Region:Middle East

Author(s):Shubham

Product Code:KRAB3159

Pages:83

Published On:October 2025

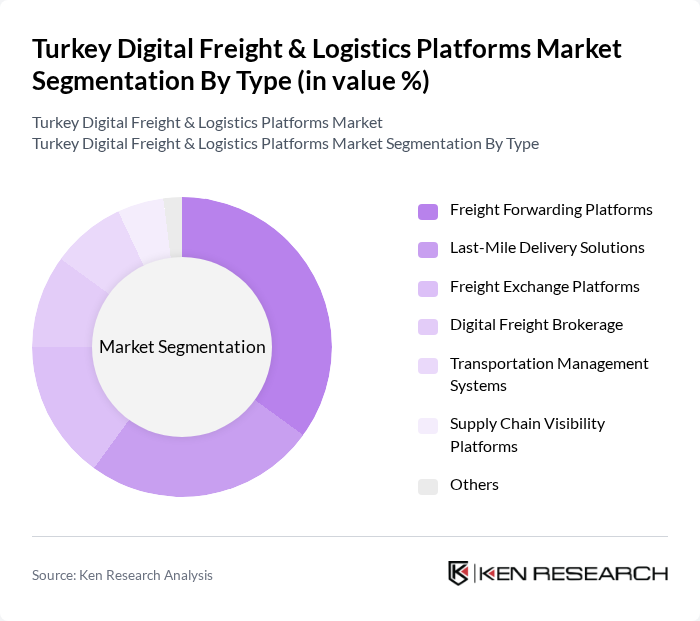

By Type:The market is segmented into various types, including Freight Forwarding Platforms, Last-Mile Delivery Solutions, Freight Exchange Platforms, Digital Freight Brokerage, Transportation Management Systems, Supply Chain Visibility Platforms, and Others. Among these, Freight Forwarding Platforms are currently leading the market due to their essential role in managing logistics and transportation processes efficiently. The increasing demand for seamless logistics solutions has driven the growth of this segment, as businesses seek to optimize their supply chains.

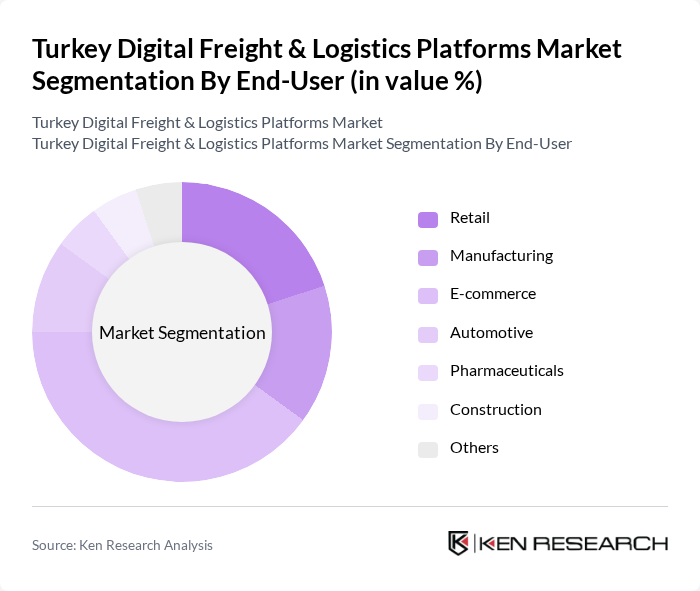

By End-User:The end-user segmentation includes Retail, Manufacturing, E-commerce, Automotive, Pharmaceuticals, Construction, and Others. The E-commerce segment is currently dominating the market, driven by the rapid growth of online shopping and the need for efficient delivery solutions. As consumer preferences shift towards online purchasing, logistics platforms that cater specifically to e-commerce needs are experiencing significant demand.

The Turkey Digital Freight & Logistics Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as TCDD Tasimacilik A.S., Getir, Hepsijet, Aras Kargo, Yurtiçi Kargo, PTT Kargo, MNG Kargo, Kargoist, TIRPORT, Logiwa, Tredex, Shipya, Cargofix, Taksim Logistics, Tedarik Zinciri Yönetimi A.S. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's digital freight and logistics platforms is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt integrated logistics solutions, the focus will shift towards enhancing operational efficiency and customer experience. The rise of mobile applications and big data analytics will further streamline processes, enabling platforms to offer personalized services. Additionally, sustainability initiatives will gain traction, aligning with global trends towards greener logistics practices, ultimately reshaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Platforms Last-Mile Delivery Solutions Freight Exchange Platforms Digital Freight Brokerage Transportation Management Systems Supply Chain Visibility Platforms Others |

| By End-User | Retail Manufacturing E-commerce Automotive Pharmaceuticals Construction Others |

| By Service Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Intermodal Services Warehousing Services Customs Clearance Services Others |

| By Technology | Cloud-based Solutions Mobile Applications IoT-enabled Platforms Blockchain Technology AI and Machine Learning Others |

| By Distribution Mode | Direct Sales Online Platforms Third-party Logistics Providers Freight Brokers Others |

| By Pricing Model | Subscription-based Pay-per-use Tiered Pricing Flat Rate Pricing Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Freight Platforms | 100 | CEOs, Product Managers |

| Logistics Service Providers | 80 | Operations Managers, Business Development Heads |

| E-commerce Logistics | 90 | Supply Chain Directors, Fulfillment Managers |

| Technology Providers in Logistics | 70 | CTOs, Software Development Leads |

| Regulatory Bodies and Associations | 50 | Policy Makers, Industry Analysts |

The Turkey Digital Freight & Logistics Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital technologies, the rise of e-commerce, and the need for efficient supply chain management.