Region:Europe

Author(s):Rebecca

Product Code:KRAB0300

Pages:95

Published On:August 2025

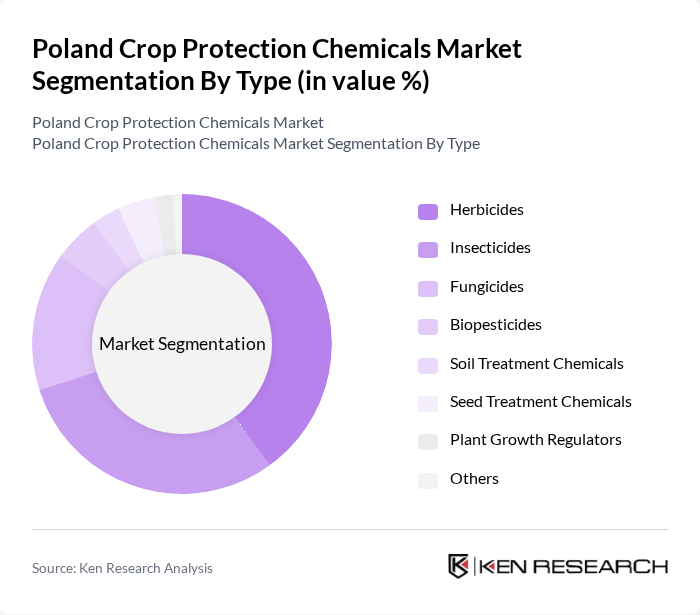

By Type:The market is segmented into various types of crop protection chemicals, includingherbicides, insecticides, fungicides, biopesticides, soil treatment chemicals, seed treatment chemicals, plant growth regulators, and others. Among these,herbicides and insecticidesare the most widely used due to their effectiveness in controlling weeds and pests, which are critical for maintaining crop yields. The increasing adoption of integrated pest management practices is also driving the demand forbiopesticides, reflecting a shift towards more sustainable agricultural solutions .

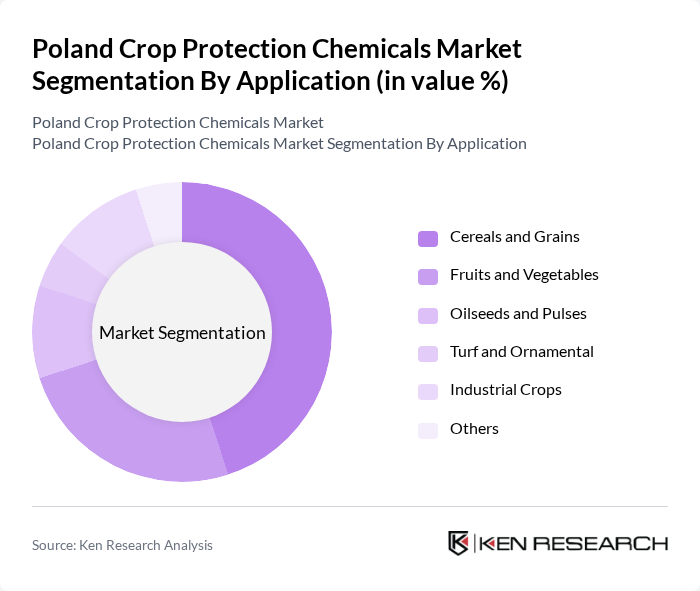

By Application:The application segment includescereals and grains, fruits and vegetables, oilseeds and pulses, turf and ornamental, industrial crops, and others.Cereals and grainsdominate the market due to their significant contribution to food security and the high demand for crop protection solutions to enhance yield. The increasing consumption of fruits and vegetables is also driving growth in this segment, as farmers seek effective solutions to combat pests and diseases that threaten these crops .

The Poland Crop Protection Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, Bayer AG, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions Ltd., Nufarm Limited, UPL Limited, Sumitomo Chemical Co., Ltd., Arysta LifeScience Corporation, Cheminova A/S, Isagro S.p.A., Albaugh, LLC, Belchim Crop Protection NV, Biobest Group NV, Ciech Sarzyna S.A., Sumi Agro Poland Sp. z o.o., Intermag Sp. z o.o., Synthos Agro Sp. z o.o., Biopartner Sp. z o.o. contribute to innovation, geographic expansion, and service delivery in this space .

The Poland crop protection chemicals market is poised for transformation as it adapts to evolving agricultural practices and consumer preferences. With a strong emphasis on sustainability, companies are likely to invest in research and development to create environmentally friendly products. Additionally, the integration of digital technologies in farming will enhance the efficiency of crop protection applications. As these trends continue, the market will likely see a shift towards innovative solutions that meet both regulatory standards and consumer demands for safer agricultural practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Insecticides Fungicides Biopesticides Soil Treatment Chemicals Seed Treatment Chemicals Plant Growth Regulators Others |

| By Application | Cereals and Grains (e.g., wheat, corn, barley, triticale, oats) Fruits and Vegetables Oilseeds and Pulses Turf and Ornamental Industrial Crops (e.g., sugar beet, potatoes, rapeseed) Others |

| By End-User | Individual Farmers Agricultural Cooperatives Large Commercial Farms Distributors and Retailers Government Agencies Others |

| By Distribution Channel | Direct Sales (Manufacturer to Farmer) Retail Outlets (Agrocenters, Cooperatives) Online Sales Platforms Agricultural Shows and Expos Wholesalers/Distributors Others |

| By Region | Northern Poland Southern Poland Eastern Poland Western Poland Central Poland Others |

| By Product Formulation | Liquid Formulations Granular Formulations Powder Formulations Emulsifiable Concentrates Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Herbicide Usage in Major Crops | 100 | Agronomists, Crop Managers |

| Insecticide Application Trends | 80 | Pest Control Specialists, Farmers |

| Fungicide Market Insights | 60 | Field Researchers, Agricultural Scientists |

| Distribution Channels for Crop Protection Chemicals | 90 | Distributors, Retail Managers |

| Regulatory Impact on Chemical Usage | 50 | Compliance Officers, Policy Makers |

The Poland Crop Protection Chemicals Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing agricultural productivity demands and the adoption of advanced farming techniques.