Region:Asia

Author(s):Dev

Product Code:KRAD3245

Pages:98

Published On:November 2025

By Type:The weight loss supplements market is segmented into various types, including Fat Burners, Appetite Suppressants, Meal Replacement Products, Herbal Supplements, Protein Supplements, and Others. Among these, Fat Burners are currently dominating the market due to their popularity among consumers looking for quick results. The increasing trend of fitness and bodybuilding has led to a surge in demand for these products, as they are perceived to enhance metabolism and promote fat loss effectively.

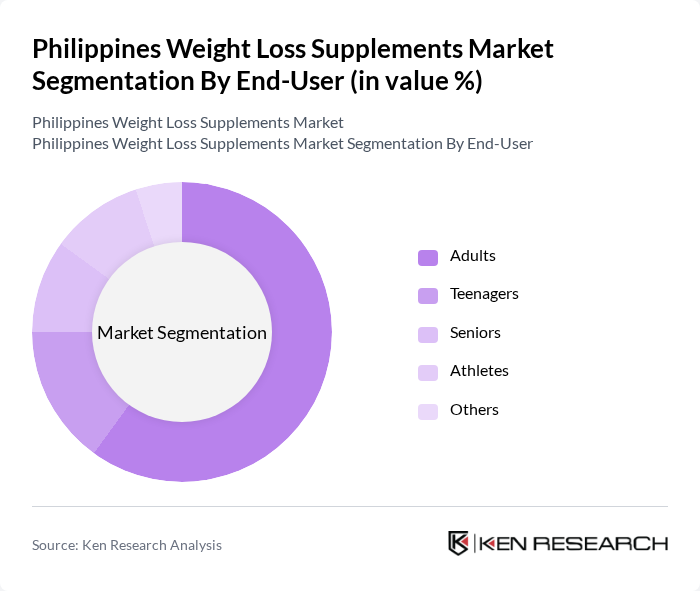

By End-User:The market is segmented by end-users, including Adults, Teenagers, Seniors, Athletes, and Others. Adults represent the largest segment, driven by the increasing prevalence of obesity and lifestyle-related diseases. The growing awareness of health and fitness among adults has led to a higher consumption of weight loss supplements, as they seek effective solutions to manage their weight and improve their overall health.

The Philippines Weight Loss Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., GNC Philippines, USANA Health Sciences, Inc., Amway Corporation, Nature’s Way Philippines, Optimum Nutrition Philippines, MusclePharm Philippines, Isagenix Philippines, SlimFast Philippines, Garden of Life Philippines, Nutrisystem Philippines, BioTrust Nutrition Philippines, Quest Nutrition Philippines, BPI Sports Philippines, 310 Nutrition Philippines, Unilab, Inc., Abbott Laboratories (Philippines), Blackmores Philippines, Swisse Wellness Philippines, Glanbia Philippines, NOW Foods Philippines, Nature’s Bounty Philippines, MegaFood Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the weight loss supplements market in the Philippines appears promising, driven by increasing health awareness and the rise of e-commerce. As consumers continue to prioritize health, the demand for innovative and effective weight loss solutions is expected to grow. Additionally, the integration of technology in product development, such as personalized nutrition plans, will likely enhance consumer engagement and satisfaction, paving the way for new market entrants and product offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Fat Burners Appetite Suppressants Meal Replacement Products Herbal Supplements Protein Supplements Others |

| By End-User | Adults Teenagers Seniors Athletes Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health and Wellness Stores Pharmacies Others |

| By Ingredient Source | Natural Ingredients Synthetic Ingredients Organic Ingredients Others |

| By Packaging Type | Bottles Sachets Tubs Others |

| By Price Range | Low Price Mid Price High Price Others |

| By Consumer Demographics | Gender Age Group Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Weight Loss Supplement Usage | 120 | Health-conscious individuals, Fitness enthusiasts |

| Retailer Insights on Supplement Sales | 50 | Store Managers, Product Buyers |

| Nutritionist Perspectives on Supplement Efficacy | 50 | Registered Dieticians, Nutrition Consultants |

| Fitness Trainer Feedback on Supplement Trends | 45 | Personal Trainers, Gym Owners |

| Market Trends from Health and Wellness Experts | 40 | Health Coaches, Wellness Program Directors |

The Philippines Weight Loss Supplements Market is valued at approximately USD 873.6 million, reflecting a significant growth trend driven by increasing health consciousness, rising obesity rates, and a growing interest in fitness and wellness among consumers.