Region:Europe

Author(s):Rebecca

Product Code:KRAB1861

Pages:95

Published On:October 2025

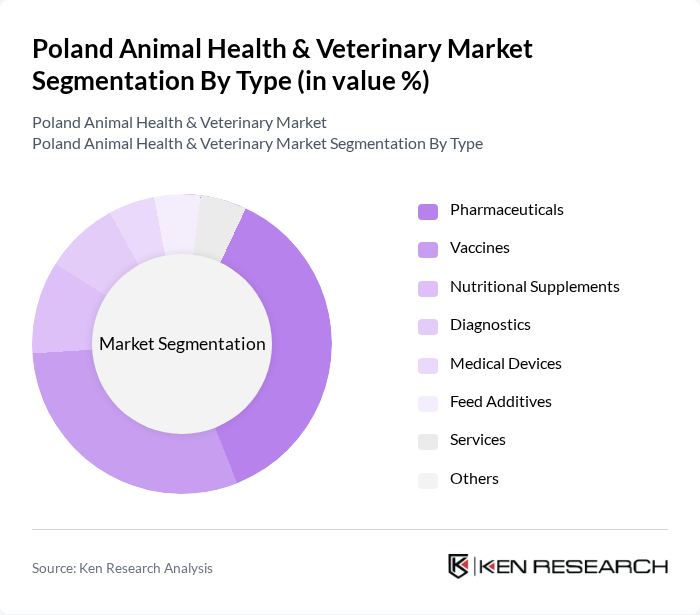

By Type:The market is segmented into various types, including Pharmaceuticals, Vaccines, Nutritional Supplements, Diagnostics, Medical Devices, Feed Additives, Services, and Others. Among these, Pharmaceuticals is the largest segment, accounting for a revenue share of approximately 44 percent in 2024, driven by its critical role in disease prevention and treatment in animals. Diagnostics is the fastest-growing segment, reflecting the increasing demand for advanced diagnostic tools and preventive healthcare. The rising prevalence of zoonotic diseases and the emphasis on preventive care continue to drive growth in pharmaceuticals and vaccines, while feed additives remain important for livestock health and productivity.

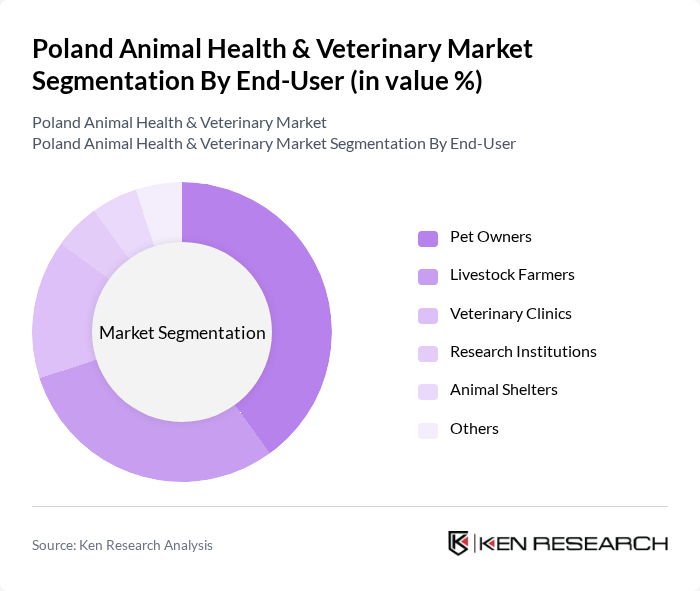

By End-User:The end-user segmentation includes Pet Owners, Livestock Farmers, Veterinary Clinics, Research Institutions, Animal Shelters, and Others. Pet Owners and Livestock Farmers are the primary consumers, driven by the increasing trend of pet adoption and the need for effective livestock management. The growing awareness of animal health and welfare among these groups is significantly influencing market dynamics. Veterinary clinics also play a crucial role as both service providers and purchasers of animal health products, while research institutions contribute to innovation and product development.

The Poland Animal Health & Veterinary Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, Elanco Animal Health, Bayer Animal Health, Ceva Santé Animale, Vetoquinol S.A., IDEXX Laboratories, Inc., Neogen Corporation, Phibro Animal Health Corporation, Alltech, Virbac S.A., Dechra Pharmaceuticals PLC, Trouw Nutrition, Vetmedin contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland Animal Health & Veterinary Market appears promising, driven by increasing pet ownership and advancements in veterinary technology. The integration of telemedicine is expected to enhance access to veterinary care, particularly in rural areas. Additionally, the growing trend towards preventive healthcare will likely lead to increased spending on veterinary services. As consumer awareness of animal health continues to rise, the market is poised for significant growth, fostering innovation and investment in animal health solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceuticals Vaccines Nutritional Supplements Diagnostics Medical Devices Feed Additives Services Others |

| By End-User | Pet Owners Livestock Farmers Veterinary Clinics Research Institutions Animal Shelters Others |

| By Distribution Channel | Veterinary Clinics Online Retail Pharmacies Agricultural Supply Stores Direct Sales Distributors Others |

| By Animal Type | Companion Animals Livestock Aquaculture Others |

| By Service Type | Preventive Care Emergency Care Surgical Services Diagnostic Services Others |

| By Product Formulation | Injectable Oral Topical Feed-Through Others |

| By Price Range | Low Medium High Others |

| By Region | Northern Poland Southern Poland Eastern Poland Western Poland Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Animal Health Product Distributors | 90 | Sales Representatives, Distribution Managers |

| Livestock Farmers | 120 | Farm Owners, Animal Health Managers |

| Pet Owners | 100 | Pet Owners, Animal Caretakers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

The Poland Animal Health & Veterinary Market is valued at approximately USD 900 million, reflecting significant growth driven by increasing pet ownership, advancements in veterinary technology, and rising awareness of animal health.