Vietnam Sports Equipment and Fitness Apparel Market Overview

- The Vietnam Sports Equipment and Fitness Apparel Market is valued at USD 1.4 billion, based on a five-year historical analysis of the combined sports equipment and sportswear segments. This market growth is primarily driven by increasing health consciousness, rising disposable incomes, and a strong trend towards fitness and outdoor activities. Demand for both sports equipment and fitness apparel has surged as more consumers participate in physical activities, sports, and wellness routines. Notably, e-commerce platforms have played a significant role in expanding market access and driving sales, especially in urban and semi-urban regions.

- Key cities such as Ho Chi Minh City and Hanoi continue to dominate the market due to their large populations, rapid urbanization, and the presence of numerous fitness centers and sports clubs. These urban hubs are also critical for retail and e-commerce distribution, hosting flagship stores of international brands and serving as focal points for sporting events and activities. Southern Vietnam, including Ho Chi Minh City, currently holds the largest market share, reflecting higher urbanization rates and consumer spending power.

- In 2023, the Vietnamese government advanced the National Strategy for Physical Training and Sports Development, as set out in Decision No. 1076/QD-TTg issued by the Prime Minister. This binding instrument allocated substantial funding for the development of sports infrastructure and facilities nationwide, with a focus on youth participation and accessibility. The strategy mandates the construction and upgrade of sports complexes, school facilities, and community centers, requiring compliance with national standards for safety and accessibility. This initiative directly supports the expansion of sports and fitness resources, further stimulating demand for sports equipment and apparel.

Vietnam Sports Equipment and Fitness Apparel Market Segmentation

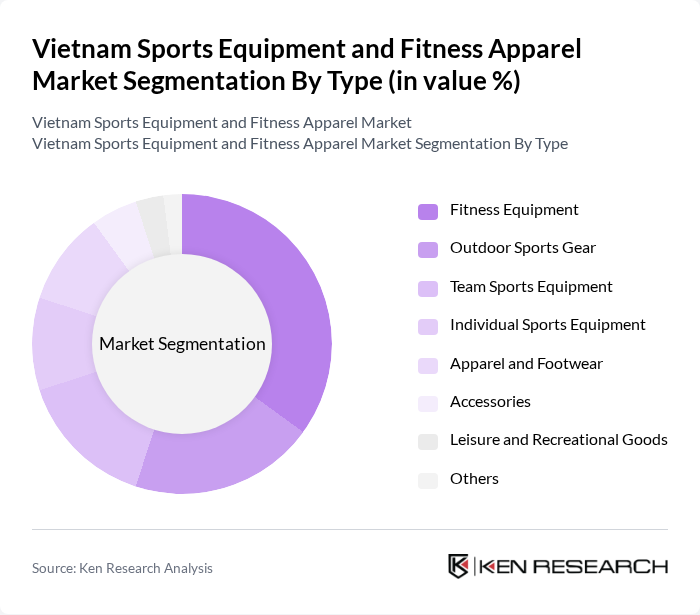

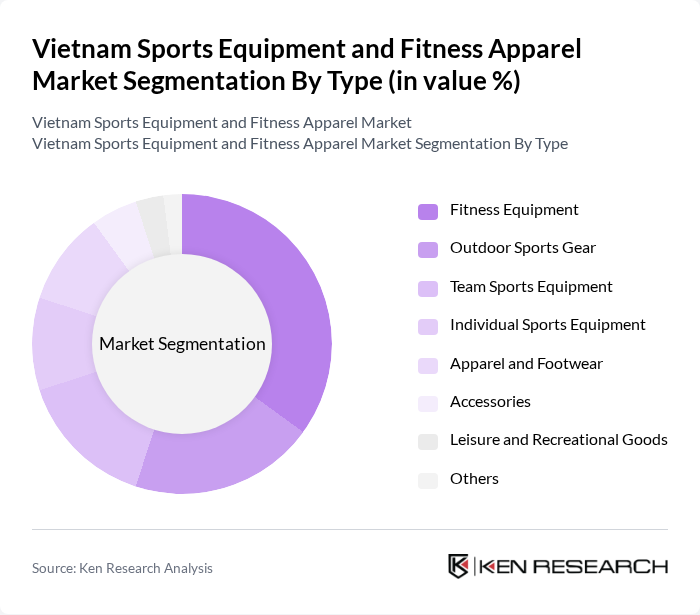

By Type:The market is segmented into Fitness Equipment, Outdoor Sports Gear, Team Sports Equipment, Individual Sports Equipment, Apparel and Footwear, Accessories, Leisure and Recreational Goods, and Others. Fitness Equipment remains the leading sub-segment, driven by the increasing popularity of home workouts, gym memberships, and the adoption of digital fitness solutions. Consumers are investing in high-quality equipment and smart devices to enhance their workout experiences, with demand further boosted by influencer marketing and the expansion of specialty retail outlets.

