Region:Middle East

Author(s):Dev

Product Code:KRAB7554

Pages:100

Published On:October 2025

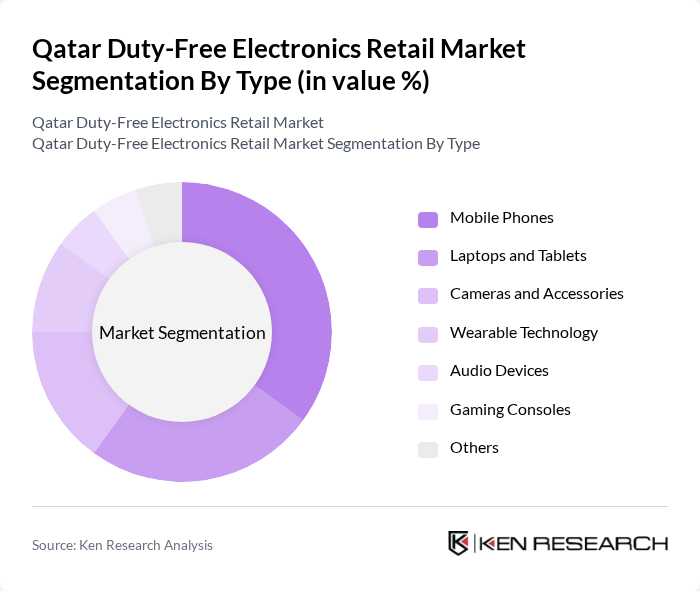

By Type:The market is segmented into various types of electronics, including mobile phones, laptops and tablets, cameras and accessories, wearable technology, audio devices, gaming consoles, and others. Among these, mobile phones and laptops are the most popular due to their high demand among travelers seeking the latest technology and competitive pricing. The trend towards portable and multifunctional devices has further fueled the growth of these segments.

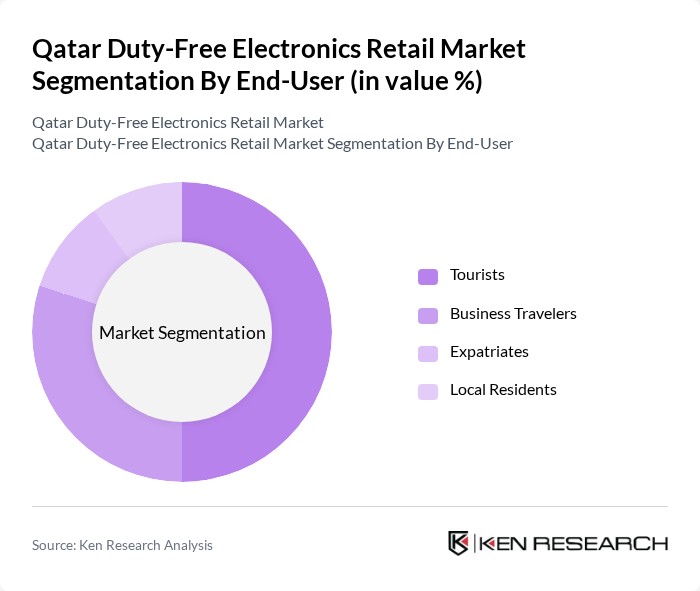

By End-User:The end-user segmentation includes tourists, business travelers, expatriates, and local residents. Tourists and business travelers dominate the market, driven by their need for electronics during their travels. The increasing number of international events and conferences in Qatar has also contributed to the growth of the business traveler segment, as they often seek high-quality electronics for work and leisure.

The Qatar Duty-Free Electronics Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Duty Free Company, Al Meera Consumer Goods Company, Carrefour Qatar, Lulu Hypermarket, Virgin Megastore Qatar, Sharaf DG, Jumbo Electronics, Doha Duty Free, Techno Blue, Qatar Electronics, Al-Futtaim Electronics, Emax Electronics, Carrefour Qatar, Axiom Telecom, iSpot Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar duty-free electronics retail market appears promising, driven by increasing tourism and technological advancements. Retailers are expected to enhance their offerings by integrating smart technologies and improving customer experiences. Additionally, the anticipated growth in e-commerce will compel duty-free shops to adopt hybrid models, blending online and offline shopping experiences. This evolution will likely attract a broader consumer base, ensuring sustained growth in the sector as it adapts to changing market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Phones Laptops and Tablets Cameras and Accessories Wearable Technology Audio Devices Gaming Consoles Others |

| By End-User | Tourists Business Travelers Expatriates Local Residents |

| By Sales Channel | Airport Retail Stores Online Duty-Free Platforms Physical Retail Outlets Pop-Up Stores |

| By Price Range | Budget Mid-Range Premium |

| By Brand | International Brands Local Brands Luxury Brands |

| By Product Features | High-Performance Electronics Eco-Friendly Products Smart Technology Integration |

| By Distribution Mode | Direct Sales Third-Party Distributors Online Marketplaces |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Purchases at Duty-Free | 150 | Frequent Travelers, Airport Retail Managers |

| Consumer Preferences for Electronics | 100 | Travelers, Electronics Enthusiasts |

| Impact of Promotions on Sales | 80 | Marketing Managers, Sales Executives |

| Trends in Electronics Consumption | 120 | Industry Analysts, Retail Buyers |

| Customer Satisfaction and Feedback | 90 | End Consumers, Customer Service Representatives |

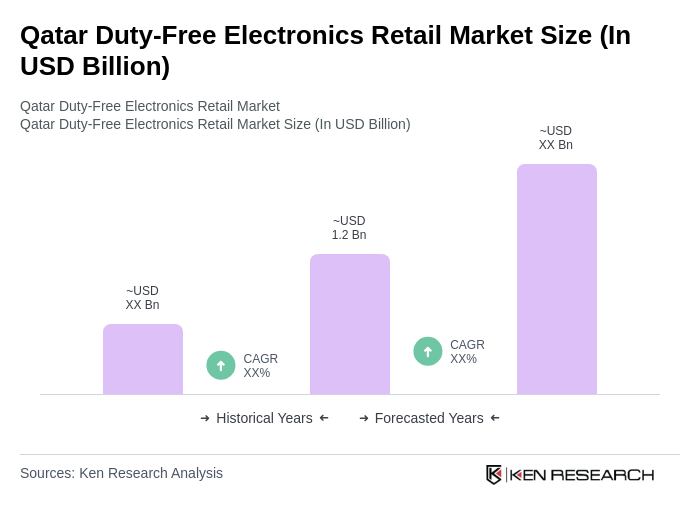

The Qatar Duty-Free Electronics Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased international travel, the expansion of Hamad International Airport, and rising demand for electronic gadgets among tourists and expatriates.