Region:Asia

Author(s):Rebecca

Product Code:KRAB5270

Pages:87

Published On:October 2025

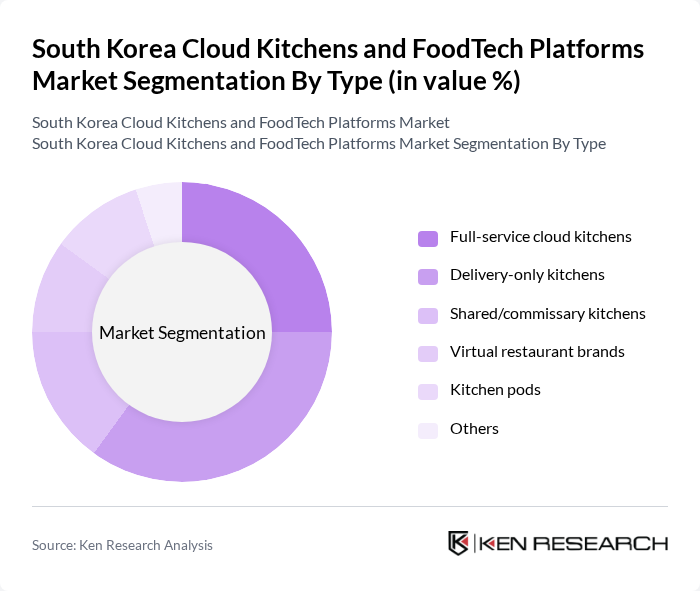

By Type:The market is segmented into various types, including full-service cloud kitchens, delivery-only kitchens, shared/commissary kitchens, virtual restaurant brands, kitchen pods, and others. Among these,delivery-only kitchensare gaining significant traction due to the increasing preference for convenience and the rise of food delivery apps. Full-service cloud kitchens also play a crucial role by offering a comprehensive dining experience through delivery.

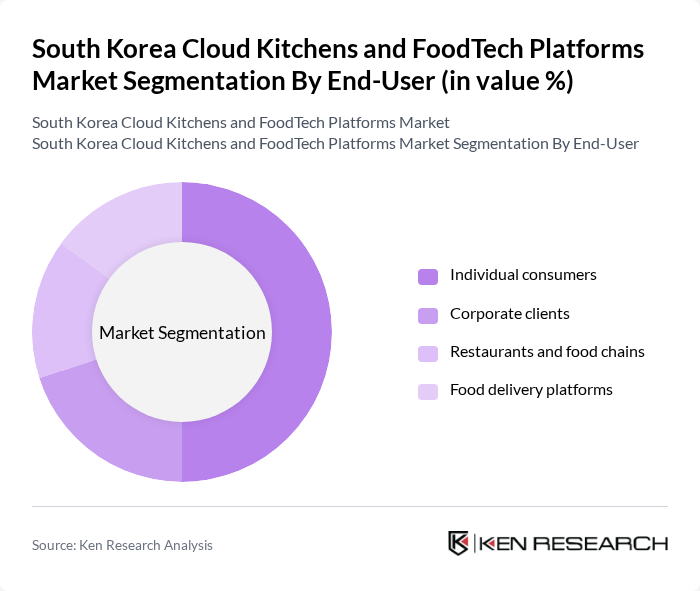

By End-User:The end-user segmentation includes individual consumers, corporate clients, restaurants and food chains, and food delivery platforms.Individual consumersdominate the market, driven by the growing trend of online food ordering and the convenience of home delivery. Corporate clients also represent a significant segment, as businesses increasingly opt for catering services from cloud kitchens for events and meetings.

The South Korea Cloud Kitchens and FoodTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baedal Minjok (?????, Woowa Brothers), Yogiyo (???, Delivery Hero Korea), Coupang Eats (????, Coupang Corp.), Ghost Kitchen Korea (?????), Simple Project Company Co., Ltd (WeCook, ????????? ??), Monthly Kitchen Co., Ltd (?????), Market Kurly (????, Kurly Inc.), FoodFly (?????), Shuttle Delivery (??????), CJ Freshway (CJ?????), Samsung Welstory (??????), LG CNS (Smart Kitchen Solutions), Baemin Kitchen (????, Woowa Brothers), Kitchen Connect (?????), FreshCode (?????) contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean cloud kitchen and FoodTech platforms market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As AI and data analytics become integral to operations, businesses will enhance efficiency and customer engagement. Additionally, the focus on sustainability will shape new business models, encouraging eco-friendly practices. The expansion into rural markets presents untapped potential, allowing companies to diversify their customer base and adapt to regional preferences, ultimately fostering growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-service cloud kitchens Delivery-only kitchens Shared/commissary kitchens Virtual restaurant brands Kitchen pods Others |

| By End-User | Individual consumers Corporate clients Restaurants and food chains Food delivery platforms |

| By Cuisine Type | Korean cuisine Western cuisine Asian cuisine Fast food Health-focused/functional foods Others |

| By Service Model | On-demand delivery Subscription services Meal kits Takeaway only Others |

| By Distribution Channel | Online platforms Mobile applications Direct sales Aggregator platforms Others |

| By Pricing Strategy | Premium pricing Competitive pricing Value-based pricing Dynamic pricing Others |

| By Customer Segment | Millennials Families Working professionals Students Single-person households Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Kitchen Operators | 100 | Founders, Operations Managers |

| Food Delivery Platforms | 60 | Platform Managers, Marketing Directors |

| Consumer Preferences | 120 | Frequent Food Delivery Users, Young Professionals |

| Food Safety Regulators | 40 | Policy Makers, Compliance Officers |

| Investors in FoodTech | 50 | Venture Capitalists, Angel Investors |

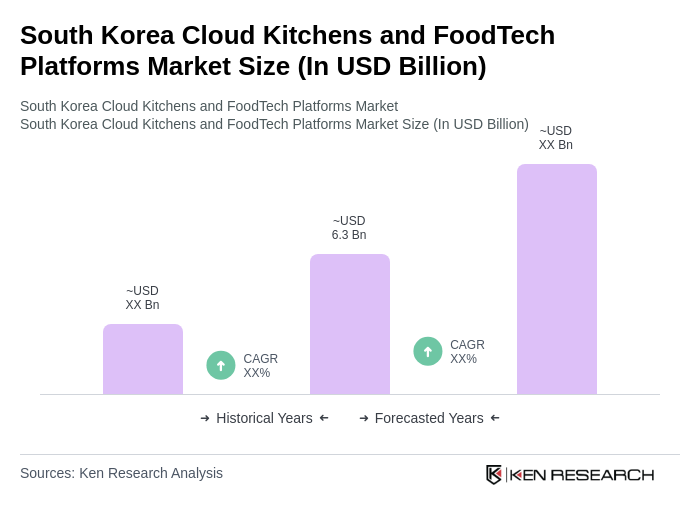

The South Korea Cloud Kitchens and FoodTech Platforms Market is valued at approximately USD 6.3 billion, reflecting significant growth driven by increasing demand for food delivery services and the rise of online food ordering among consumers.