Region:Asia

Author(s):Geetanshi

Product Code:KRAE0623

Pages:86

Published On:December 2025

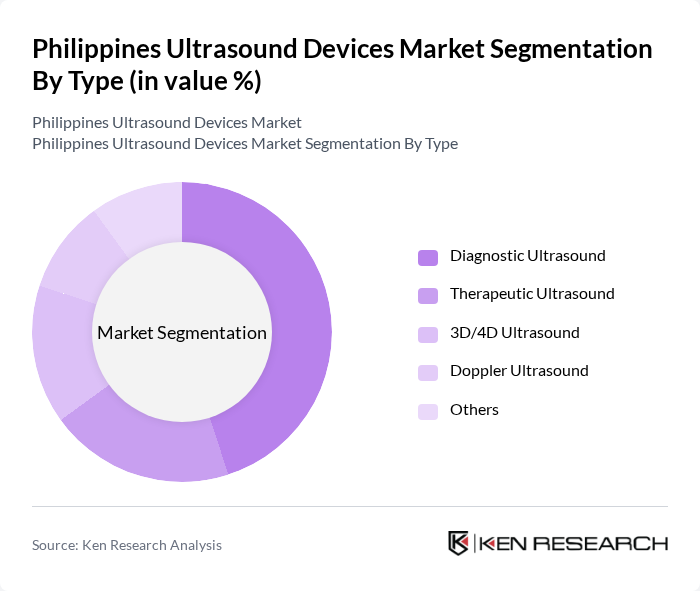

By Type:The ultrasound devices market is segmented into various types, including Diagnostic Ultrasound, Therapeutic Ultrasound, 3D/4D Ultrasound, Doppler Ultrasound, and Others. Among these, Diagnostic Ultrasound is the leading segment due to its widespread application in various medical fields, particularly in obstetrics and gynecology. The increasing prevalence of chronic diseases and the need for early diagnosis are driving the demand for diagnostic ultrasound systems. The adoption of advanced imaging technologies and the growing preference for non-invasive diagnostic methods further bolster this segment's growth.

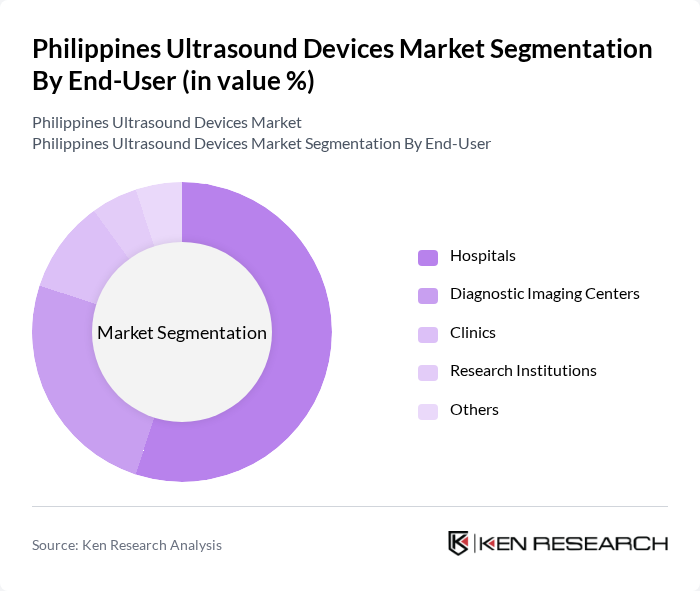

By End-User:The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Clinics, Research Institutions, and Others. Hospitals are the dominant end-user segment, accounting for a significant share of the market. This is attributed to the high volume of patients requiring diagnostic imaging services, particularly in emergency and critical care settings. The increasing number of hospitals and healthcare facilities investing in advanced ultrasound technology to enhance patient care and diagnostic capabilities is also a key factor driving this segment's growth.

The Philippines Ultrasound Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, GE Healthcare, Siemens Healthineers, Canon Medical Systems, Fujifilm Medical Systems, Mindray Medical International, Samsung Medison, Hitachi Medical Corporation, Esaote S.p.A., Carestream Health, Toshiba Medical Systems, Alpinion Medical Systems, Chison Medical Imaging, B. Braun Melsungen AG, SonoSite, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ultrasound devices market in the Philippines appears promising, driven by ongoing technological advancements and increasing healthcare investments. As the government focuses on enhancing healthcare infrastructure, particularly in underserved areas, the adoption of ultrasound technology is expected to rise. Additionally, the integration of telemedicine and remote diagnostics will likely expand access to ultrasound services, enabling more patients to benefit from timely and accurate diagnoses, ultimately improving health outcomes across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Ultrasound Therapeutic Ultrasound D/4D Ultrasound Doppler Ultrasound Others |

| By End-User | Hospitals Diagnostic Imaging Centers Clinics Research Institutions Others |

| By Application | Obstetrics and Gynecology Cardiology Urology Musculoskeletal Others |

| By Technology | Analog Ultrasound Digital Ultrasound Portable Ultrasound Contrast-Enhanced Ultrasound Others |

| By Region | Luzon Visayas Mindanao |

| By Investment Source | Private Investments Government Funding International Aid Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Regulatory Support for New Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Ultrasound Departments | 100 | Radiologists, Ultrasound Technicians |

| Private Clinics and Diagnostic Centers | 80 | Clinic Owners, Medical Directors |

| Medical Device Distributors | 60 | Procurement Managers, Sales Representatives |

| Healthcare Policy Makers | 50 | Health Department Officials, Policy Analysts |

| Research Institutions and Universities | 40 | Medical Researchers, Academic Professors |

The Philippines Ultrasound Devices Market is valued at approximately USD 730 million, reflecting a significant growth driven by increasing demand for diagnostic imaging in maternal and general healthcare, as well as technological advancements in ultrasound devices.