Region:Europe

Author(s):Shubham

Product Code:KRAA1803

Pages:99

Published On:August 2025

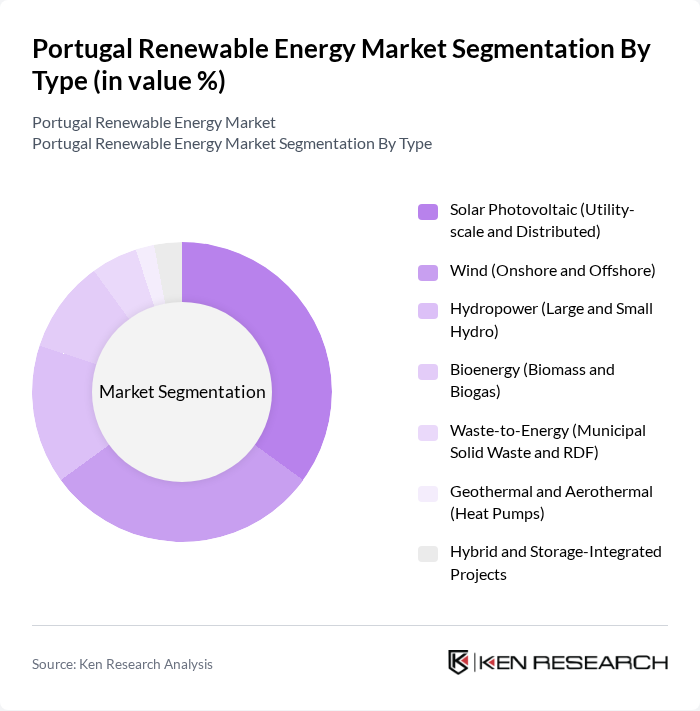

By Type:The market is segmented into various types of renewable energy sources, including solar photovoltaic, wind, hydropower, bioenergy, waste-to-energy, geothermal, and hybrid projects. Each type plays a crucial role in the overall energy landscape, with specific applications and technologies driving growth. Hydropower and onshore wind remain core contributors to annual generation, while solar PV is the fastest-growing technology supported by auctions and corporate PPAs; Portugal also operates bioenergy from forestry residues and municipal waste, and is piloting floating offshore wind and hybrid-storage projects to enhance system flexibility.

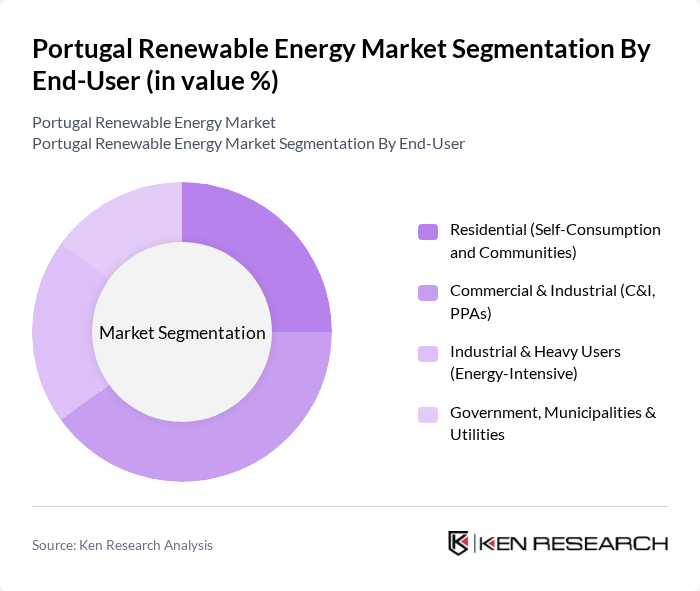

By End-User:The end-user segmentation includes residential, commercial & industrial, industrial & heavy users, and government entities. Each segment has unique energy needs and consumption patterns, influencing the demand for renewable energy solutions. Corporate and industrial buyers increasingly use long-term PPAs for price certainty and decarbonization, residential self-consumption and energy communities are expanding with streamlined permitting for smaller solar sites, and public/municipal entities support grid integration and resilience investments.

The Portugal Renewable Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as EDP Renewables (EDPR), EDP – Energias de Portugal, S.A., GALP Energia, S.G.P.S., S.A., Iberdrola, S.A., Acciona Energía, S.A., Finerge, S.A., REN – Redes Energéticas Nacionais, S.A., Voltalia Portugal, Aquila Capital (Aquila Clean Energy Portugal), Greenvolt – Energias Renováveis, S.A., Martifer Solar (Martifer SGPS), Galp Solar / Casa Galp (Distributed Solar), Enel Green Power Portugal, Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy, S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the renewable energy market in Portugal appears promising, driven by increasing government support and technological advancements. By the future, the integration of smart grid technologies is expected to enhance energy efficiency and reliability. Additionally, the expansion of energy storage solutions will facilitate the management of intermittent renewable sources, ensuring a stable energy supply. As public awareness of climate change grows, the demand for sustainable energy solutions will likely continue to rise, further propelling market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Photovoltaic (Utility-scale and Distributed) Wind (Onshore and Offshore) Hydropower (Large and Small Hydro) Bioenergy (Biomass and Biogas) Waste-to-Energy (Municipal Solid Waste and RDF) Geothermal and Aerothermal (Heat Pumps) Hybrid and Storage-Integrated Projects |

| By End-User | Residential (Self-Consumption and Communities) Commercial & Industrial (C&I, PPAs) Industrial & Heavy Users (Energy-Intensive) Government, Municipalities & Utilities |

| By Investment Source | Domestic (Utilities and IPPs) Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes and EU Funding (PRR, PNEC) |

| By Application | Grid-Connected Off-Grid and Remote Rooftop and Behind-the-Meter Utility-Scale and Merchant Projects |

| By Policy Support | Subsidies and Investment Grants Tax Incentives (Depreciation, VAT) Guarantees of Origin (GOs) and RECs |

| By Technology | Solar PV (Fixed-Tilt and Trackers) Concentrated Solar Power (CSP) Onshore Wind Turbines Offshore Wind (Fixed and Floating) |

| By Distribution Mode | Direct Power Sales (PPAs, Merchant) Online/Platform-Based Energy Services EPC/Developers and Integrators Retail and Installers Network |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Solar Energy Project Developers | 100 | Project Managers, Business Development Executives |

| Wind Energy Operators | 80 | Operations Managers, Technical Directors |

| Hydropower Facility Managers | 60 | Site Managers, Environmental Compliance Officers |

| Energy Policy Experts | 50 | Regulatory Affairs Specialists, Policy Analysts |

| Investors in Renewable Energy | 70 | Investment Analysts, Portfolio Managers |

The Portugal Renewable Energy Market is valued at approximately USD 1314 billion, reflecting significant growth in wind, hydro, and solar capacities, driven by government incentives and a commitment to sustainability.