Region:Asia

Author(s):Geetanshi

Product Code:KRAB2810

Pages:88

Published On:October 2025

By Type:The market can be segmented into various types of educational offerings, including Executive MBA Programs, Leadership Development Programs, Short Courses and Workshops, Online Learning Modules, Certification Programs, Coaching and Mentoring Services, Corporate Training Solutions, and Others. Each of these sub-segments caters to different learning needs and preferences of professionals and organizations.

The Leadership Development Programs segment is currently dominating the market due to the increasing emphasis on developing managerial skills and leadership qualities among professionals. Organizations recognize the importance of effective leadership in driving business success and are investing heavily in these programs. The trend towards personalized learning experiences and the integration of technology in training delivery further enhance the appeal of leadership development initiatives.

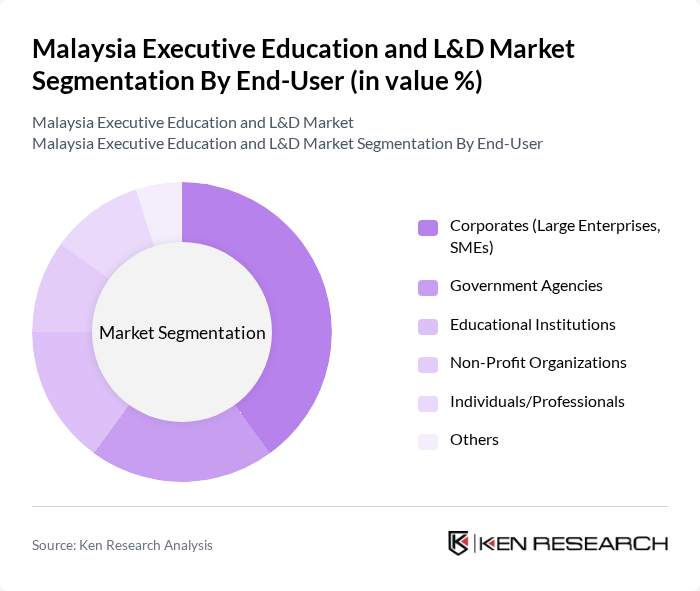

By End-User:The market is segmented by end-users, including Corporates (Large Enterprises, SMEs), Government Agencies, Educational Institutions, Non-Profit Organizations, Individuals/Professionals, and Others. Each end-user group has distinct training needs and preferences, influencing the types of programs they seek.

Corporates, particularly large enterprises and SMEs, dominate the market as they invest significantly in employee development to enhance productivity and retain talent. The increasing competition in various industries drives organizations to prioritize training and development initiatives, making this segment the largest contributor to the market.

The Malaysia Executive Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as Universiti Malaya (UM) – Graduate School of Business, INCEIF University – The Global University of Islamic Finance, Asia School of Business (in collaboration with MIT Sloan), Universiti Kebangsaan Malaysia (UKM) – UKM Graduate School of Business, Universiti Putra Malaysia (UPM) – Putra Business School, Monash University Malaysia – School of Business, Taylor's University – Taylor's Business School, Sunway University – Sunway Business School, HELP University – ELM Graduate School, UCSI University – Faculty of Business & Management, Malaysian Institute of Management (MIM), International Centre for Education in Islamic Finance (INCEIF), University of Nottingham Malaysia – Nottingham University Business School Malaysia, ELM Graduate School (HELP University), Malaysian Institute of Human Resource Management (MIHRM), Leaderonomics, K-Pintar Sdn Bhd, HRDF (Human Resource Development Corporation), PwC’s Academy Malaysia, FranklinCovey Malaysia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysian executive education market appears promising, driven by technological advancements and a growing emphasis on leadership development. As organizations increasingly recognize the importance of soft skills, training programs will evolve to incorporate these elements. Furthermore, the collaboration between educational institutions and corporations is expected to strengthen, leading to tailored programs that meet specific industry needs. This synergy will enhance the overall effectiveness of executive education, ensuring that it remains relevant in a rapidly changing job market.

| Segment | Sub-Segments |

|---|---|

| By Type | Executive MBA Programs Leadership Development Programs Short Courses and Workshops Online Learning Modules Certification Programs Coaching and Mentoring Services Corporate Training Solutions Others |

| By End-User | Corporates (Large Enterprises, SMEs) Government Agencies Educational Institutions Non-Profit Organizations Individuals/Professionals Others |

| By Delivery Mode | In-Person Training Online Learning (Synchronous & Asynchronous) Blended Learning On-the-Job Training Others |

| By Duration | Short-Term Programs (Less than 1 Month) Medium-Term Programs (1-6 Months) Long-Term Programs (More than 6 Months) Others |

| By Industry Focus | Finance and Banking Technology and IT Healthcare Manufacturing Retail Oil & Gas / Energy Public Sector Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Industry-Specific Certifications Professional Certifications (e.g., HRDF, PMI, CFA) Others |

| By Pricing Tier | Premium Tier Mid-Tier Budget Tier Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 120 | HR Directors, L&D Managers |

| Public Sector Training Initiatives | 90 | Government Training Coordinators, Policy Makers |

| Higher Education Institutions Offering Executive Programs | 60 | Deans, Program Directors |

| Industry-Specific Training Needs | 50 | Industry Association Leaders, Training Coordinators |

| Alumni Feedback on Executive Programs | 70 | Program Graduates, Corporate Trainers |

The Malaysia Executive Education and L&D Market is valued at approximately USD 85 million, driven by the increasing demand for skilled professionals and the expansion of digital and STEM-focused programs, reflecting a trend towards lifelong learning and upskilling initiatives.