Region:Europe

Author(s):Geetanshi

Product Code:KRAA3714

Pages:94

Published On:September 2025

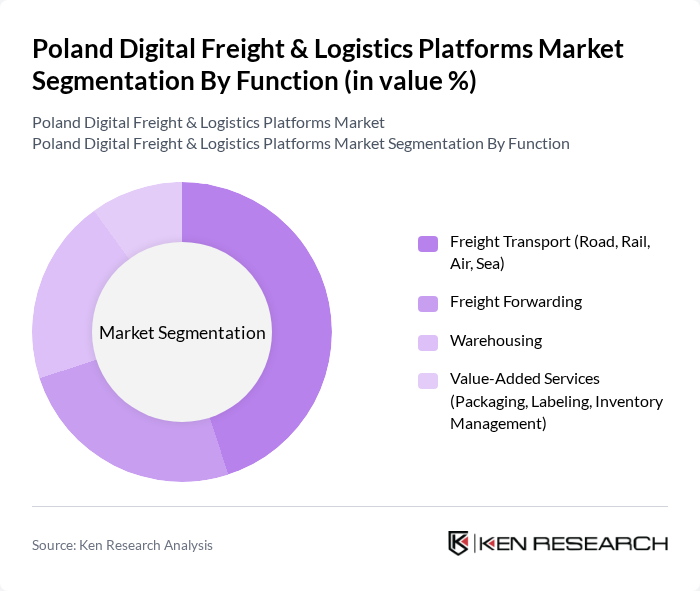

By Function:The market is segmented into various functions that include Freight Transport (Road, Rail, Air, Sea), Freight Forwarding, Warehousing, and Value-Added Services (Packaging, Labeling, Inventory Management). Among these, Freight Transport is the leading segment due to the increasing demand for efficient and timely delivery of goods across various modes of transport. The rise in e-commerce and cross-border trade has further fueled the need for robust freight transport solutions, making it a critical component of the logistics ecosystem. Automation and digital brokerage platforms are increasingly adopted to optimize shipment management and reduce operational costs.

By End-User:The end-user segmentation includes Construction, Oil & Gas and Quarrying, Agriculture, Fishing, and Forestry, Manufacturing and Automotive, Distributive Trade (Retail, Wholesale, E-commerce), Telecommunications, and Other End-Users (Pharmaceutical, Food & Beverage). The Distributive Trade segment is currently the most dominant, driven by the rapid growth of e-commerce and the increasing need for efficient logistics solutions to meet consumer demands. This segment's growth is further supported by the rise in online shopping, cross-border transactions, and the need for timely deliveries, especially in rural and international markets.

The Poland Digital Freight & Logistics Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as DB Schenker, DPD Polska, TSL Express, InPost, Raben Group, Kuehne + Nagel, DHL Supply Chain, XPO Logistics, Geodis, Trans.eu, C.H. Robinson, Zasada Group, TIMOCOM, CargoON (Grupa Trans.eu), Shippeo, PKP Cargo, Poczta Polska, DSV, FedEx Express Polska, Lotos Kolej contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland digital freight and logistics platforms market appears promising, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt AI and automation, operational efficiencies are expected to improve significantly. Additionally, the integration of sustainable practices will likely become a focal point, aligning with global trends towards environmental responsibility. The market is poised for transformation, with innovative solutions enhancing service delivery and customer satisfaction in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Function | Freight Transport (Road, Rail, Air, Sea) Freight Forwarding Warehousing Value-Added Services (Packaging, Labeling, Inventory Management) |

| By End-User | Construction Oil & Gas and Quarrying Agriculture, Fishing, and Forestry Manufacturing and Automotive Distributive Trade (Retail, Wholesale, E-commerce) Telecommunications Other End-Users (Pharmaceutical, Food & Beverage) |

| By Service Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Intermodal Services Express & Courier Services Warehousing & Distribution Value-Added Logistics Services |

| By Delivery Mode | Road Transport Rail Transport Air Transport Sea Transport |

| By Market Structure | Organized Unorganized |

| By Geographic Coverage | Domestic International |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Freight Platform Users | 70 | Logistics Coordinators, Freight Managers |

| Third-Party Logistics Providers | 50 | Operations Directors, Business Development Managers |

| Shippers and Manufacturers | 40 | Supply Chain Managers, Procurement Specialists |

| Technology Providers in Logistics | 40 | Product Managers, IT Directors |

| Regulatory Bodies and Associations | 40 | Policy Makers, Industry Analysts |

The Poland Digital Freight & Logistics Platforms Market is valued at approximately USD 36 billion, driven by the increasing demand for efficient logistics solutions, the rise of e-commerce, and advancements in technology such as automation and 5G-enabled tracking.