Region:Middle East

Author(s):Dev

Product Code:KRAC0919

Pages:97

Published On:December 2025

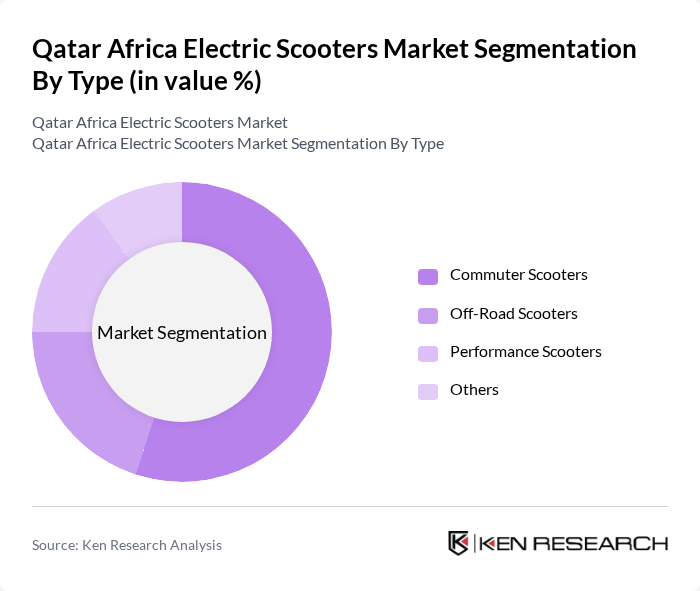

By Type:The electric scooters market is segmented into various types, including commuter scooters, off-road scooters, performance scooters, and others. Among these, commuter scooters dominate the market due to their practicality and efficiency for urban transportation. The increasing urban population and the need for convenient, eco-friendly commuting options have led to a surge in demand for commuter scooters, making them the preferred choice for daily travel.

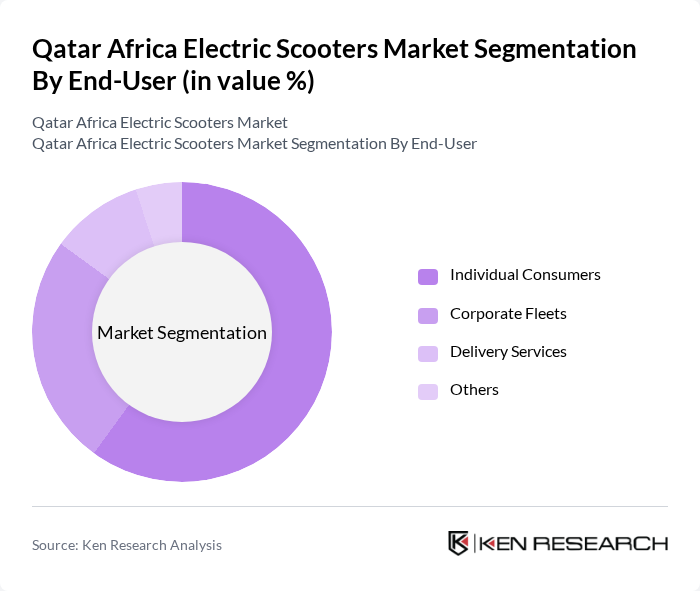

By End-User:The market is also segmented by end-user, which includes individual consumers, corporate fleets, delivery services, and others. Individual consumers represent the largest segment, driven by the growing trend of personal mobility solutions and the increasing adoption of electric scooters for short-distance travel. The convenience and cost-effectiveness of electric scooters make them an attractive option for personal use, further propelling their market share.

The Qatar Africa Electric Scooters Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honda Motor Co Ltd, Yamaha Motor Company Limited, Ninebot Limited, and Yadea Technology Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric scooter market in Qatar appears promising, driven by ongoing infrastructure development and a strong push for sustainable mobility solutions. With plans to install over 1,500 EV charging stations in the future, the government is laying the groundwork for broader adoption of electric vehicles, including e-scooters. Additionally, the increasing focus on reducing CO? emissions aligns with global sustainability trends, creating a favorable environment for the growth of eco-friendly transport options in urban settings.

| Segment | Sub-Segments |

|---|---|

| By Type | Commuter Scooters Off-Road Scooters Performance Scooters Others |

| By End-User | Individual Consumers Corporate Fleets Delivery Services Others |

| By Battery Type | Lithium-Ion Batteries Lead-Acid Batteries Others |

| By Range | Short Range (up to 30 km) Medium Range (30-60 km) Long Range (above 60 km) |

| By Charging Type | Standard Charging Fast Charging Wireless Charging Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Policy Support | Subsidies Tax Exemptions Incentives for Charging Infrastructure Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Adoption of Electric Scooters | 150 | Urban Residents, Young Professionals |

| Retail Market Insights | 100 | Retail Managers, Sales Executives |

| Government Policy Impact | 80 | Policy Makers, Transportation Officials |

| Infrastructure Readiness Assessment | 70 | Urban Planners, Civil Engineers |

| Environmental Impact Perspectives | 60 | Sustainability Advocates, Environmental Scientists |

The Qatar Africa Electric Scooters Market is valued at approximately USD 60 million, reflecting a growing interest in eco-friendly transportation and electric scooter sharing services, supported by improved urban infrastructure and consumer demand for sustainable mobility solutions.