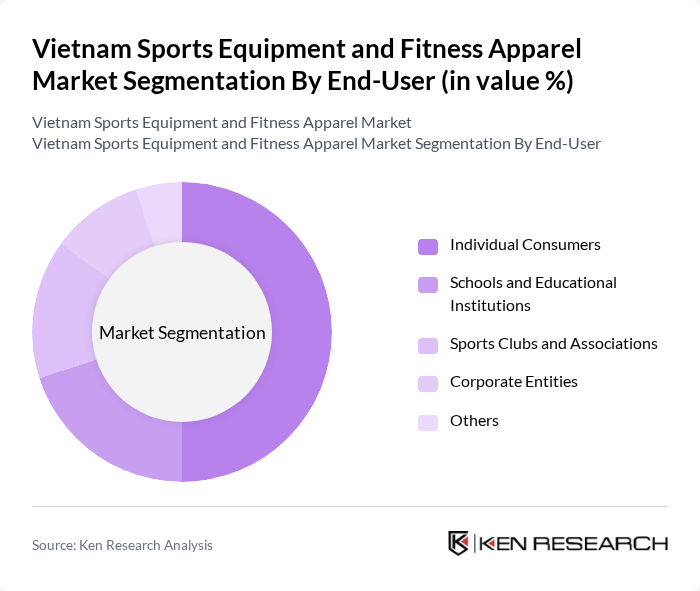

By End-User:The market is segmented by end-users, including Individual Consumers, Schools and Educational Institutions, Sports Clubs and Associations, Corporate Entities, and Others. Individual Consumers represent the largest segment, reflecting the growing trend of personal fitness, wellness, and recreational sports. This segment is characterized by diverse consumer profiles, ranging from fitness enthusiasts to casual users, with increased spending on both equipment and apparel facilitated by digital retail channels and social media influence.

Vietnam Sports Equipment and Fitness Apparel Market Competitive Landscape

The Vietnam Sports Equipment and Fitness Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike Vietnam, Adidas Vietnam, Decathlon Vietnam, Puma Vietnam, Under Armour Vietnam, Li-Ning Vietnam, Anta Sports Vietnam, Mizuno Vietnam, Asics Vietnam, New Balance Vietnam, Columbia Sportswear Vietnam, Skechers Vietnam, The North Face Vietnam, Bitis, 360° Sport, Xtep Vietnam, Aristino, Keep & Fly contribute to innovation, geographic expansion, and service delivery in this space.

Vietnam Sports Equipment and Fitness Apparel Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The Vietnamese population is becoming increasingly health-conscious, with 62% of adults engaging in regular physical activity. This shift is driven by rising obesity rates, which reached 19% in urban areas. The government’s health initiatives, including the National Strategy for Nutrition, aim to promote active lifestyles, further fueling demand for sports equipment and fitness apparel. This growing awareness is expected to significantly boost market growth in the coming years.

- Rising Disposable Income:Vietnam's GDP per capita is projected to reach approximately $4,500, reflecting a 6% increase from the previous year. This rise in disposable income allows consumers to allocate more funds towards health and fitness-related purchases. As more individuals can afford quality sports equipment and apparel, the market is likely to expand, with a notable increase in premium product sales, catering to a more affluent consumer base.

- Growth of Fitness Culture:The fitness culture in Vietnam is rapidly evolving, with a 32% increase in gym memberships reported. The proliferation of fitness centers and community sports events has encouraged participation across various demographics. Additionally, the rise of social media influencers promoting fitness lifestyles has further popularized sports activities, leading to increased demand for related equipment and apparel, thus driving market growth significantly.

Market Challenges

- Intense Competition:The sports equipment and fitness apparel market in Vietnam is characterized by fierce competition, with over 210 brands vying for market share. Major international players like Nike and Adidas dominate, making it challenging for local brands to establish a foothold. This saturation leads to aggressive pricing strategies, which can erode profit margins and hinder the growth of smaller companies trying to differentiate themselves in a crowded marketplace.

- Price Sensitivity Among Consumers:Despite rising disposable incomes, a significant portion of the Vietnamese population remains price-sensitive, particularly in rural areas where average incomes are lower, around $2,600 per capita. This sensitivity limits the market for premium products, as consumers often prioritize affordability over brand loyalty. Consequently, companies must balance quality and pricing to attract a broader customer base while maintaining profitability.

Vietnam Sports Equipment and Fitness Apparel Market Future Outlook

The Vietnam sports equipment and fitness apparel market is poised for substantial growth, driven by increasing health awareness and a burgeoning fitness culture. As disposable incomes rise, consumers are expected to invest more in quality products. Additionally, the expansion of e-commerce platforms will facilitate access to a wider range of products, enhancing consumer choice. Companies that adapt to these trends and focus on sustainability will likely capture significant market share in the evolving landscape.

Market Opportunities

- Growth in Online Retail:The e-commerce sector in Vietnam is projected to reach $25 billion, driven by increased internet penetration and mobile usage. This growth presents a significant opportunity for sports equipment and fitness apparel brands to expand their online presence, catering to a tech-savvy consumer base that prefers shopping online for convenience and variety.

- Increasing Participation in Sports Events:With over 1,200 sports events held annually in Vietnam, including marathons and triathlons, there is a growing demand for specialized sports gear. This trend offers brands the chance to develop targeted marketing strategies and product lines that cater to event participants, enhancing brand visibility and driving sales in a competitive market.