Portugal Sports Equipment and Fitness Apparel Market Overview

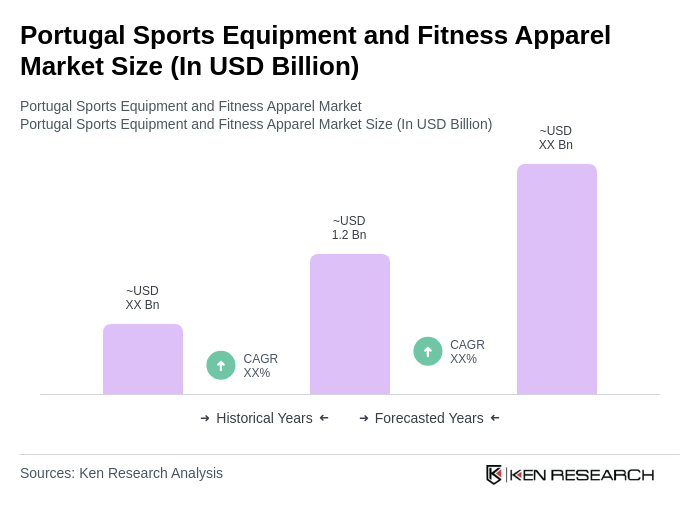

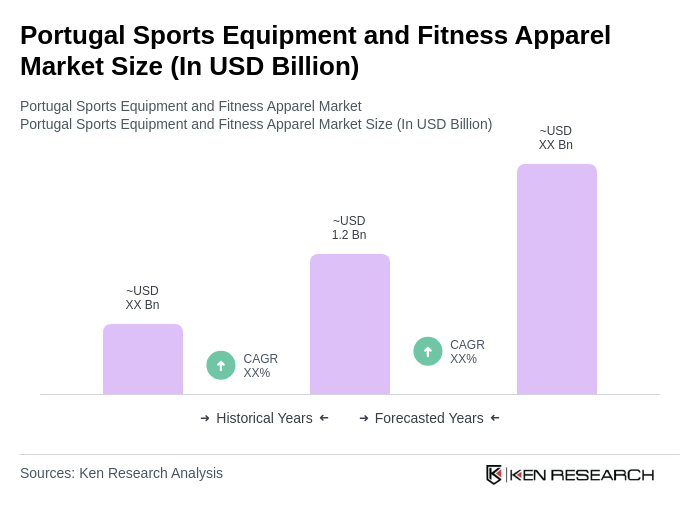

- The Portugal Sports Equipment and Fitness Apparel Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, a rise in fitness activities, and the growing popularity of sports events. The market has seen a significant uptick in demand for both fitness equipment and apparel, reflecting a broader trend towards active lifestyles.

- Key cities such as Lisbon and Porto dominate the market due to their urban population density and a vibrant culture of fitness and sports. These cities have a higher concentration of gyms, fitness centers, and sports clubs, which contribute to the demand for sports equipment and fitness apparel. Additionally, the presence of major retail outlets and e-commerce platforms in these urban areas facilitates easy access to a variety of products.

- In recent years, the Portuguese government has implemented regulations aimed at promoting physical activity among citizens. One notable initiative is the "National Physical Activity Plan," which encourages local municipalities to develop sports facilities and programs. This plan aims to increase participation in sports and physical activities, thereby boosting the demand for sports equipment and fitness apparel across the country.

Portugal Sports Equipment and Fitness Apparel Market Segmentation

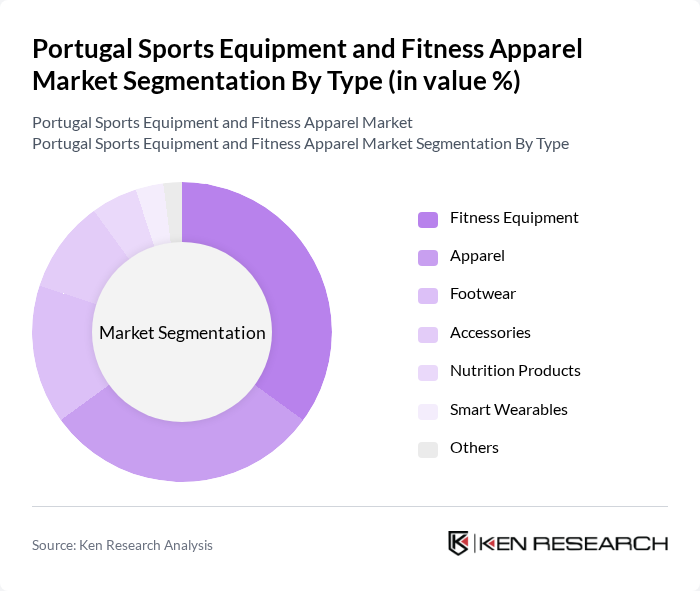

By Type:The market is segmented into various types, including Fitness Equipment, Apparel, Footwear, Accessories, Nutrition Products, Smart Wearables, and Others. Among these, Fitness Equipment and Apparel are the most significant segments, driven by the increasing number of fitness enthusiasts and the growing trend of athleisure wear. The demand for smart wearables is also on the rise, reflecting consumer interest in technology-integrated fitness solutions.

