Region:Middle East

Author(s):Shubham

Product Code:KRAB7284

Pages:100

Published On:October 2025

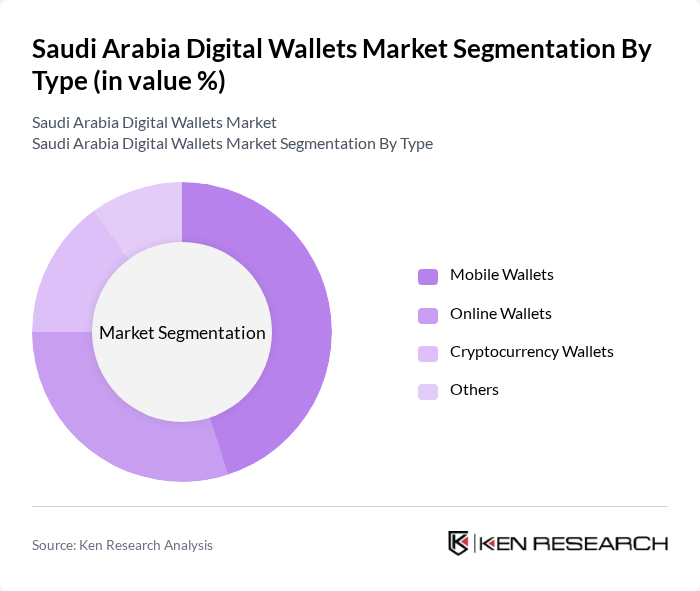

By Type:The digital wallets market can be segmented into various types, including Mobile Wallets, Online Wallets, Cryptocurrency Wallets, and Others. Among these, Mobile Wallets are gaining significant traction due to their convenience and user-friendly interfaces. Online Wallets are also popular, especially for e-commerce transactions. Cryptocurrency Wallets are emerging but still represent a smaller segment. The Others category includes various niche wallet services catering to specific consumer needs.

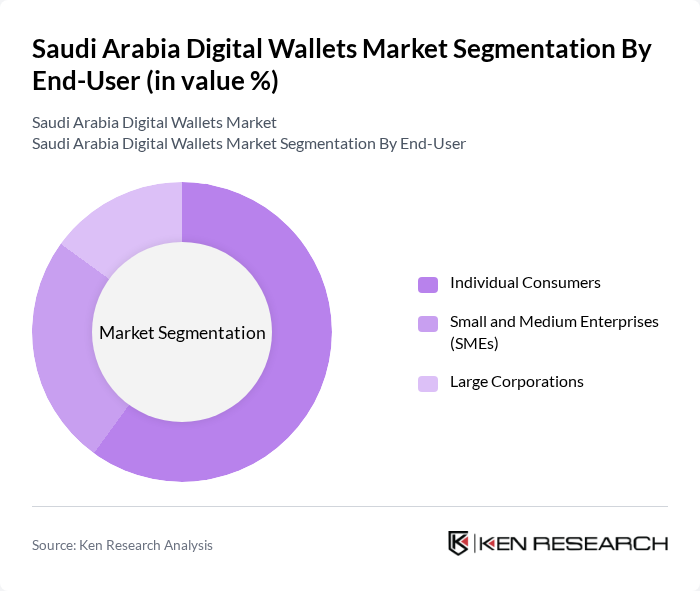

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), and Large Corporations. Individual Consumers dominate the market as they increasingly prefer digital wallets for everyday transactions. SMEs are also adopting these solutions to streamline payments and enhance customer experiences. Large Corporations utilize digital wallets for operational efficiency and to cater to tech-savvy customers.

The Saudi Arabia Digital Wallets Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Pay, Mada, Apple Pay, Samsung Pay, PayPal, Al Rajhi Bank, NCB, Mobily, Zain Cash, Fawry, PayFort, Tap Payments, HyperPay, Raqami, QPay contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital wallets market in Saudi Arabia appears promising, driven by technological advancements and increasing consumer acceptance. The integration of artificial intelligence and machine learning is expected to enhance security and user experience, while the rise of contactless payments will further facilitate transactions. As the government continues to support cashless initiatives, the market is likely to witness accelerated growth, with digital wallets becoming a staple in everyday financial activities for consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Online Wallets Cryptocurrency Wallets Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations |

| By Payment Method | Credit/Debit Card Integration Bank Transfers QR Code Payments Others |

| By Industry | Retail Hospitality Transportation Others |

| By User Demographics | Age Group (18-24, 25-34, 35-44) Income Level (Low, Middle, High) |

| By Geographic Distribution | Urban Areas Rural Areas |

| By Customer Loyalty Programs | Points-Based Systems Cashback Offers Subscription Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Wallet Usage | 150 | Regular Users, Occasional Users |

| Merchant Adoption of Digital Payments | 100 | Small Business Owners, Retail Managers |

| Fintech Industry Insights | 80 | Fintech Executives, Product Managers |

| Regulatory Impact Assessment | 60 | Policy Makers, Financial Regulators |

| Consumer Attitudes Towards Digital Payments | 120 | Young Adults, Tech-Savvy Consumers |

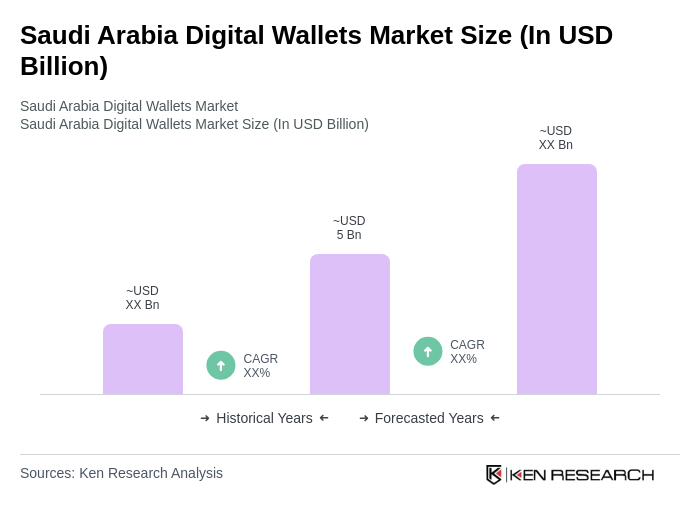

The Saudi Arabia Digital Wallets Market is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions and a tech-savvy population, alongside government initiatives promoting a cashless economy.