Region:Asia

Author(s):Geetanshi

Product Code:KRAD0060

Pages:96

Published On:August 2025

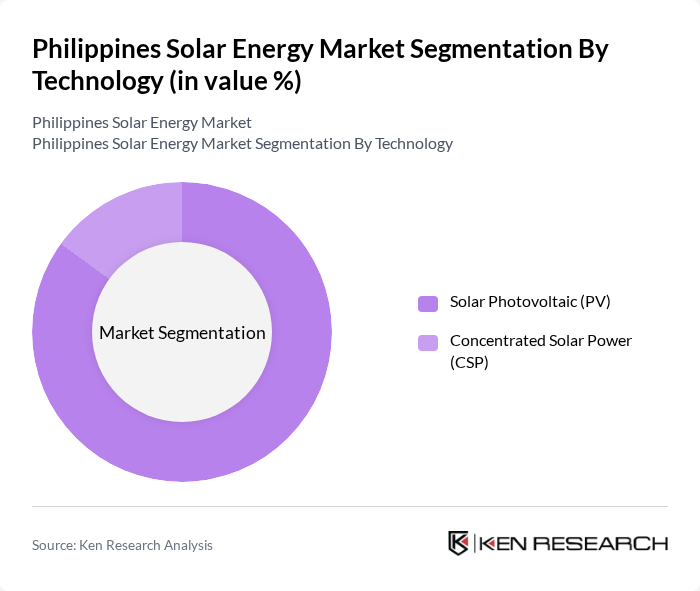

By Technology:The solar energy market is segmented into two primary technologies: Solar Photovoltaic (PV) and Concentrated Solar Power (CSP). Solar PV technology is the most widely adopted due to its versatility, cost-effectiveness, and suitability for both distributed and utility-scale applications. CSP, while less common in the Philippines, is considered for large-scale generation where energy storage and dispatchability are required .

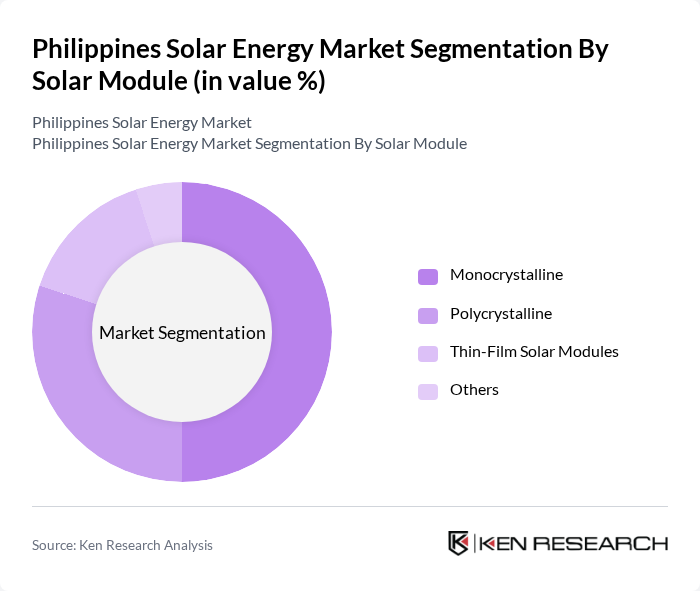

By Solar Module:The solar module segment includes Monocrystalline, Polycrystalline, Thin-Film Solar Modules, and Others. Monocrystalline modules lead the market due to their high efficiency and compact design, making them popular in both residential and commercial installations. Polycrystalline modules offer a cost-effective alternative and are widely used in large-scale projects. Thin-film modules are chosen for applications requiring flexibility and lightweight characteristics, such as building-integrated photovoltaics and portable systems .

The Philippines Solar Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Solar Philippines Power Project Holdings, Inc., AC Energy Corporation, First Gen Corporation, Aboitiz Power Corporation, Meralco PowerGen Corporation, Solaric Corp., Philergy Solar Inc., GoSolar Philippines, Transnational Uyeno Solar Corporation, WeGen Energy Philippines, Solenergy Systems Inc., Vena Energy, JinkoSolar Holding Co., Ltd., Canadian Solar Inc., SunPower Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines solar energy market is poised for significant growth, driven by increasing energy demand and supportive government policies. In future, the integration of energy storage solutions is expected to enhance the reliability of solar power, making it a more attractive option for consumers. Additionally, the rise of solar farms and community solar projects will further democratize access to renewable energy, fostering a more sustainable energy landscape. Continued technological innovations will also play a pivotal role in shaping the future of solar energy in the country.

| Segment | Sub-Segments |

|---|---|

| By Technology | Solar Photovoltaic (PV) Concentrated Solar Power (CSP) |

| By Solar Module | Monocrystalline Polycrystalline Thin-Film Solar Modules Others |

| By Application | Residential Commercial and Industrial Utility |

| By End-User | Households Businesses Government & Utilities |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Users | 120 | Homeowners, Property Managers |

| Commercial Solar Installations | 90 | Facility Managers, Business Owners |

| Utility-Scale Solar Projects | 60 | Project Developers, Energy Analysts |

| Government Policy Makers | 40 | Energy Regulators, Policy Advisors |

| Solar Technology Providers | 50 | Product Managers, R&D Engineers |

The Philippines Solar Energy Market is valued at approximately USD 2.1 billion, reflecting significant growth driven by increasing demand for renewable energy, government initiatives, and rising consumer awareness regarding environmental sustainability.