Region:Africa

Author(s):Shubham

Product Code:KRAB5604

Pages:87

Published On:October 2025

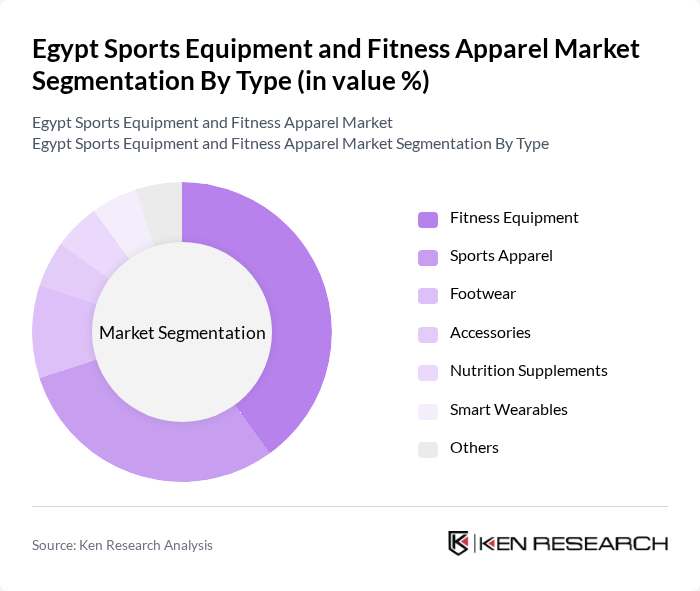

By Type:The market is segmented into various types, including Fitness Equipment, Sports Apparel, Footwear, Accessories, Nutrition Supplements, Smart Wearables, and Others. Among these, Fitness Equipment is currently the leading sub-segment, driven by the increasing number of gyms and fitness centers across the country. The growing trend of home workouts has also contributed to the demand for fitness equipment, as consumers seek to maintain their fitness routines at home. Sports Apparel follows closely, as consumers are increasingly looking for stylish and functional clothing for both workouts and casual wear.

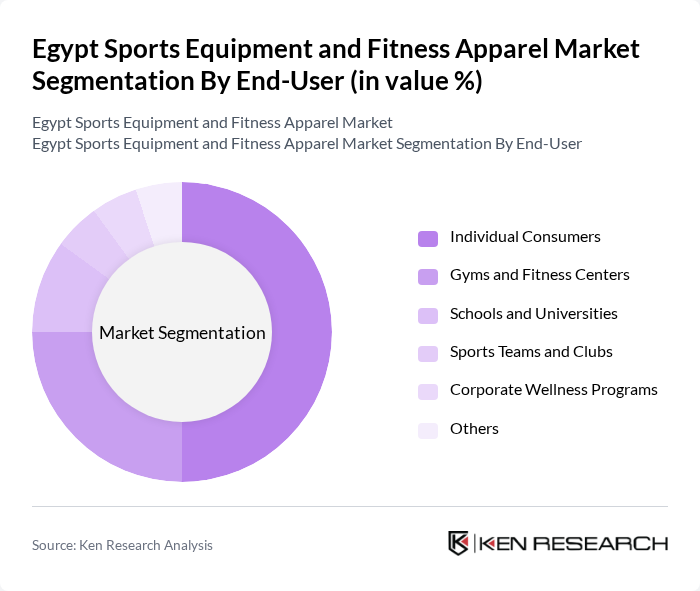

By End-User:The market is segmented by end-users, including Individual Consumers, Gyms and Fitness Centers, Schools and Universities, Sports Teams and Clubs, Corporate Wellness Programs, and Others. Individual Consumers represent the largest segment, as more people are investing in personal fitness and wellness. Gyms and Fitness Centers also play a significant role, as they require a wide range of equipment and apparel to cater to their members. The increasing focus on health and fitness in educational institutions further boosts the demand from Schools and Universities.

The Egypt Sports Equipment and Fitness Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adidas AG, Nike Inc., Puma SE, Under Armour Inc., Decathlon S.A., Reebok International Ltd., New Balance Athletics, Inc., Asics Corporation, Columbia Sportswear Company, Skechers USA, Inc., Champion Athleticwear, Fila Holdings Corp., Mizuno Corporation, Hummel International, Kappa S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt sports equipment and fitness apparel market appears promising, driven by a growing health-conscious population and increasing participation in fitness activities. As government initiatives continue to promote sports, the market is likely to see enhanced infrastructure and community engagement. Additionally, the rise of e-commerce platforms will facilitate access to a broader range of products, catering to diverse consumer preferences and driving innovation in product offerings, particularly in athleisure and eco-friendly segments.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Sports Apparel Footwear Accessories Nutrition Supplements Smart Wearables Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Universities Sports Teams and Clubs Corporate Wellness Programs Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Trend-Focused Customers Others |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage Others |

| By Material Type | Synthetic Fabrics Natural Fabrics Blended Fabrics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Equipment | 150 | Store Managers, Sales Representatives |

| Fitness Apparel Retailers | 100 | Brand Managers, Merchandisers |

| Consumer Fitness Trends | 200 | Fitness Enthusiasts, Gym Members |

| Online Fitness Equipment Sales | 80 | E-commerce Managers, Digital Marketing Specialists |

| Fitness Influencers and Trainers | 70 | Personal Trainers, Fitness Coaches |

The Egypt Sports Equipment and Fitness Apparel Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increased health consciousness and government initiatives promoting sports and fitness among the population.