Region:Europe

Author(s):Rebecca

Product Code:KRAB5368

Pages:84

Published On:October 2025

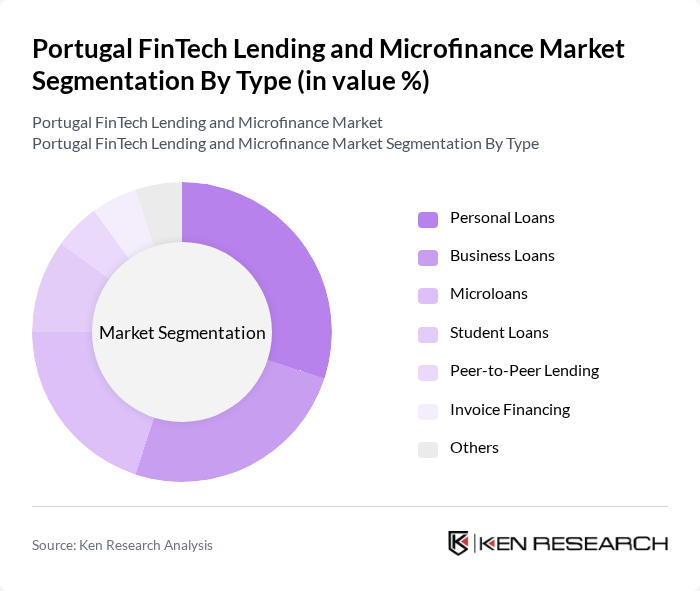

By Type:The market is segmented into various types of lending products, including personal loans, business loans, microloans, student loans, peer-to-peer lending, invoice financing, and others. Personal loans have gained significant traction due to their flexibility and ease of access, while business loans cater to the growing needs of SMEs. Microloans are particularly popular among entrepreneurs seeking small amounts of capital to start or expand their businesses.

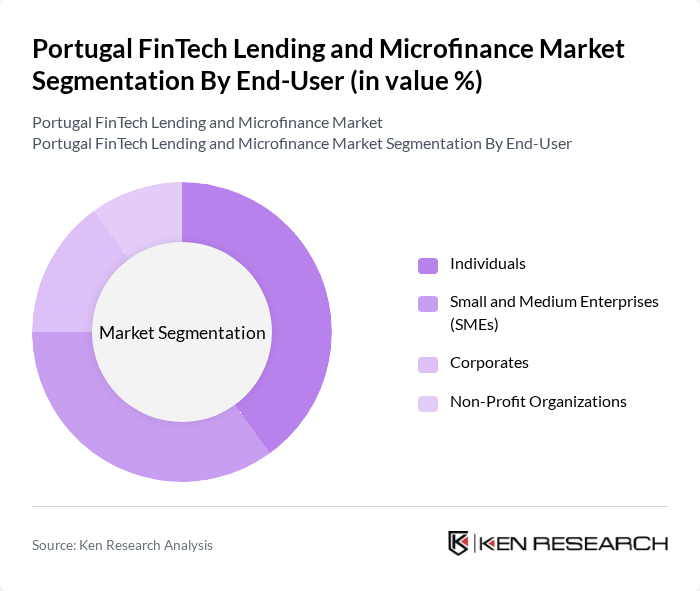

By End-User:The end-user segmentation includes individuals, small and medium enterprises (SMEs), corporates, and non-profit organizations. Individuals represent a significant portion of the market, driven by the need for personal financing solutions. SMEs are increasingly turning to alternative lending options to support their growth, while corporates and non-profits also seek tailored financial products to meet their specific needs.

The Portugal FinTech Lending and Microfinance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco BPI, Unilend, Raize, Creditea, Lendico, FinanZero, Banco CTT, Muda.me, Finsolutia, BNI Europa, Lendico, Kiva, Fintonic, P2P Lending Portugal, Zopa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the FinTech lending and microfinance market in Portugal appears promising, driven by technological innovations and a growing emphasis on financial inclusion. As digital platforms continue to evolve, the integration of AI and big data analytics will enhance credit assessment processes, making lending more accessible. Additionally, partnerships between FinTechs and traditional banks are expected to expand, creating a more robust financial ecosystem that caters to diverse consumer needs while addressing regulatory challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Microloans Student Loans Peer-to-Peer Lending Invoice Financing Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Non-Profit Organizations |

| By Loan Purpose | Home Improvement Debt Consolidation Business Expansion Education |

| By Distribution Channel | Online Platforms Mobile Applications Traditional Banks Financial Advisors |

| By Customer Segment | Retail Customers Institutional Customers High Net-Worth Individuals |

| By Risk Profile | Low Risk Medium Risk High Risk |

| By Loan Size | Small Loans (up to €5,000) Medium Loans (€5,001 - €50,000) Large Loans (over €50,000) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| FinTech Lending Platforms | 100 | CEOs, Product Managers, Risk Analysts |

| Microfinance Institutions | 80 | Directors, Loan Officers, Compliance Managers |

| Borrower Experience Insights | 150 | Individual Borrowers, Small Business Owners |

| Regulatory Impact Assessment | 50 | Regulatory Officials, Policy Advisors |

| Market Trends and Innovations | 70 | Industry Analysts, FinTech Consultants |

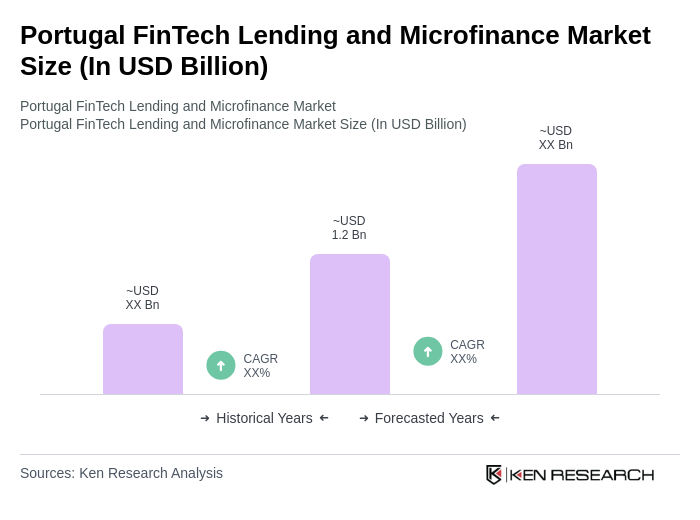

The Portugal FinTech Lending and Microfinance Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for alternative financing solutions, particularly among small and medium enterprises (SMEs) and individuals seeking quick access to funds.