Region:Europe

Author(s):Geetanshi

Product Code:KRAA3231

Pages:96

Published On:September 2025

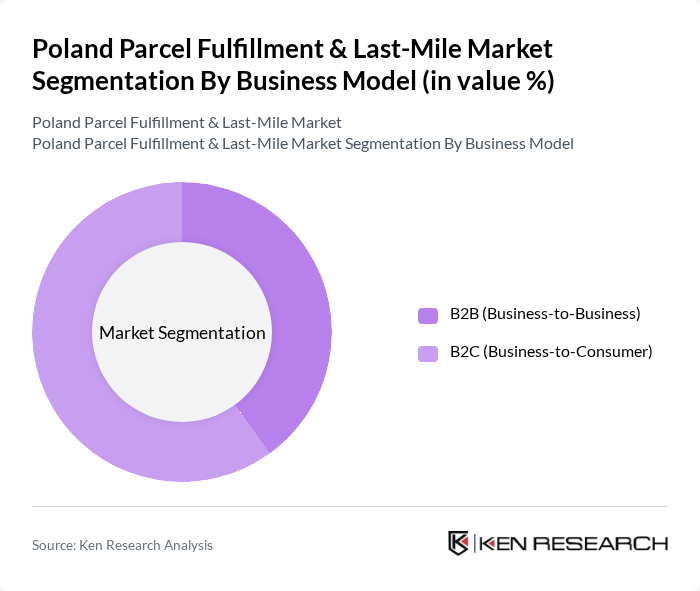

By Business Model:

The business model segmentation of the market includes B2B (Business-to-Business) and B2C (Business-to-Consumer). The B2C segment leads the market, fueled by the exponential growth of e-commerce and rising consumer expectations for convenience and rapid delivery. Businesses are increasingly adopting advanced fulfillment strategies, such as automated sorting and flexible delivery options, to meet these demands. The B2B segment remains significant but grows at a steadier pace, as it often involves more complex supply chains and longer delivery cycles .

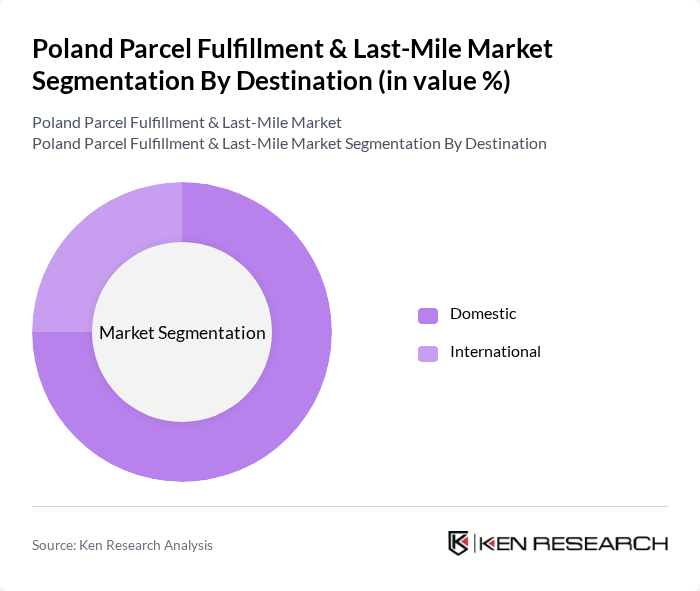

By Destination:

The destination segmentation includes Domestic and International markets. The domestic segment holds the majority share, driven by the high volume of local deliveries associated with the country’s booming e-commerce sector. Consumers increasingly prefer local fulfillment for faster and more reliable delivery. The international segment is expanding as Polish businesses leverage the country’s central European location to facilitate cross-border logistics and serve a growing base of international e-commerce shoppers .

The Poland Parcel Fulfillment & Last-Mile Market is characterized by a dynamic mix of regional and international players. Leading participants such as InPost S.A., DPD Polska, GLS Poland, FedEx Express Poland, DHL Parcel Polska, UPS Polska, Poczta Polska, Raben Group, Kuehne + Nagel Poland, DB Schenker Poland, Geis PL, XPO Logistics Poland, Rohlig SUUS Logistics, Zasada Group, TSL S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland parcel fulfillment and last-mile market appears promising, driven by ongoing e-commerce growth and urbanization. As consumer expectations for faster delivery continue to rise, logistics companies are likely to invest in innovative technologies and sustainable practices. The increasing adoption of automation and data analytics will enhance operational efficiency, while partnerships with local businesses may provide competitive advantages. Overall, the market is poised for significant transformation, adapting to evolving consumer needs and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Business Model | B2B (Business-to-Business) B2C (Business-to-Consumer) |

| By Destination | Domestic International |

| By End-User | E-commerce & Retail Services (BFSI, etc.) Manufacturing, Construction & Utilities Primary Industries (Agriculture, Natural Resources) |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport |

| By Service Type | Same-Day Delivery Scheduled Delivery Returns Management Cross-Border Fulfillment Value-Added Services (Packaging, Labeling, Inventory Management) |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Fulfillment Operations | 60 | Logistics Managers, E-commerce Directors |

| Retail Last-Mile Delivery | 50 | Supply Chain Managers, Operations Supervisors |

| Third-Party Logistics Providers | 40 | Business Development Managers, Account Executives |

| Consumer Preferences in Delivery | 80 | End Consumers, Customer Experience Managers |

| Technology Adoption in Logistics | 45 | IT Managers, Innovation Officers |

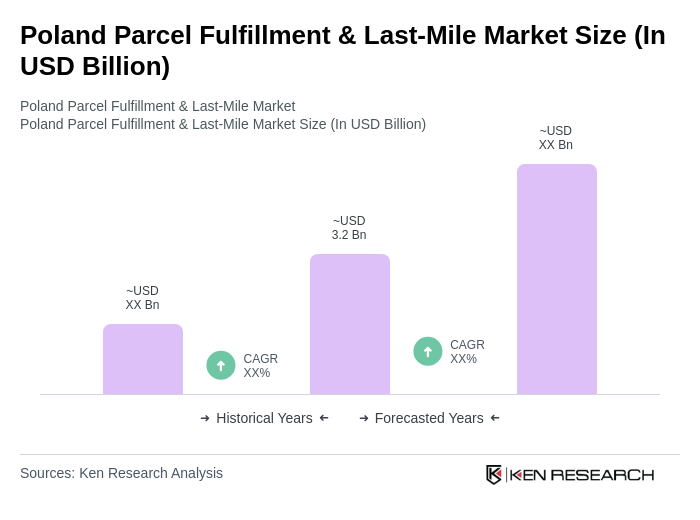

The Poland Parcel Fulfillment & Last-Mile Market is valued at approximately USD 3.2 billion, driven by the rapid growth of e-commerce and advancements in logistics technology, including automation and real-time tracking.