Region:Middle East

Author(s):Dev

Product Code:KRAB7247

Pages:83

Published On:October 2025

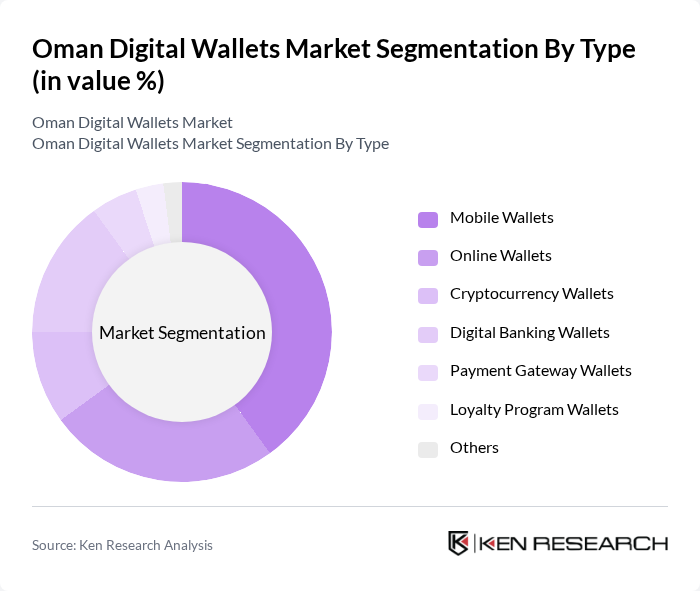

By Type:The digital wallets market can be segmented into various types, including mobile wallets, online wallets, cryptocurrency wallets, digital banking wallets, payment gateway wallets, loyalty program wallets, and others. Among these, mobile wallets are gaining significant traction due to their convenience and user-friendly interfaces, making them the preferred choice for consumers. Online wallets are also popular, especially for e-commerce transactions, while cryptocurrency wallets are emerging as a niche segment driven by the growing interest in digital currencies.

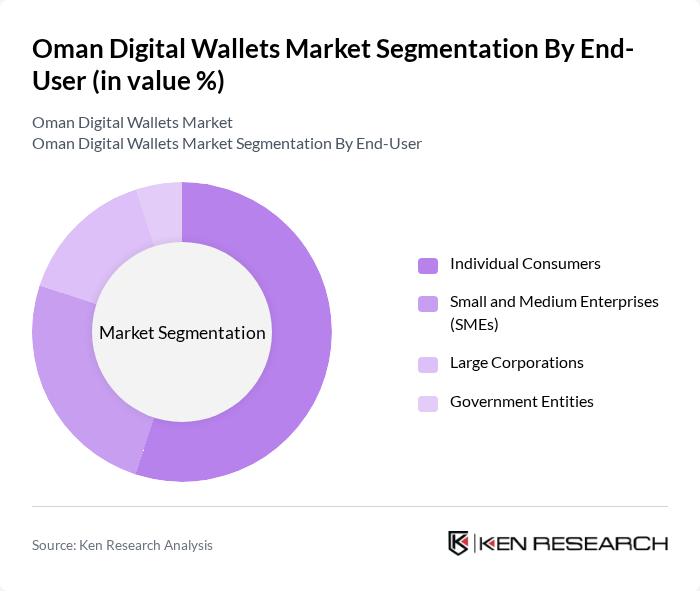

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large corporations, and government entities. Individual consumers dominate the market, driven by the increasing adoption of smartphones and the convenience of digital payments for everyday transactions. SMEs are also significant users, leveraging digital wallets for efficient payment processing and customer engagement, while large corporations and government entities are gradually adopting these solutions for operational efficiency.

The Oman Digital Wallets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omani Digital Wallet Company, Bank Muscat, Oman Arab Bank, Dhofar Insurance Company, Oman Telecommunications Company, National Bank of Oman, Bank Dhofar, Alizz Islamic Bank, Oman Investment Authority, Muscat Bank, Oman Mobile Payment Solutions, Al Baraka Bank, Majan International Bank, Oman International Bank, Muscat National Development Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman digital wallets market appears promising, driven by technological advancements and increasing consumer acceptance. As digital literacy improves, more consumers are expected to embrace digital wallets for everyday transactions. Additionally, the integration of advanced technologies such as artificial intelligence and blockchain will enhance security and user experience. The government's commitment to fostering a digital economy will further support the growth of digital wallets, making them a staple in the financial landscape of Oman.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Online Wallets Cryptocurrency Wallets Digital Banking Wallets Payment Gateway Wallets Loyalty Program Wallets Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Retail Payments Bill Payments Money Transfers E-commerce Transactions |

| By Distribution Channel | Direct Sales Online Platforms Mobile Applications |

| By User Demographics | Age Group Income Level Geographic Location |

| By Payment Method | Credit/Debit Card Integration Bank Transfers Cash-in/Cash-out Services |

| By Security Features | Biometric Authentication Two-Factor Authentication Encryption Technologies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Wallet Usage | 150 | Regular Users, Occasional Users |

| Merchant Adoption of Digital Payments | 100 | Small Business Owners, Retail Managers |

| Financial Institutions' Perspectives | 80 | Bank Executives, Payment Solution Managers |

| Regulatory Insights on Digital Payments | 50 | Regulatory Officials, Policy Makers |

| Technological Trends in Fintech | 70 | Tech Developers, Fintech Analysts |

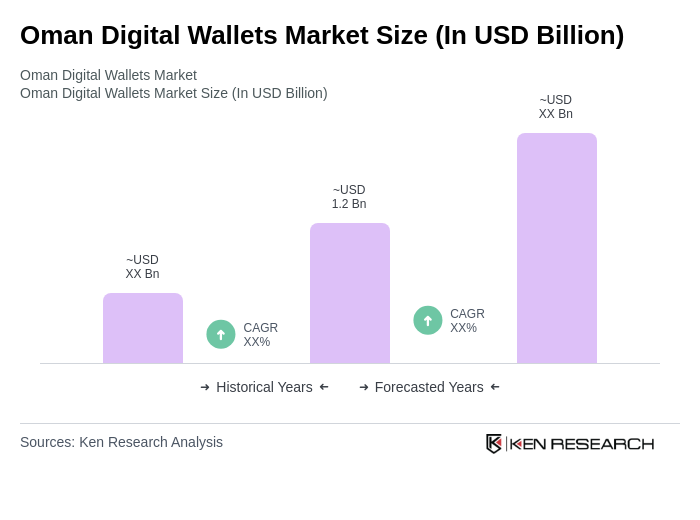

The Oman Digital Wallets Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased adoption of digital payment solutions, enhanced internet penetration, and a shift towards cashless transactions among consumers.