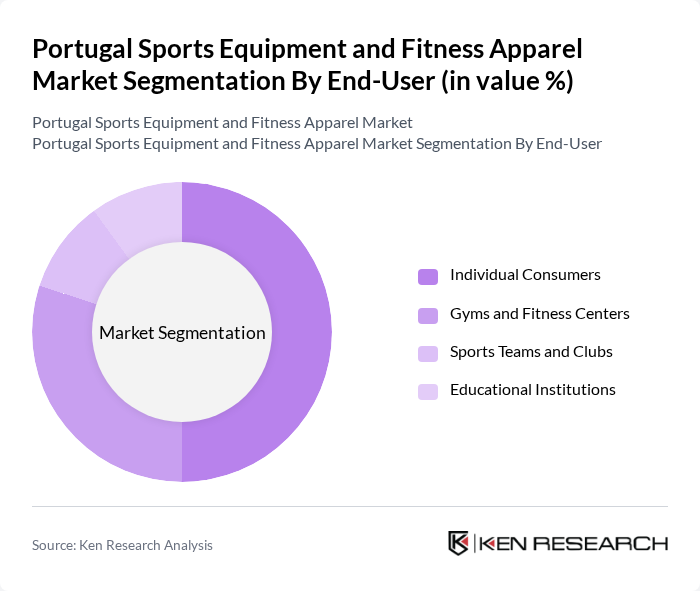

By End-User:The end-user segmentation includes Individual Consumers, Gyms and Fitness Centers, Sports Teams and Clubs, and Educational Institutions. Individual Consumers represent the largest segment, driven by the increasing trend of personal fitness and home workouts. Gyms and Fitness Centers also play a crucial role, as they require a wide range of equipment and apparel to cater to their members.

Portugal Sports Equipment and Fitness Apparel Market Competitive Landscape

The Portugal Sports Equipment and Fitness Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Decathlon S.A., ASICS Corporation, Reebok International Ltd., New Balance Athletics, Inc., Columbia Sportswear Company, Lululemon Athletica Inc., The North Face, Inc., Gymshark Ltd., Skechers USA, Inc., Fabletics, Inc., H&M Hennes & Mauritz AB contribute to innovation, geographic expansion, and service delivery in this space.

Portugal Sports Equipment and Fitness Apparel Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The Portuguese population is increasingly prioritizing health, with 60% of adults engaging in regular physical activity as of 2023. This trend is supported by the World Health Organization's recommendation of at least 150 minutes of moderate exercise weekly. The rise in health awareness has led to a surge in demand for sports equipment and fitness apparel, with the market expected to benefit from this growing consumer focus on wellness and active lifestyles.

- Rise in Participation in Sports Activities:In future, approximately 3.5 million people in Portugal participated in organized sports, reflecting a 15% increase from 2020. This growth is driven by government initiatives promoting sports and community engagement. The increase in participation not only boosts the demand for sports equipment but also enhances the market for fitness apparel, as more individuals seek quality gear to support their activities and performance.

- Growth of E-commerce Platforms:E-commerce sales in Portugal's sports equipment and fitness apparel sector reached €450 million in future, marking a 25% increase from the previous year. The convenience of online shopping, coupled with the rise of digital marketing strategies, has made it easier for consumers to access a wide range of products. This shift towards online purchasing is expected to continue, further driving market growth as brands enhance their digital presence and customer engagement.

Market Challenges

- Intense Competition:The Portuguese sports equipment and fitness apparel market is characterized by intense competition, with over 200 brands vying for market share. Major players like Nike and Adidas dominate, but local brands are also emerging, creating a saturated environment. This competition pressures pricing strategies and profit margins, making it challenging for new entrants to establish themselves and for existing brands to maintain market position.

- Economic Fluctuations:Portugal's economy is projected to grow at a modest rate of 1.5% in future, influenced by global economic conditions. Economic fluctuations can impact consumer spending on non-essential items, including sports equipment and fitness apparel. A downturn could lead to reduced discretionary spending, affecting sales and profitability in the sector, as consumers prioritize essential goods over fitness-related purchases.

Portugal Sports Equipment and Fitness Apparel Market Future Outlook

The future of the Portugal sports equipment and fitness apparel market appears promising, driven by ongoing trends in health and wellness. As more consumers embrace active lifestyles, the demand for innovative and high-quality products is expected to rise. Additionally, the integration of technology in fitness apparel, such as smart fabrics, will likely enhance user experience. Brands that adapt to these trends and focus on sustainability will be well-positioned to capture market share and meet evolving consumer preferences.

Market Opportunities

- Expansion of Fitness Centers:The number of fitness centers in Portugal has increased by 20% since 2020, reaching over 1,200 facilities in future. This growth presents significant opportunities for sports equipment and apparel brands to partner with gyms and fitness studios, enhancing visibility and driving sales through targeted promotions and exclusive product offerings.

- Increasing Demand for Sustainable Products:A survey conducted in future revealed that 70% of Portuguese consumers prefer brands that prioritize sustainability. This trend opens avenues for companies to develop eco-friendly sports equipment and apparel, tapping into a growing market segment that values environmental responsibility and ethical production practices, thereby enhancing brand loyalty and market reach.