Region:Asia

Author(s):Rebecca

Product Code:KRAD0261

Pages:83

Published On:August 2025

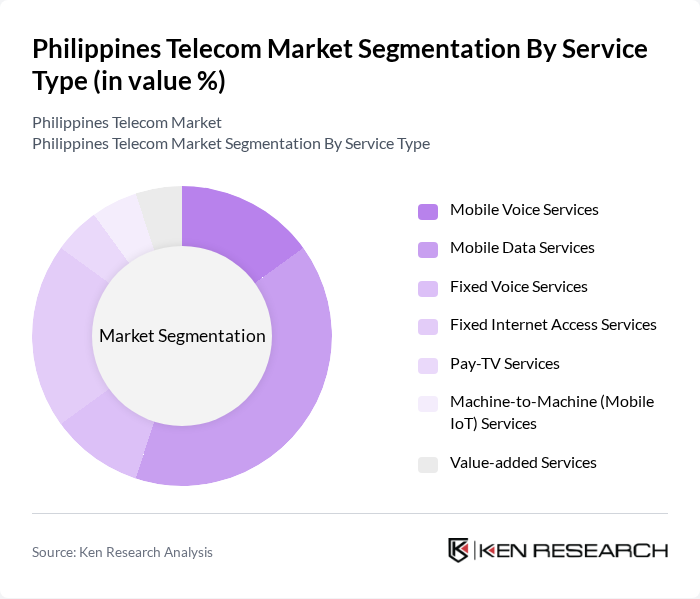

By Service Type:The service type segmentation includes various offerings such as mobile voice services, mobile data services, fixed voice services, fixed internet access services, pay-TV services, machine-to-machine (mobile IoT) services, and value-added services. Among these, mobile data services are currently dominating the market due to the increasing reliance on smartphones and mobile internet for daily activities. The growing trend of digital content consumption, expansion of 4G and 5G networks, and the rise of remote work and e-learning have further accelerated the demand for mobile data, making it a critical component of the telecom landscape .

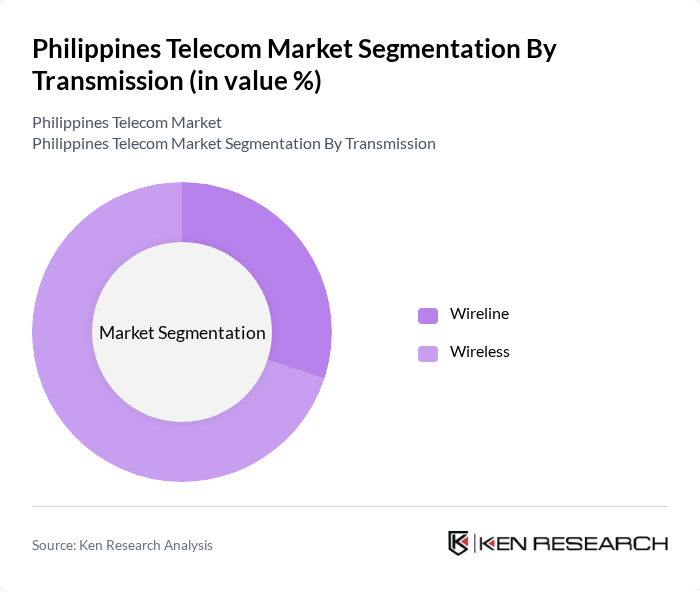

By Transmission:The transmission segmentation encompasses wireline and wireless services. Wireless services are currently leading the market, driven by the rapid adoption of mobile devices, the expansion of 4G and 5G networks, and the increasing demand for high-speed connectivity. The convenience and flexibility offered by wireless connectivity have made it the preferred choice for consumers and businesses alike, contributing significantly to the overall growth of the telecom market .

The Philippines Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as PLDT Inc., Globe Telecom, Inc., DITO Telecommunity Corporation, Smart Communications, Inc., Converge ICT Solutions Inc., Sky Cable Corporation, Eastern Telecommunications Philippines, Inc., NOW Telecom Company, Inc., Voyager Innovations, Inc., Radius Telecoms, Inc., InfiniVAN, Inc., PT&T (Philippine Telegraph and Telephone Corporation), Bayan Telecommunications, Inc., Cherry Mobile (Cosmic Technologies Inc.), Seatel Philippines contribute to innovation, geographic expansion, and service delivery in this space .

The Philippines telecom market is poised for transformative growth driven by technological advancements and increasing digital adoption. In future, the focus will shift towards enhancing customer experience through personalized services and innovative solutions. Telecom providers are expected to invest heavily in cloud-based technologies and artificial intelligence to streamline operations. Additionally, the rise of e-commerce and smart city initiatives will create new revenue streams, further solidifying the sector's role in the country's economic development.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Mobile Voice Services Mobile Data Services Fixed Voice Services Fixed Internet Access Services Pay-TV Services Machine-to-Machine (Mobile IoT) Services Value-added Services |

| By Transmission | Wireline Wireless |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms Third-party Resellers |

| By Service Plan | Prepaid Plans Postpaid Plans Unlimited Plans Family Plans |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Enterprises Educational Institutions |

| By Pricing Model | Subscription-based Pay-as-you-go Bundled Services |

| By Technology | G LTE G Fiber Optic Satellite |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 120 | Individual Consumers, Mobile Plan Subscribers |

| Broadband Service Subscribers | 80 | Residential Users, Small Business Owners |

| Enterprise Telecom Solutions | 60 | IT Managers, Procurement Officers in Corporates |

| Regulatory Impact Assessment | 40 | Policy Makers, Regulatory Affairs Specialists |

| Consumer Satisfaction Surveys | 100 | General Public, Telecom Service Users |

The Philippines Telecom Market is valued at approximately USD 6.1 billion, driven by the increasing demand for mobile data services, expansion of internet infrastructure, and rising adoption of digital services among consumers and businesses.