Region:Middle East

Author(s):Dev

Product Code:KRAA8263

Pages:83

Published On:November 2025

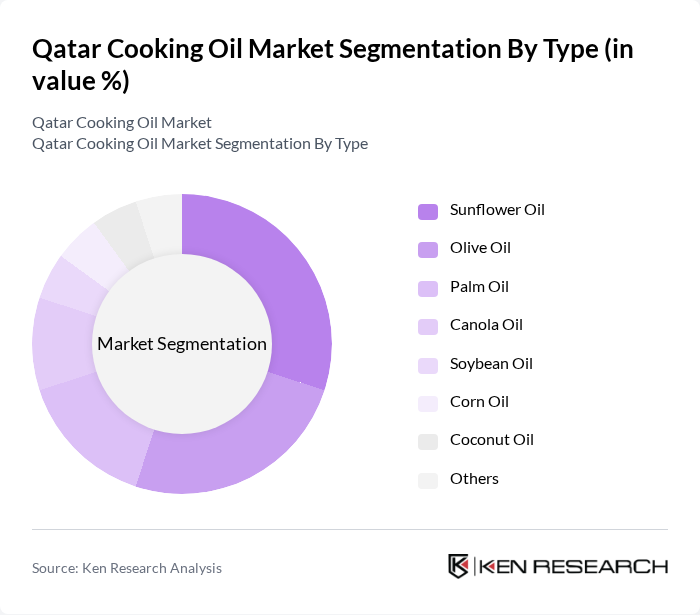

By Type:The cooking oil market is segmented into various types, including sunflower oil, olive oil, palm oil, canola oil, soybean oil, corn oil, coconut oil, and others. Among these, sunflower oil and olive oil are the most popular due to their health benefits and versatility in cooking. The demand for olive oil has surged as consumers seek healthier alternatives, while sunflower oil remains a staple in many households and food service outlets. Palm oil and canola oil are also widely used in commercial food preparation due to their stability and cost-effectiveness. The market reflects a growing preference for oils with lower saturated fat and higher nutritional value .

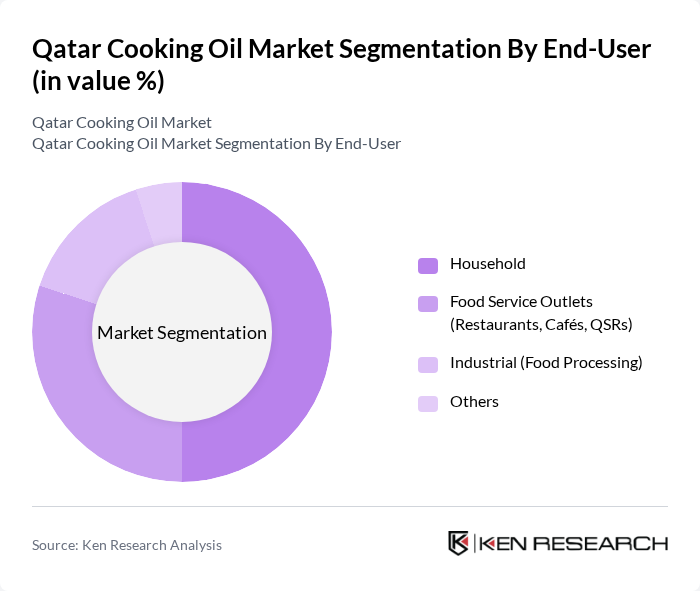

By End-User:The end-user segmentation includes households, food service outlets (restaurants, cafés, QSRs), industrial (food processing), and others. The household segment dominates the market as cooking oil is a staple in every kitchen. However, the food service sector is rapidly growing due to the increasing number of restaurants and cafés, which are adopting healthier cooking practices and offering diverse menus. Industrial users, including food processors, are also increasing their consumption of specialty and bulk oils to meet rising demand for packaged and processed foods .

The Qatar Cooking Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as QatarFry, Golden Harvest Oils, Al Watania Agriculture, Al-Ahli Foods, Al-Mana Group, Qatar National Food Company, Al-Faisal Group, Al-Mansoori Group, Al-Jazeera Foods, United Foods Company, Al-Mahhar Group, Savola Group, Qatar Industrial Manufacturing Company, Qatar Food Industries, IFFCO Group contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar cooking oil market is poised for significant transformation, driven by evolving consumer preferences and regulatory changes. As health consciousness continues to rise, the demand for organic and healthier oil options is expected to increase. Additionally, the government's support for local production and sustainability initiatives will likely enhance the competitive landscape. Innovations in packaging and digital marketing strategies will further shape consumer engagement, creating a dynamic environment for both established and emerging brands in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Sunflower Oil Olive Oil Palm Oil Canola Oil Soybean Oil Corn Oil Coconut Oil Others |

| By End-User | Household Food Service Outlets (Restaurants, Cafés, QSRs) Industrial (Food Processing) Others |

| By Packaging Type | Bottles Cans Pouches Bulk Packaging Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Wholesale Distributors Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Brand Type | National Brands Private Labels Imported Brands Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Cooking Oil Sales | 120 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 150 | Household Decision Makers, Health-Conscious Consumers |

| Food Service Industry Insights | 100 | Restaurant Owners, Chefs |

| Import/Export Dynamics | 80 | Logistics Coordinators, Trade Analysts |

| Health and Nutrition Perspectives | 70 | Nutritionists, Dietitians |

The Qatar Cooking Oil Market is valued at approximately USD 670 million, reflecting a significant growth trend driven by increasing consumer demand for healthier cooking oils and the expansion of the food service industry.