will further improve the quality and availability of recycled plastics, positioning the industry for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Polymer Type (PCR Plastics) | Polypropylene (rPP) Polyethylene Terephthalate (rPET) Polyethylene (rPE – LDPE/HDPE) Acrylonitrile Butadiene Styrene (rABS) and Other Engineering Plastics Others (PVC, PS, PC, Blends) |

| By Automotive Component | Interior Components (Trim, Panels, Consoles, Seat Parts) Exterior Components (Bumpers, Grilles, Wheel Arch Liners) Under-the-Hood & Functional Components (Battery Trays, Fluid Reservoirs, Covers) Non-Structural Accessories (Floor Mats, Luggage Trays, Clips & Fasteners) Others |

| By Automotive Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles & Buses Two-Wheelers & Three-Wheelers Others (Off-Highway, Specialty Vehicles) |

| By Material Source (Post-Consumer Feedstock) | Beverage Bottles and Containers Flexible Packaging and Plastic Bags Household & Consumer Product Packaging End-of-Life Vehicle Plastics Others (Industrial & Commercial Post-Consumer Waste) |

| By Recycling / Processing Technology | Mechanical Recycling (Sorting, Washing, Re-granulation) Chemical / Advanced Recycling (Depolymerisation, Pyrolysis, Solvolysis) Compounding & Upcycling (PCR Blends and Masterbatches) Others |

| By Sales / Supply Channel | Direct Supply to Automotive OEMs Supply to Tier-1 / Tier-2 Auto Component Manufacturers Industrial Distributors & Resin Traders Others |

| By Region | Luzon (Including Metro Manila and CALABARZON Automotive Corridor) Visayas Mindanao Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 120 | Production Managers, Sustainability Officers |

| Suppliers of Recycled Plastics | 90 | Sales Managers, Product Development Leads |

| Regulatory Bodies | 40 | Policy Makers, Environmental Compliance Officers |

| Industry Experts and Consultants | 60 | Market Analysts, Sustainability Consultants |

| Consumer Insights | 80 | Automotive Enthusiasts, Eco-conscious Consumers |

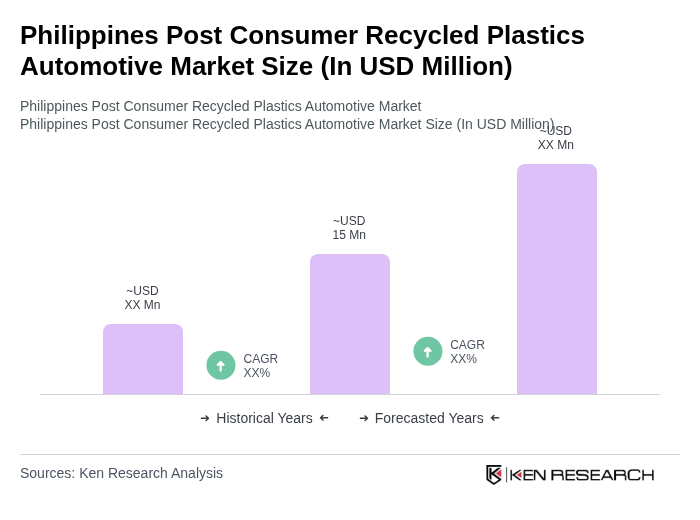

The Philippines Post Consumer Recycled Plastics Automotive Market is valued at approximately USD 15 million, reflecting a growing trend towards sustainable materials in the automotive sector driven by environmental awareness and government regulations.