Region:Europe

Author(s):Shubham

Product Code:KRAB3199

Pages:96

Published On:October 2025

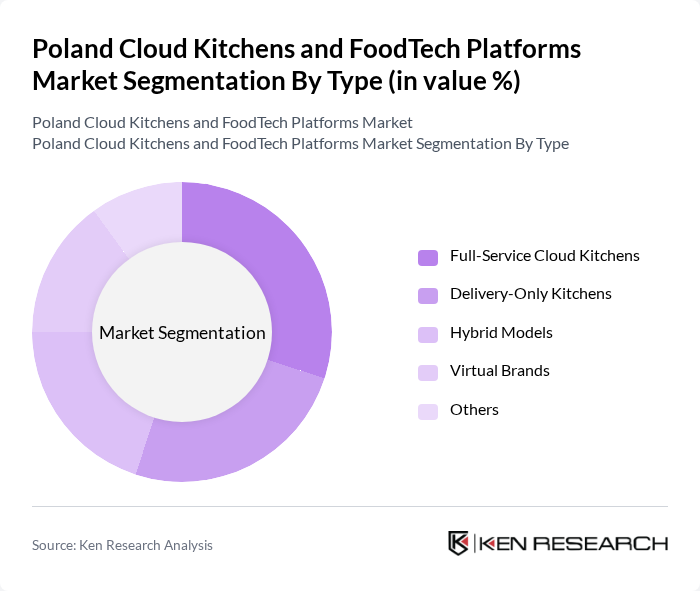

By Type:The market is segmented into various types, including Full-Service Cloud Kitchens, Delivery-Only Kitchens, Hybrid Models, Virtual Brands, and Others. Each of these sub-segments caters to different consumer needs and preferences, influencing their market presence.

The Full-Service Cloud Kitchens segment is currently dominating the market due to their ability to offer a wide range of cuisines and services under one roof. This model appeals to consumers looking for variety and quality, as these kitchens often employ professional chefs and utilize advanced cooking techniques. The convenience of having multiple dining options from a single provider has led to increased consumer preference for this segment, making it a key player in the overall market landscape.

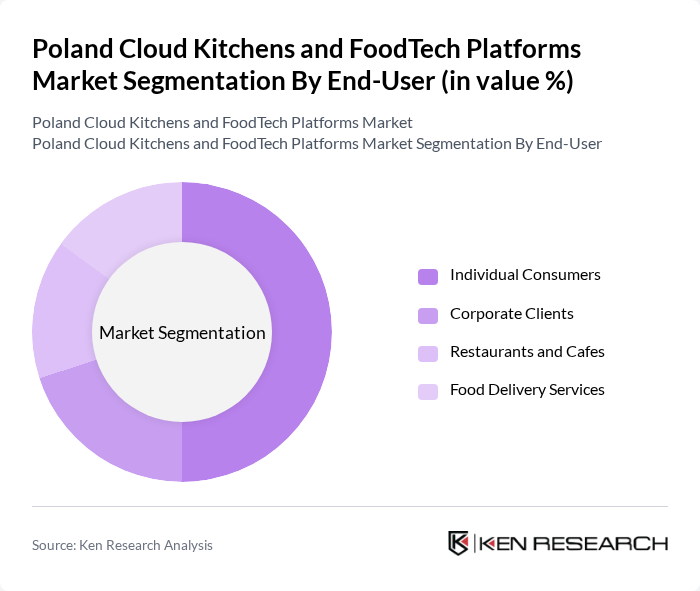

By End-User:The market is segmented based on end-users, including Individual Consumers, Corporate Clients, Restaurants and Cafes, and Food Delivery Services. Each segment has unique requirements and contributes differently to the market dynamics.

The Individual Consumers segment is the largest contributor to the market, driven by the growing trend of online food ordering and the increasing preference for convenience. This demographic is particularly influenced by the ease of access to diverse food options and the ability to order from the comfort of their homes. As a result, cloud kitchens that cater to individual consumers are seeing significant growth, making them a focal point in the market.

The Poland Cloud Kitchens and FoodTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deliveroo, Uber Eats, Glovo, Takeaway.com, Foodpanda, Wolt, Just Eat, Zomato, Pyszne.pl, KFC Poland, McDonald's Poland, Pizza Hut Poland, Burger King Poland, Greenway, and Local Polish Startups contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Cloud Kitchens and FoodTech platforms in Poland appears promising, driven by evolving consumer preferences and technological innovations. As the market adapts to increasing demand for delivery services and health-conscious options, operators are likely to invest in advanced technologies to enhance efficiency. Additionally, the integration of sustainable practices will become crucial, as consumers increasingly prioritize eco-friendly options. This dynamic environment presents opportunities for growth and differentiation in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Cloud Kitchens Delivery-Only Kitchens Hybrid Models Virtual Brands Others |

| By End-User | Individual Consumers Corporate Clients Restaurants and Cafes Food Delivery Services |

| By Cuisine Type | Italian Asian Fast Food Vegan/Vegetarian Others |

| By Sales Channel | Online Platforms Mobile Applications Direct Orders Third-Party Delivery Services |

| By Distribution Mode | Direct-to-Consumer B2B Partnerships Franchise Models Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value Pricing Discount Pricing |

| By Customer Segment | Millennials Families Professionals Health-Conscious Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Kitchen Operators | 100 | Founders, Operations Managers |

| Food Delivery Platforms | 80 | Product Managers, Marketing Directors |

| Consumer Preferences | 150 | Frequent Food Delivery Users, General Consumers |

| Food Safety Experts | 50 | Regulatory Compliance Officers, Food Safety Inspectors |

| Investors in FoodTech | 60 | Venture Capitalists, Angel Investors |

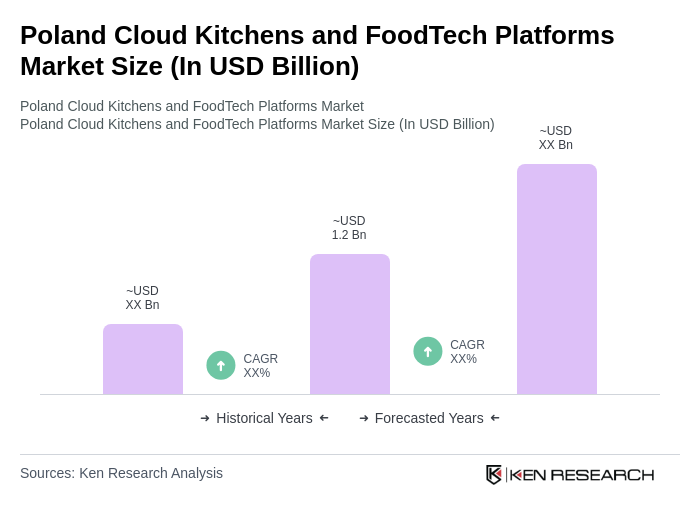

The Poland Cloud Kitchens and FoodTech Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing demand for food delivery services and the rise of online ordering among consumers.