Region:Middle East

Author(s):Dev

Product Code:KRAD7844

Pages:81

Published On:December 2025

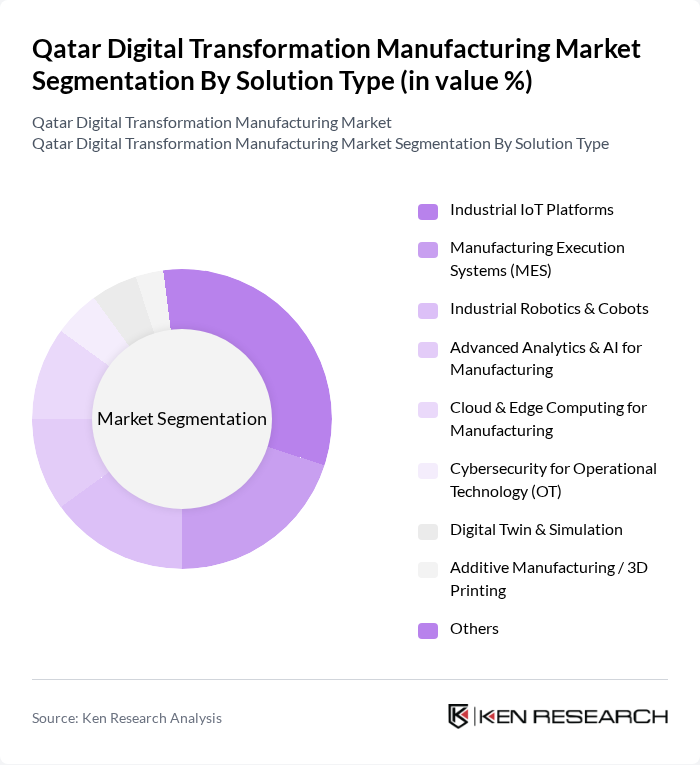

By Solution Type:The solution type segmentation includes various technologies that facilitate digital transformation in manufacturing. The subsegments are Industrial IoT Platforms, Manufacturing Execution Systems (MES), Industrial Robotics & Cobots, Advanced Analytics & AI for Manufacturing, Cloud & Edge Computing for Manufacturing, Cybersecurity for Operational Technology (OT), Digital Twin & Simulation, Additive Manufacturing / 3D Printing, and Others. Among these, Industrial IoT Platforms are leading the market due to their ability to connect devices and systems, enabling real-time data analysis, asset monitoring, and predictive maintenance in plants. The growing trend of smart factories, integration of IIoT in energy and manufacturing, and the need for higher operational efficiency, energy optimization, and reduced downtime are driving the adoption of IoT and connected automation solutions.

By Manufacturing End?User:This segmentation focuses on the various industries that utilize digital transformation solutions in manufacturing. The subsegments include Metals & Heavy Industries (Steel, Aluminum), Oil & Gas–Linked Processing and Petrochemicals, Food & Beverage Manufacturing, Pharmaceuticals & Chemicals, Building Materials (Cement, Glass, Plastics), Discrete Manufacturing (Electronics, Machinery, Automotive Components), and Others. The Oil & Gas–linked processing and petrochemicals segment is the dominant end-user, driven by the need for enhanced operational efficiency, uptime, and safety in complex processing and refining activities, and by Qatar’s strong hydrocarbon base. The increasing demand for automation, IIoT-based monitoring, advanced process control, and data analytics in this sector is propelling its growth, while metals, building materials, and food industries are also accelerating adoption as part of Qatar’s wider industrial diversification agenda.

The Qatar Digital Transformation Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens W.L.L. Qatar, Schneider Electric Qatar, Honeywell Qatar, ABB Qatar, Microsoft Qatar, Ooredoo Qatar Q.P.S.C., Vodafone Qatar P.Q.S.C., QatarEnergy (formerly Qatar Petroleum), Qatar Industrial Manufacturing Company Q.P.S.C., Qatar Free Zones Authority, Qatar Science & Technology Park (QSTP), Milaha (Qatar Navigation Q.P.S.C.), Mannai Corporation Q.P.S.C., Gulf Business Machines – GBM Qatar, Qatar Development Bank (QDB) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's digital transformation in manufacturing appears promising, driven by ongoing government support and technological advancements. As the sector embraces automation and Industry 4.0 technologies, productivity is expected to rise significantly. In future, the integration of smart manufacturing solutions will likely enhance operational efficiency, reduce costs, and improve product quality. Continued investment in workforce training and development will be essential to bridge the skills gap, ensuring that the workforce is equipped to meet the demands of a rapidly evolving industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Industrial IoT Platforms Manufacturing Execution Systems (MES) Industrial Robotics & Cobots Advanced Analytics & AI for Manufacturing Cloud & Edge Computing for Manufacturing Cybersecurity for Operational Technology (OT) Digital Twin & Simulation Additive Manufacturing / 3D Printing Others |

| By Manufacturing End?User | Metals & Heavy Industries (Steel, Aluminum) Oil & Gas–Linked Processing and Petrochemicals Food & Beverage Manufacturing Pharmaceuticals & Chemicals Building Materials (Cement, Glass, Plastics) Discrete Manufacturing (Electronics, Machinery, Automotive Components) Others |

| By Industry Vertical (Broader Use of Industrial Facilities) | Oil, Gas and Utilities Transportation and Logistics Construction and Smart Infrastructure Healthcare and Pharmaceuticals Government and Public Sector Industrial Initiatives Others |

| By Technology Stack | Analytics, Artificial Intelligence and Machine Learning Internet of Things (IoT) and Sensors Industrial Robotics and Automation Extended Reality (AR/VR/XR) Blockchain and Secure Traceability Mobility and Connectivity (5G, Private LTE) Others |

| By Deployment Model | On-Premise Cloud Hybrid Edge-First Architectures |

| By Service Type | Consulting and Digital Roadmapping System Integration and Implementation Managed Services and Remote Monitoring Training, Change Management and Support Others |

| By Policy & Ecosystem Support | Government Grants and Subsidy Programs Tax Incentives and Customs Exemptions Research, Innovation and Testbed Support Industrial Zones and Free Zones Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Digital Solutions | 100 | IT Managers, Production Directors |

| Electronics Manufacturing Automation | 80 | Operations Managers, Technology Officers |

| Textile Industry Digital Transformation | 70 | Supply Chain Managers, R&D Heads |

| Food Processing Digital Innovations | 60 | Quality Assurance Managers, Plant Managers |

| General Manufacturing Technology Adoption | 90 | Business Development Managers, Strategy Officers |

The Qatar Digital Transformation Manufacturing Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the adoption of advanced technologies such as IoT, AI, and industrial automation in manufacturing processes.